Undiscovered Gems in Europe for December 2025

As European markets show signs of steady economic growth, buoyed by the pan-European STOXX Europe 600 Index rising 1.60% and major stock indexes also experiencing gains, investors are keenly observing opportunities within this dynamic landscape. With the European Central Bank maintaining a stable interest rate environment and projecting moderate GDP growth in the coming years, small-cap stocks that exhibit robust fundamentals and adaptability to evolving market conditions could present intriguing prospects for discerning investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

STIF Société anonyme (ENXTPA:ALSTI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: STIF Société anonyme manufactures and sells components for the handling of bulk products in France, with a market capitalization of €276.29 million.

Operations: The company's primary revenue stream is derived from its Machinery & Industrial Equipment segment, generating €72.71 million.

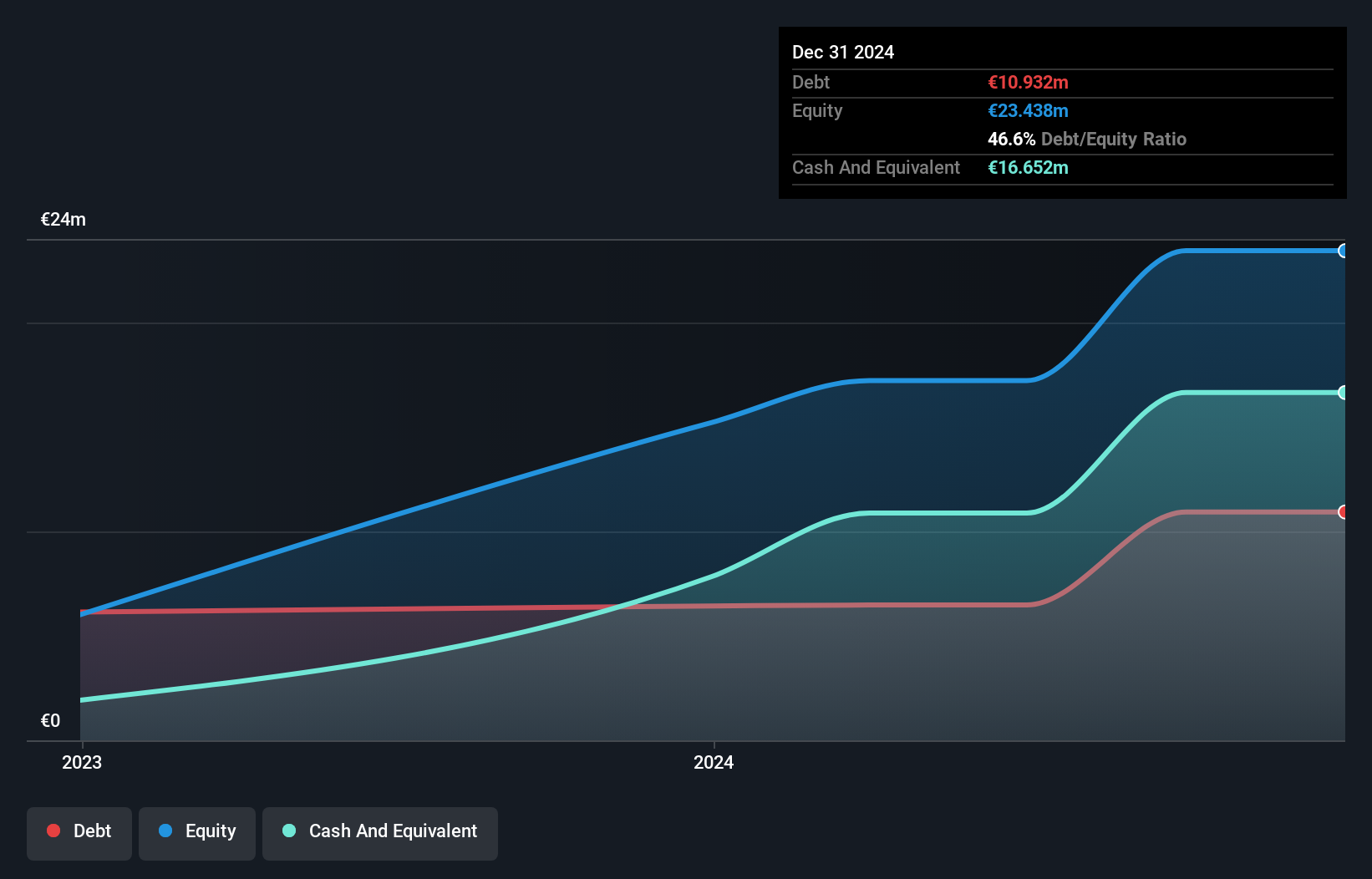

STIF Société anonyme, a nimble player in its sector, has shown impressive growth with earnings increasing 157% over the past year, outpacing the Machinery industry's -31.6%. The company reported half-year sales of €36.7 million and net income of €6.4 million, both significantly up from last year's figures of €27.7 million and €3.4 million respectively. With a satisfactory net debt to equity ratio at 9%, STIF appears well-positioned financially, while trading at 54% below estimated fair value suggests potential for future appreciation in market perception or performance.

- Click here and access our complete health analysis report to understand the dynamics of STIF Société anonyme.

Assess STIF Société anonyme's past performance with our detailed historical performance reports.

Haypp Group (OM:HAYPP)

Simply Wall St Value Rating: ★★★★★★

Overview: Haypp Group AB (publ) is an online retailer specializing in tobacco-free nicotine pouches and snus products across Sweden, Norway, the rest of Europe, and the United States with a market cap of approximately SEK4.41 billion.

Operations: The company's revenue streams are categorized into Core (SEK2.74 billion), Growth (SEK835.83 million), and Emerging Market (SEK137.67 million) segments. The net profit margin exhibits notable trends, reflecting the company's efficiency in managing its costs relative to its revenue generation across these segments.

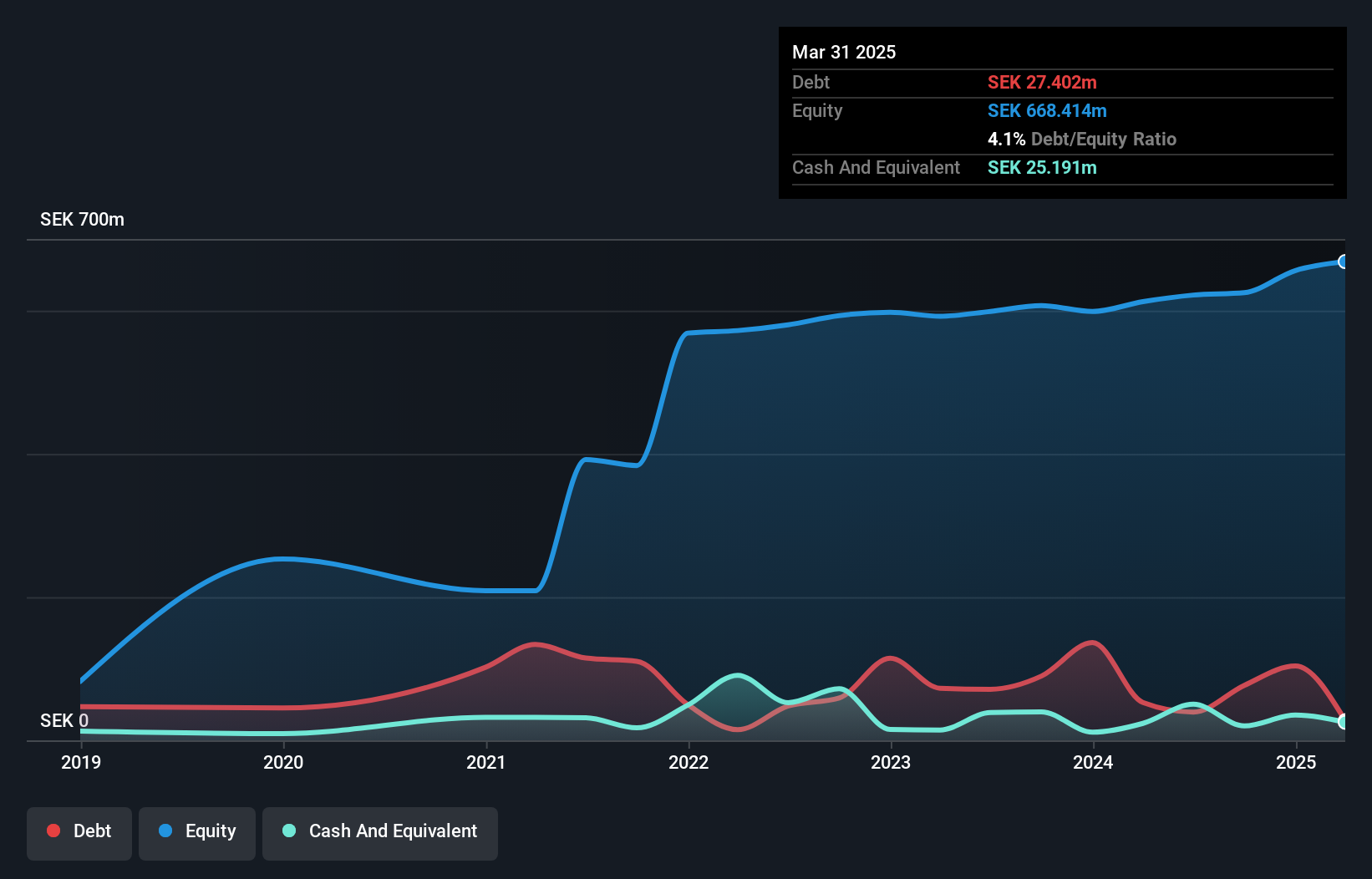

Haypp Group, a notable player in the Specialty Retail sector, has showcased impressive earnings growth of 118.4% over the past year, outpacing industry peers. The company's financial health appears robust with a net debt to equity ratio of just 2%, suggesting prudent financial management. Additionally, its interest payments are well covered by EBIT at 4.7 times, indicating strong operational efficiency. Recent announcements revealed sales for Q3 reached SEK 962.64 million and net income was SEK 4.48 million, reflecting some fluctuations in profitability but overall stability in revenue streams compared to last year’s figures.

- Get an in-depth perspective on Haypp Group's performance by reading our health report here.

Gain insights into Haypp Group's historical performance by reviewing our past performance report.

COLTENE Holding (SWX:CLTN)

Simply Wall St Value Rating: ★★★★★★

Overview: COLTENE Holding AG is a company that specializes in the development, manufacturing, and sale of dental disposables, tools, and equipment across various regions including Europe, the Middle East, Africa, North America, Latin America, and Asia/Oceania with a market capitalization of CHF320.88 million.

Operations: With a revenue of CHF240.71 million from its dental disposables, tools, and equipment segment, COLTENE focuses on serving dentists and dental laboratories across multiple regions.

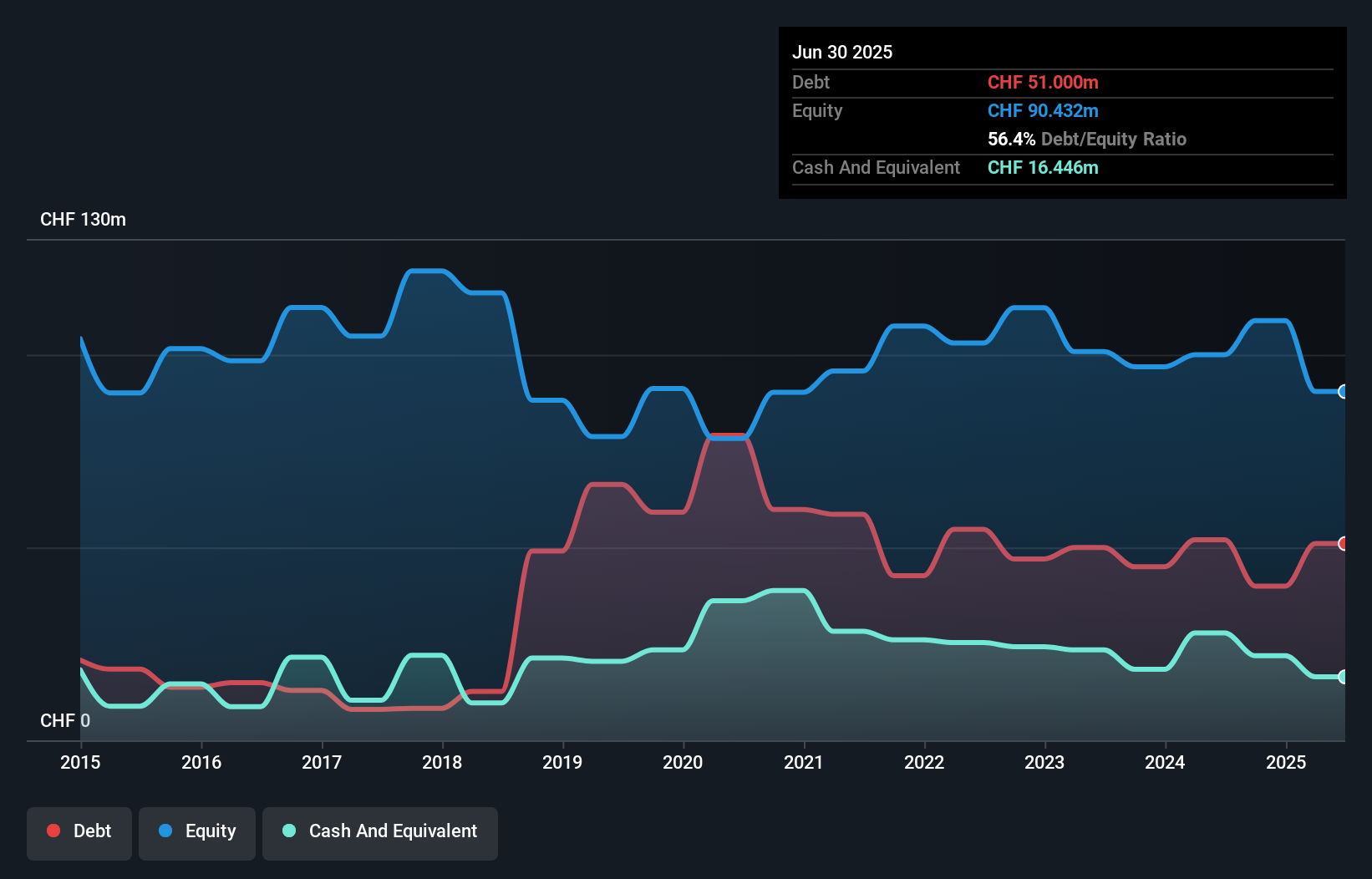

Coltene, a player in the medical equipment sector, has shown impressive growth with earnings increasing by 16% over the past year, outpacing the industry's 7.8%. The company seems to manage its finances well; its debt to equity ratio improved significantly from 101.1% to 56.4% in five years, and net debt to equity sits at a satisfactory 38.2%. Interest payments are comfortably covered by EBIT at a multiple of 6.5x, indicating robust financial health. Trading at about 22.7% below estimated fair value suggests potential upside for investors looking into this niche market opportunity in Europe.

- Unlock comprehensive insights into our analysis of COLTENE Holding stock in this health report.

Understand COLTENE Holding's track record by examining our Past report.

Next Steps

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 300 more companies for you to explore.Click here to unveil our expertly curated list of 303 European Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报