European Dividend Stocks To Watch Now

As European markets show signs of steady economic growth and benefit from looser monetary policy, the pan-European STOXX Europe 600 Index recently climbed by 1.60%, with major stock indexes also experiencing gains. In this environment, dividend stocks can be particularly appealing to investors looking for income stability and potential capital appreciation, as they often represent companies with strong financial health and consistent cash flow.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.05% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.64% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.00% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| Evolution (OM:EVO) | 4.87% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.14% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 10.12% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.22% | ★★★★★★ |

Click here to see the full list of 195 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

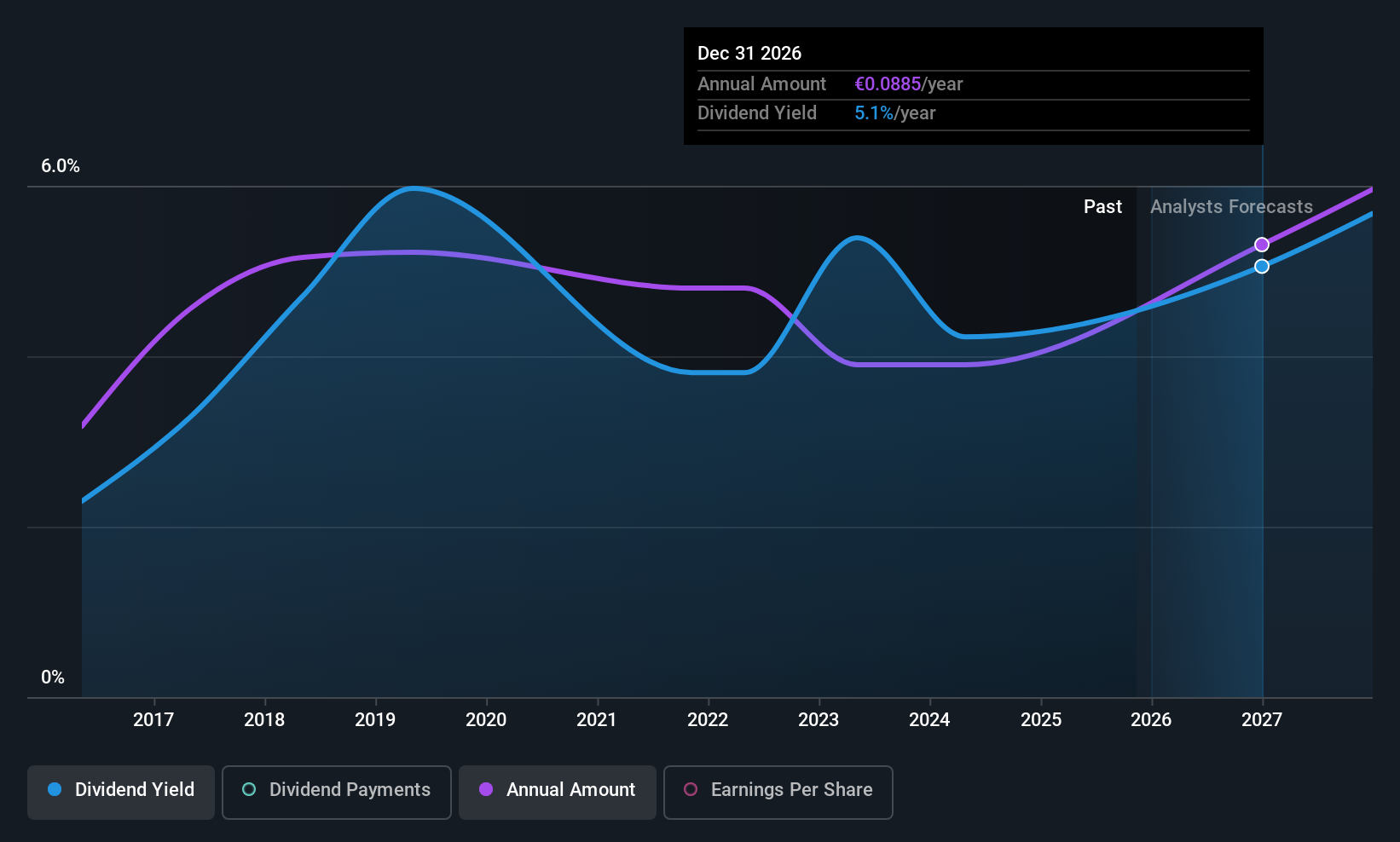

Banca Sistema (BIT:BST)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banca Sistema S.p.A. offers a range of business and retail banking products and services in Italy, with a market cap of €135.34 million.

Operations: Banca Sistema S.p.A. generates revenue through its diverse offerings of business and retail banking products and services in Italy.

Dividend Yield: 3.9%

Banca Sistema offers a reliable dividend with a payout ratio of 34.8%, ensuring coverage by earnings and expected to improve to 25.4% in three years. Its dividends have been stable and growing over the past decade, though its yield of 3.86% is lower than top-tier Italian payers. Despite trading at good value, concerns include high bad loans at 18.8% and low allowance for these loans at 13%. Recent earnings growth has been strong, but future declines are forecasted.

- Click here and access our complete dividend analysis report to understand the dynamics of Banca Sistema.

- The analysis detailed in our Banca Sistema valuation report hints at an deflated share price compared to its estimated value.

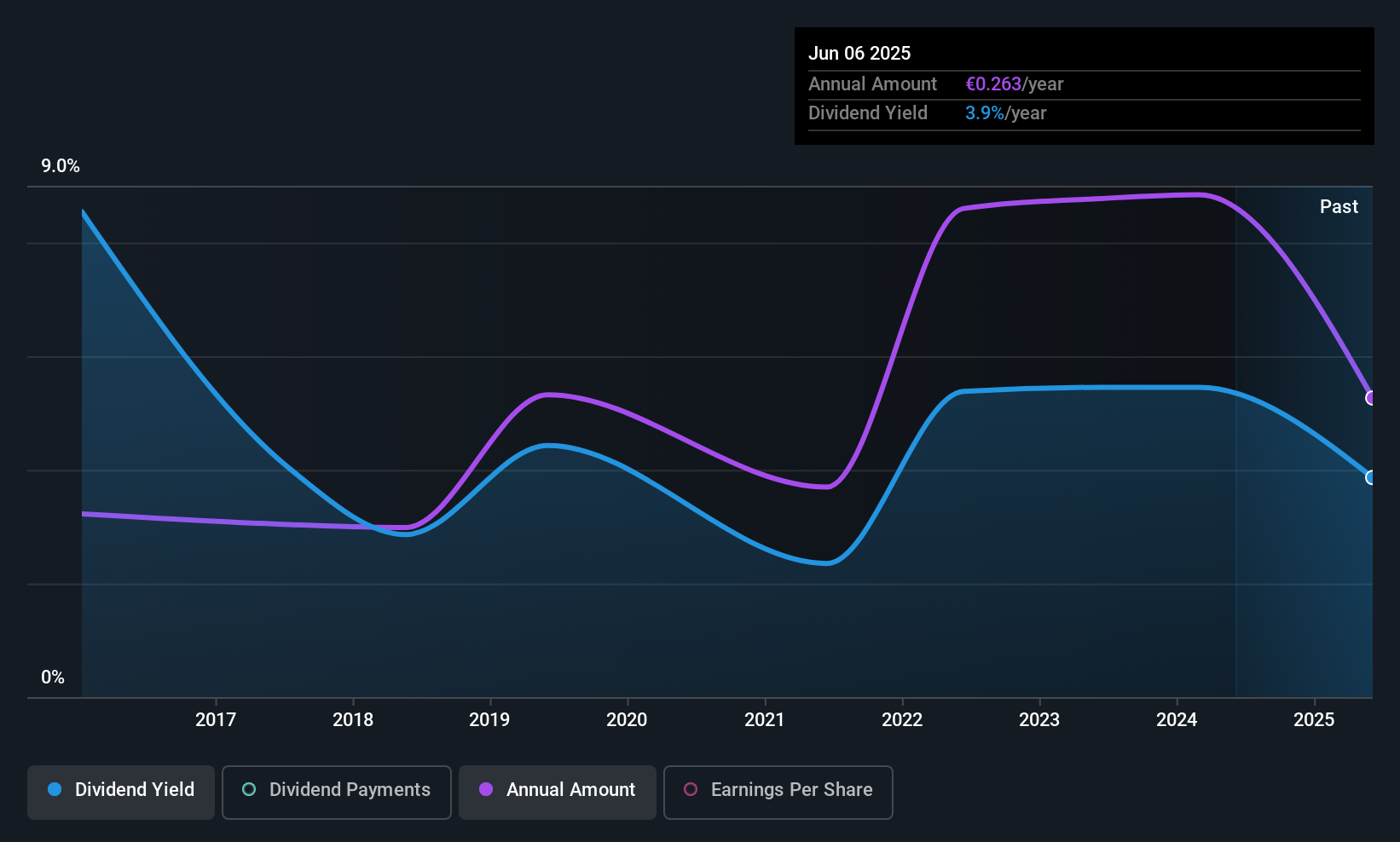

Payton Planar Magnetics (ENXTBR:PAY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Payton Planar Magnetics Ltd., along with its subsidiaries, specializes in the development, manufacturing, and marketing of planar and conventional transformers globally, with a market cap of €113.09 million.

Operations: Payton Planar Magnetics Ltd. generates revenue primarily from its transformer segment, amounting to $45.85 million.

Dividend Yield: 4%

Payton Planar Magnetics' dividend payments have been volatile over the past decade, though they are well-covered by earnings and cash flows with payout ratios of 45.7% and 43.6%, respectively. The company's dividend yield of 3.98% is below the top quartile in Belgium, but its price-to-earnings ratio of 11.5x suggests good value compared to the market average. Recent earnings show a slight decline, with nine-month net income at US$9.44 million from US$11.16 million previously.

- Click to explore a detailed breakdown of our findings in Payton Planar Magnetics' dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Payton Planar Magnetics shares in the market.

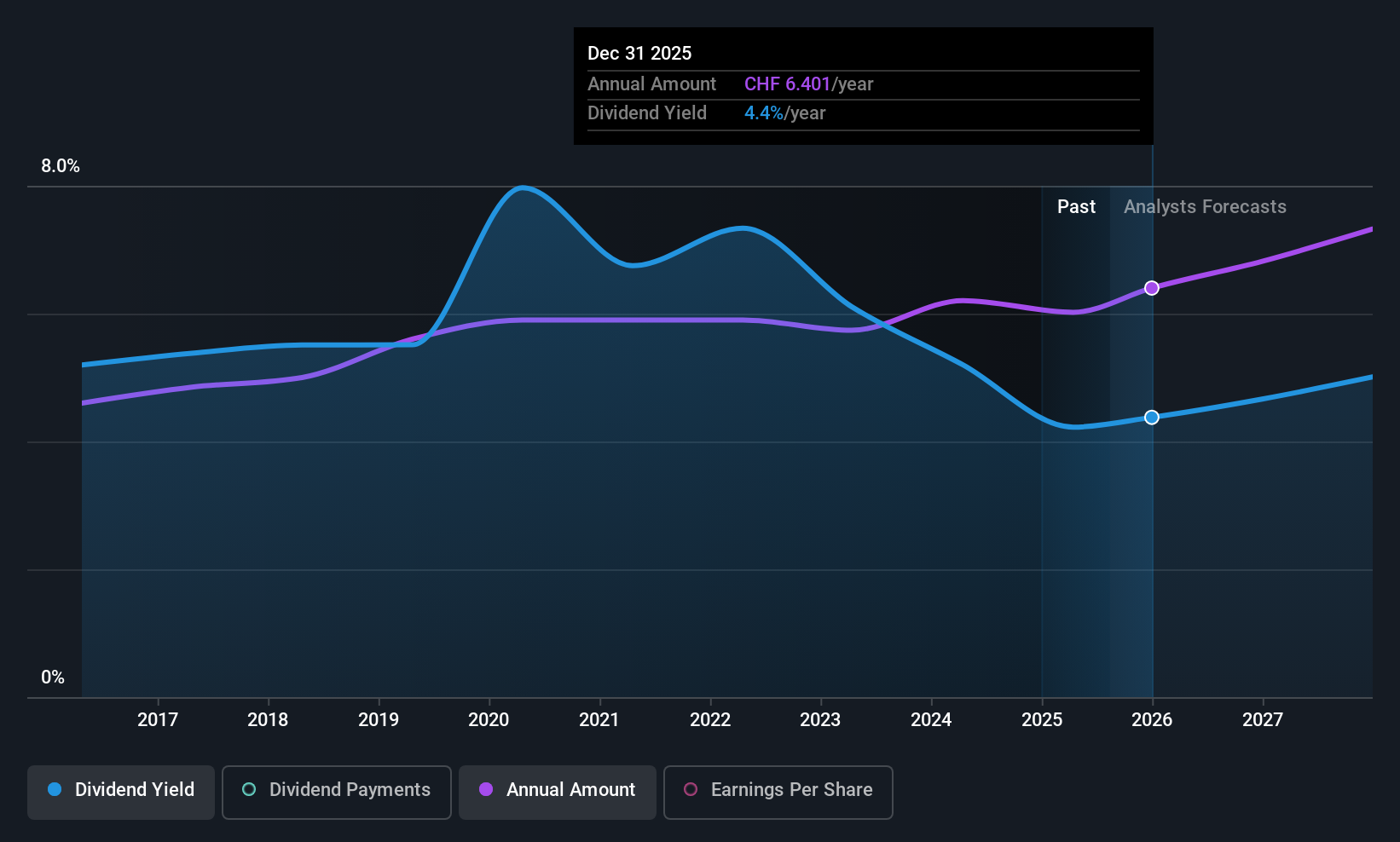

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Swiss Re AG, with a market cap of CHF39.13 billion, operates globally by providing reinsurance, insurance, and other risk transfer and insurance-related services through its subsidiaries.

Operations: Swiss Re AG generates its revenue through various segments, including reinsurance and insurance services, as well as other risk transfer solutions across global markets.

Dividend Yield: 4.4%

Swiss Re's dividend yield of 4.35% places it in the top quartile among Swiss dividend payers, though its track record has been volatile with past annual drops over 20%. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 58.1% and 59.8%, respectively. The company trades at a significant discount to fair value estimates and expects net income to exceed US$4.4 billion in 2025, supported by strategic alliances like the recent MoU with RIQ for AI-driven solutions in reinsurance.

- Take a closer look at Swiss Re's potential here in our dividend report.

- Our expertly prepared valuation report Swiss Re implies its share price may be lower than expected.

Make It Happen

- Reveal the 195 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报