High Growth Tech Stocks Including TomTom For Potential Portfolio Strength

As global markets navigate mixed economic signals, with the Russell 2000 Index experiencing a decline and tech stocks facing valuation concerns, investors are closely watching how inflation trends and interest rate adjustments will impact market sentiment. In this context, identifying high-growth tech stocks like TomTom can be crucial for portfolio strength, as these companies often demonstrate resilience through innovation and adaptability in fluctuating economic landscapes.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

TomTom (ENXTAM:TOM2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TomTom N.V. is a company that develops and sells navigation and location-based products and services globally, with a market capitalization of approximately €662 million.

Operations: TomTom generates revenue primarily from its Location Technology segment, which accounts for €503.92 million, and the Consumer segment contributing €77.52 million.

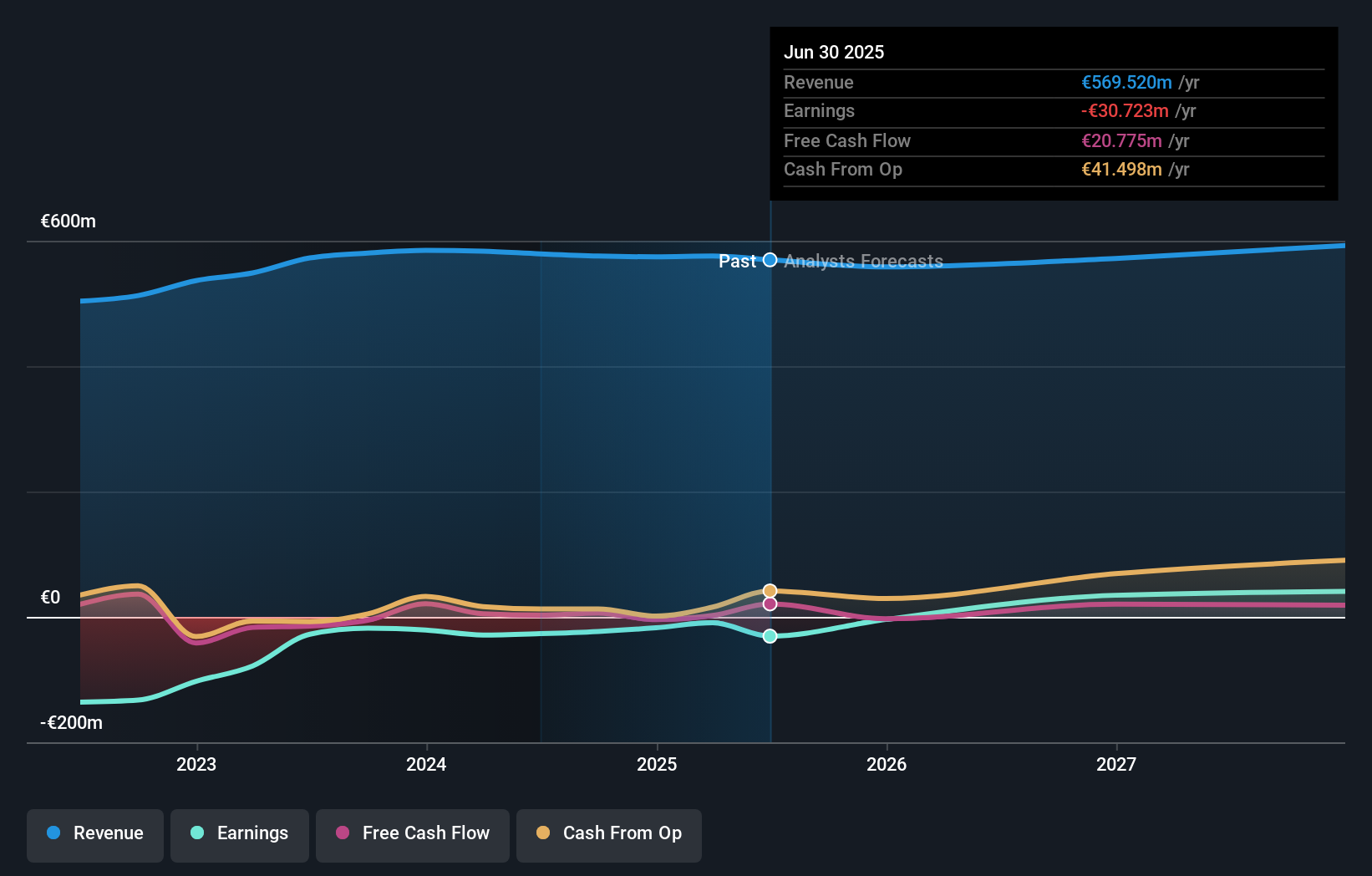

TomTom, navigating a challenging tech landscape, reported a modest revenue growth of 1.9% annually but is poised for significant earnings acceleration with an expected increase of 108.6% per year. Despite current unprofitability, the company's strategic partnerships, like the renewed agreement with GeoInt and Hyundai AutoEver, leverage its robust mapping APIs to enhance fleet management and in-dash navigation systems across Europe and Africa. These collaborations not only solidify TomTom's role in geospatial solutions but also set the stage for its transition into profitability within three years, supported by a projected high return on equity of 22.2%.

- Take a closer look at TomTom's potential here in our health report.

Understand TomTom's track record by examining our Past report.

EMRO (KOSDAQ:A058970)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EMRO, Incorporated provides supply chain management software in South Korea and internationally, with a market cap of ₩457.30 billion.

Operations: EMRO generates revenue through the provision of supply chain management software services both domestically in South Korea and internationally.

EMRO, despite its challenges, is charting a promising course in the tech sector with an impressive annual revenue growth of 18.7% and an even more striking earnings growth forecast at 54.6% per year. This performance outpaces the broader Korean market's growth rates significantly. However, it's important to note that EMRO's profit margins have dipped to 6.5% from last year’s 14.1%, reflecting some operational pressures. The company recently showcased its AI-based solutions and strategic initiatives at various industry events, signaling robust efforts to maintain its competitive edge and expand globally. These developments could potentially bolster EMRO’s market position and future financial performance, despite current margin pressures.

- Get an in-depth perspective on EMRO's performance by reading our health report here.

Review our historical performance report to gain insights into EMRO's's past performance.

Shengyi Electronics (SHSE:688183)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shengyi Electronics Co., Ltd. is involved in the design, production, and sale of printed circuit boards in China, with a market capitalization of CN¥82.46 billion.

Operations: Shengyi Electronics focuses on the design, production, and sale of printed circuit boards within China.

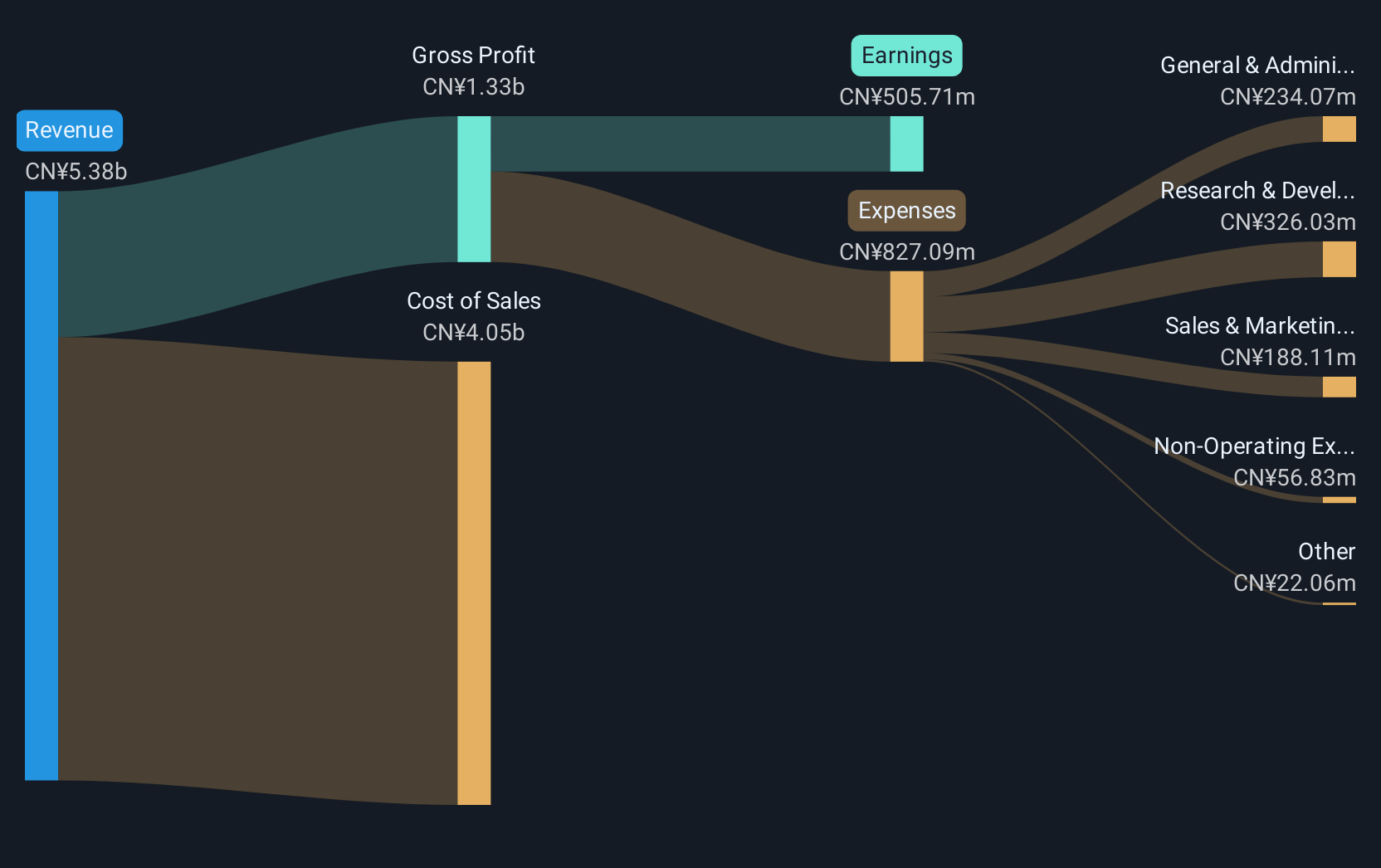

Shengyi Electronics has demonstrated a robust growth trajectory, with revenue soaring by 115% to CNY 6.83 billion and net income escalating dramatically to CNY 1.11 billion from just CNY 186.52 million in the previous year. This performance is underpinned by a significant annual earnings growth rate of 33.3%, surpassing the broader Chinese market's average of 27.5%. The company's strategic moves, including a substantial private placement aiming to raise up to CNY 2.6 billion and its emphasis on R&D at their recent shareholders' meetings, underscore its commitment to innovation and expansion in the tech sector despite its highly volatile share price over the past three months.

- Click here to discover the nuances of Shengyi Electronics with our detailed analytical health report.

Gain insights into Shengyi Electronics' past trends and performance with our Past report.

Where To Now?

- Investigate our full lineup of 244 Global High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报