3 Undervalued Small Caps In Global With Recent Insider Buying Activity

As global markets navigate a landscape of mixed economic signals and shifting monetary policies, small-cap stocks have faced particular challenges, with the Russell 2000 Index recently declining by 0.86%. Amidst these fluctuations, investors often seek opportunities in undervalued small-cap companies that exhibit potential for growth, particularly those with recent insider buying activity as it may suggest confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.4x | 0.7x | 42.31% | ★★★★★☆ |

| Paragon Care | 17.3x | 0.1x | 22.42% | ★★★★★☆ |

| Vita Life Sciences | 14.9x | 1.6x | 37.31% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.63% | ★★★★☆☆ |

| Senior | 25.2x | 0.8x | 24.95% | ★★★★☆☆ |

| Tristel | 29.3x | 4.2x | 20.43% | ★★★☆☆☆ |

| Gooch & Housego | 46.8x | 1.1x | 22.13% | ★★★☆☆☆ |

| Amaero | NA | 63.7x | 32.25% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.2x | 0.4x | -397.77% | ★★★☆☆☆ |

| Betr Entertainment | NA | 1.5x | 9.47% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

D&L Industries (PSE:DNL)

Simply Wall St Value Rating: ★★★☆☆☆

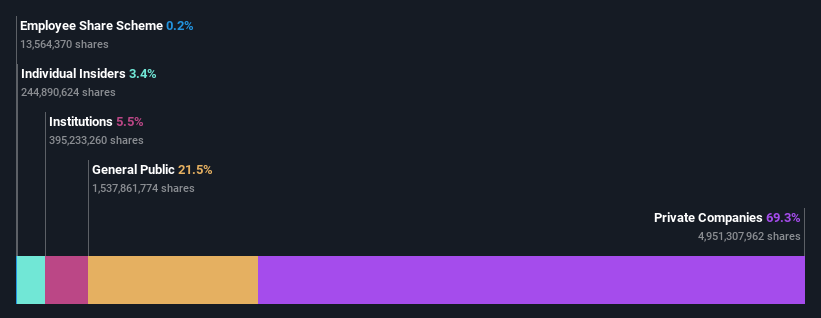

Overview: D&L Industries is a diversified manufacturing company in the Philippines, engaged in producing food ingredients, aerosols, colorants and plastic additives, oleochemicals, resins, and powder coatings with a market capitalization of ₱64.45 billion.

Operations: The company's revenue is primarily driven by Food Ingredients and Oleochemicals, Resins and Powder Coatings segments, contributing significantly to its overall earnings. The gross profit margin has shown fluctuations, reaching a high of 21.39% in the third quarter of 2019 before declining to 12.99% by the third quarter of 2025. Operating expenses include notable allocations for sales and marketing as well as general and administrative functions, impacting profitability metrics over time.

PE: 10.7x

D&L Industries, a smaller company in the market, has shown promising growth potential with earnings forecasted to increase by 18.48% annually. Recent third-quarter results revealed a revenue jump to PHP 14,686 million from PHP 10,508 million year-on-year and net income rising to PHP 554 million from PHP 493 million. Insider confidence is evident as Alvin Lao acquired 1.2 million shares for approximately ₱4.1 billion in November 2025, reflecting belief in future prospects despite reliance on external borrowing for funding needs.

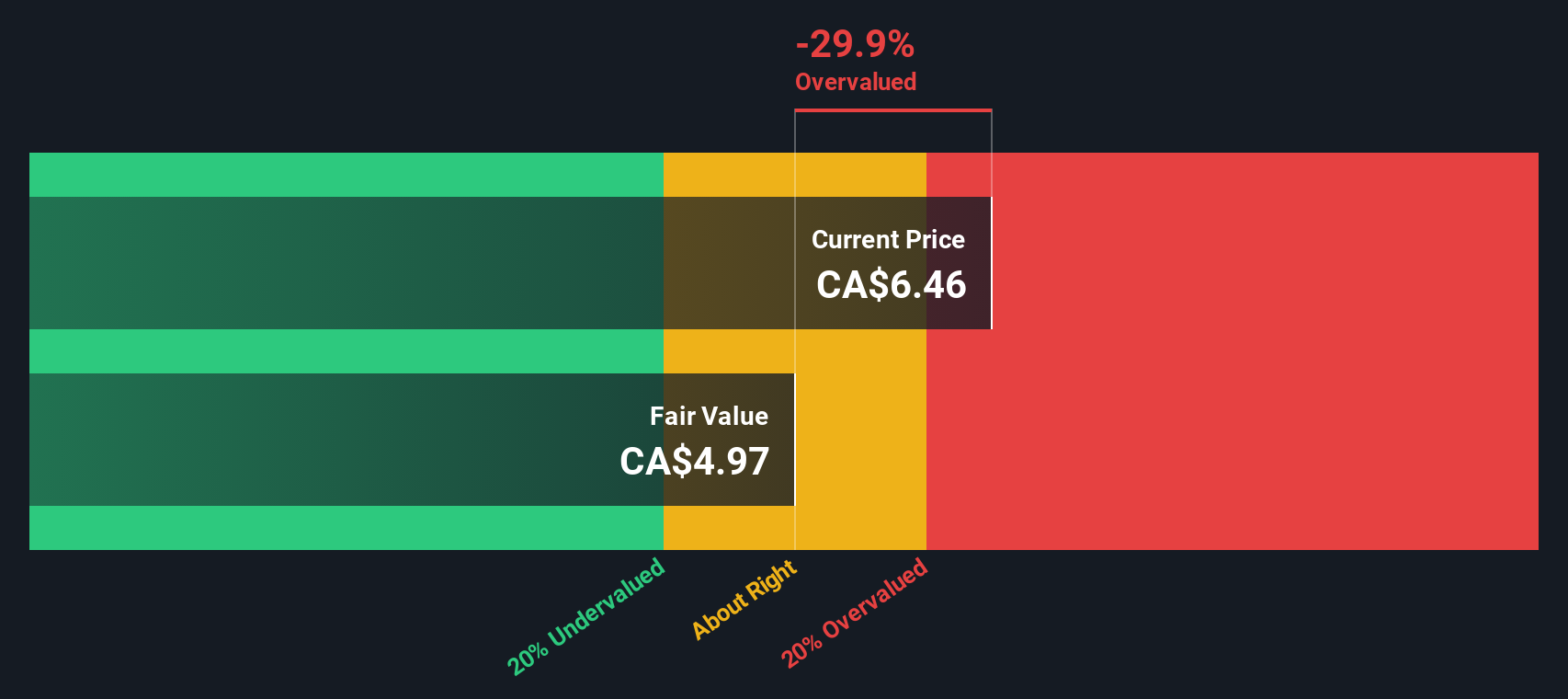

Computer Modelling Group (TSX:CMG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Computer Modelling Group specializes in developing reservoir simulation software for the oil and gas industry, with a market cap of approximately CA$0.81 billion.

Operations: The company generates its revenue primarily from software and programming, with the latest reported figure at CA$129.29 million. The gross profit margin has shown a trend of fluctuation, reaching 90.29% in recent periods but declining to 81.01% in the latest quarter. Operating expenses have been significant, with research and development being a notable component, totaling CA$30.86 million recently.

PE: 20.7x

Computer Modelling Group, a smaller player in its industry, recently caught attention with insider confidence as Alexander Davern purchased 30,000 shares for approximately C$148,526. This move suggests belief in the company's potential. Despite challenges like declining net income from C$3.76 million to C$2.72 million year-over-year for Q2 2025, CMG is optimistic about future growth with projected earnings increase of 11.25% annually and positive revenue guidance for fiscal 2027. A new software licensing deal with Shell further enhances its prospects by integrating advanced simulation solutions into global operations.

- Delve into the full analysis valuation report here for a deeper understanding of Computer Modelling Group.

Gain insights into Computer Modelling Group's past trends and performance with our Past report.

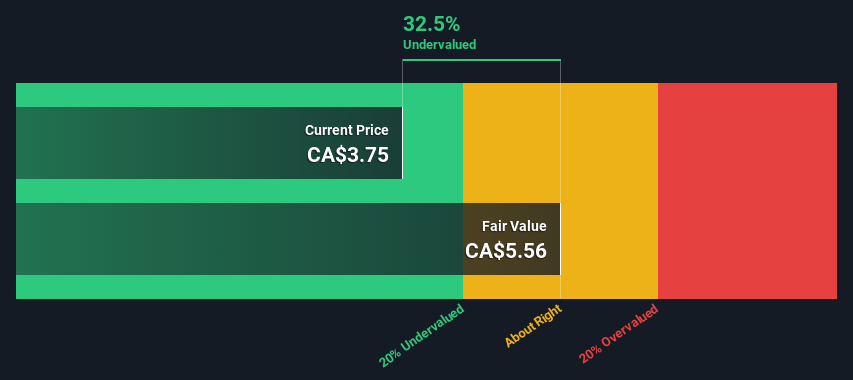

Plaza Retail REIT (TSX:PLZ.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Plaza Retail REIT focuses on the ownership and development of retail real estate, with a market capitalization of approximately CA$0.49 billion.

Operations: The company's revenue primarily stems from retail real estate ownership and development, with recent figures reaching CA$128.52 million. Costs of goods sold (COGS) have been increasing, impacting the gross profit margin, which was reported at 62.44% in the latest period. Operating expenses are consistently managed around CA$12 million, while non-operating expenses fluctuate significantly, affecting net income margins over time.

PE: 12.0x

Plaza Retail REIT, a smaller stock in the market, has shown promising financial growth with Q3 2025 sales reaching C$31.71 million and net income increasing to C$8.77 million from last year. The company's consistent monthly dividend of C$0.02333 per unit reflects its stable cash flow despite relying on external borrowing for funding, which carries higher risk than customer deposits. Insider confidence is evident as insiders have been purchasing shares throughout the year, indicating potential future value for investors seeking opportunities in smaller stocks.

Next Steps

- Dive into all 147 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报