Global Growth Stocks With Up To 39% Insider Ownership

As global markets navigate mixed signals with interest rate changes and fluctuating economic data, investors are increasingly focused on growth stocks that demonstrate resilience and potential in uncertain times. In this environment, companies with high insider ownership can be particularly appealing as they often indicate strong alignment between management and shareholder interests, suggesting confidence in the company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

We'll examine a selection from our screener results.

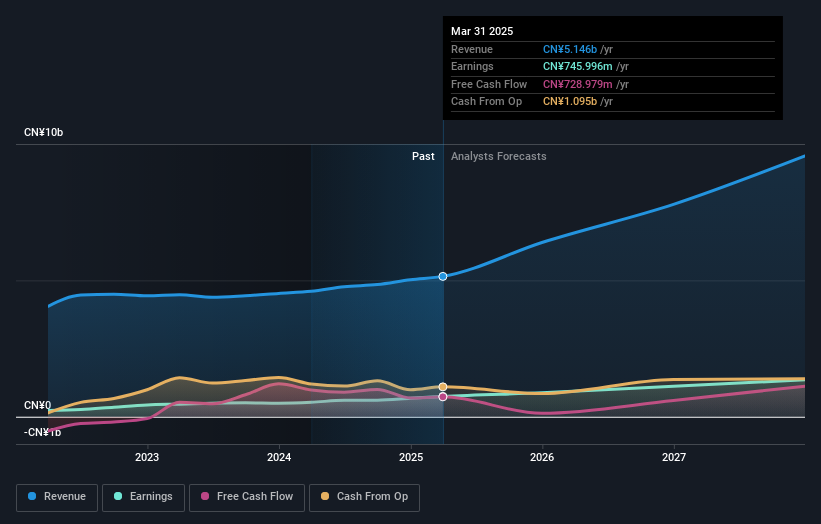

Olympic Circuit Technology (SHSE:603920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Olympic Circuit Technology Co., Ltd is engaged in the research, development, manufacture, and sales of printed circuit boards (PCBs) both in China and internationally, with a market cap of CN¥31.57 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, which generated CN¥5.42 billion.

Insider Ownership: 20.1%

Olympic Circuit Technology shows promising growth with revenue forecasted to rise 25.9% annually, outpacing the Chinese market's average. Recent earnings reports indicate robust performance, with net income reaching CNY 625.15 million for the first nine months of 2025. However, its earnings growth is expected to trail behind market averages slightly at 25.3%. Despite a low return on equity forecast and unsustainable dividends, it trades at a favorable price-to-earnings ratio compared to peers.

- Navigate through the intricacies of Olympic Circuit Technology with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Olympic Circuit Technology is priced lower than what may be justified by its financials.

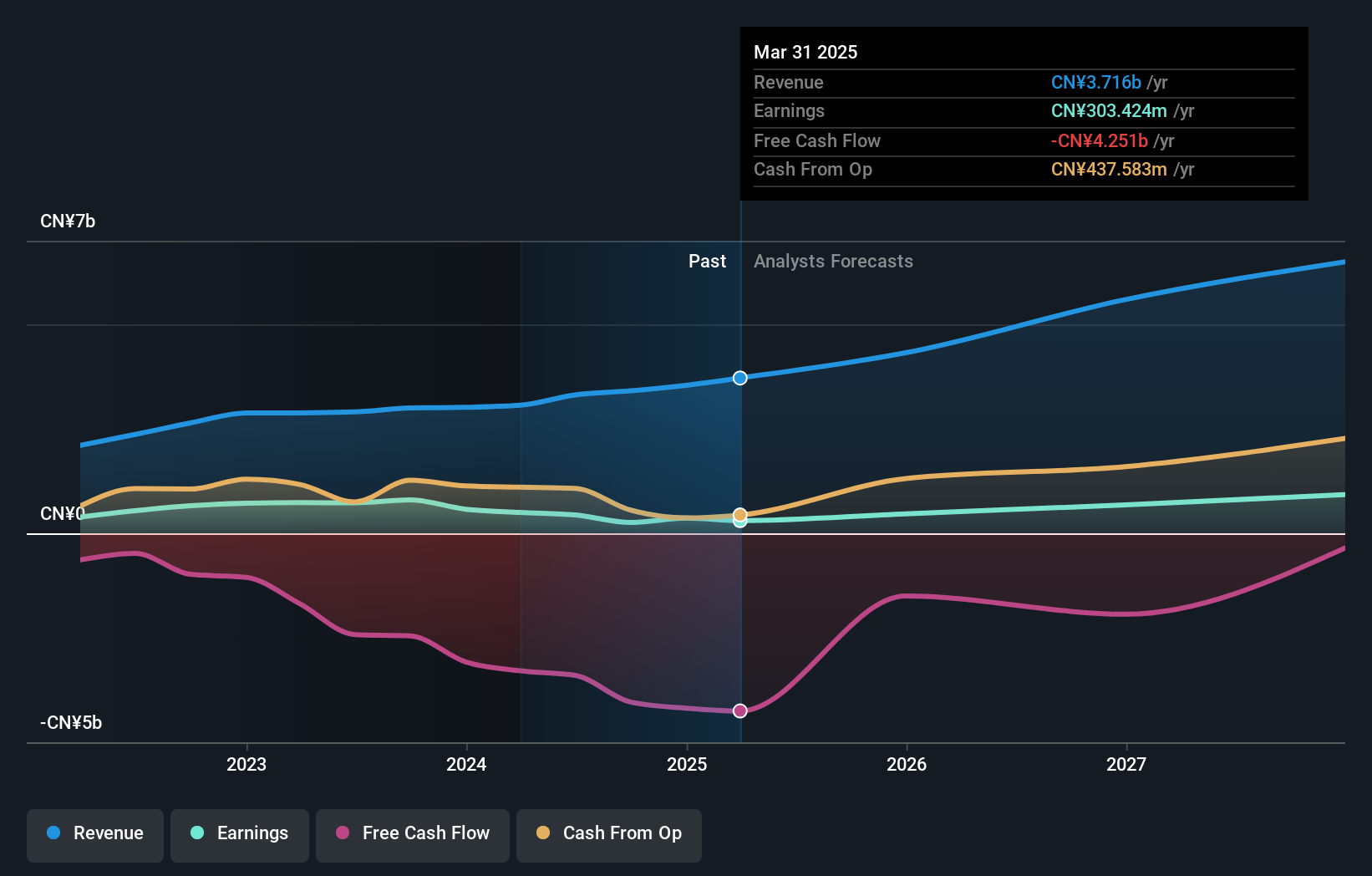

Shenzhen Senior Technology Material (SZSE:300568)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Senior Technology Material Co., Ltd. (SZSE:300568) operates in the manufacturing sector, focusing on producing materials for lithium-ion batteries, with a market cap of CN¥19.60 billion.

Operations: The company generates revenue primarily from its Lithium-Ion Battery Separator New Energy Materials segment, amounting to CN¥3.86 billion.

Insider Ownership: 13%

Shenzhen Senior Technology Material anticipates robust growth, with revenue expected to increase 25.3% annually, surpassing the Chinese market's average. Despite a volatile share price and reduced profit margins of 3.3%, earnings are forecast to grow significantly at 68% per year over the next three years. Recent earnings showed a decline in net income to CNY 114.41 million for the first nine months of 2025, highlighting challenges amidst strong growth prospects and high insider ownership stability.

- Dive into the specifics of Shenzhen Senior Technology Material here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Shenzhen Senior Technology Material's current price could be inflated.

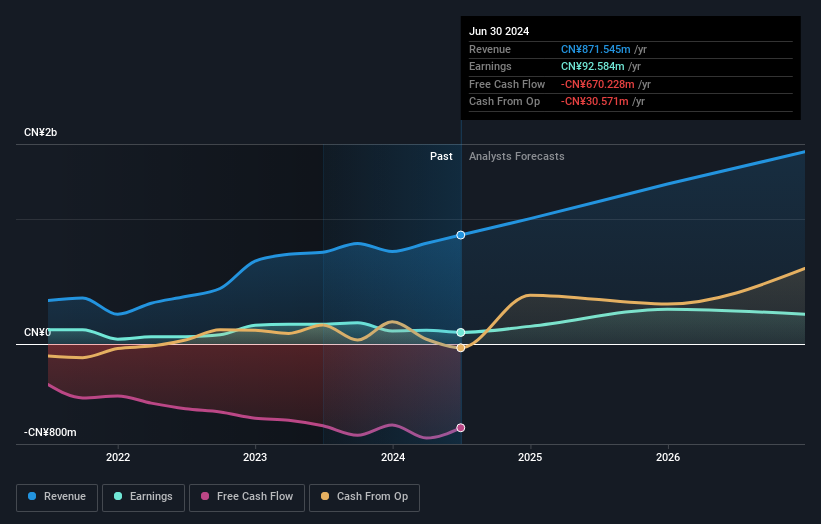

Guanglian Aviation Industry (SZSE:300900)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guanglian Aviation Industry Co., Ltd. is involved in designing and manufacturing metal and composite components, aviation process equipment, and aircraft in China with a market cap of CN¥9.15 billion.

Operations: The company generates revenue of CN¥1.15 billion from its aerospace equipment manufacturing segment.

Insider Ownership: 39.7%

Guanglian Aviation Industry is poised for significant earnings growth, forecasted at 98.24% annually, despite a volatile share price and revenue growth of 14.7%, slightly above the market average. The company reported nine-month sales of CNY 776.95 million, up from CNY 662.9 million year-on-year; however, net income dropped to CNY 17.39 million from CNY 51.3 million, reflecting profitability challenges amidst high insider ownership stability and debt concerns with operating cash flow coverage issues.

- Click here to discover the nuances of Guanglian Aviation Industry with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Guanglian Aviation Industry's share price might be too optimistic.

Make It Happen

- Click through to start exploring the rest of the 856 Fast Growing Global Companies With High Insider Ownership now.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报