3 Global Dividend Stocks To Consider With Up To 6.4% Yield

As global markets navigate a complex landscape marked by mixed economic signals and fluctuating interest rates, investors are increasingly seeking stability through dividend stocks. In this environment, a good dividend stock is characterized by its ability to provide consistent income and potential for long-term growth, making it an attractive consideration amid the current market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.65% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.71% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.77% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| NCD (TSE:4783) | 4.03% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.02% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.79% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.26% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our Top Global Dividend Stocks screener.

We'll examine a selection from our screener results.

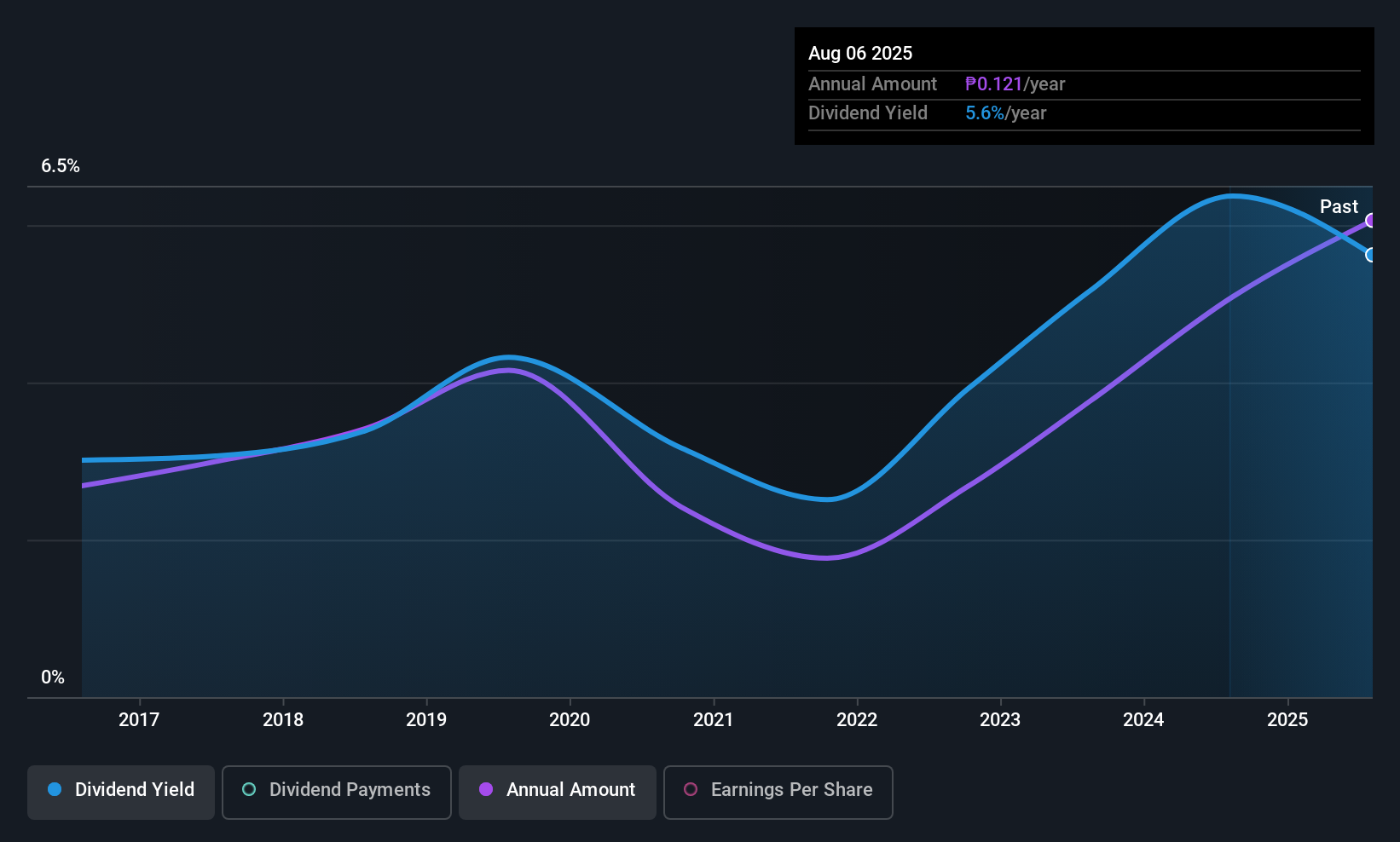

Rockwell Land (PSE:ROCK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rockwell Land Corporation is a property developer focusing on high-end and upper-mid markets primarily in Metro Manila, Philippines, with a market cap of ₱10.46 billion.

Operations: Rockwell Land Corporation's revenue is derived from two main segments: Commercial Development, which generated ₱4.36 billion, and Residential Development, contributing ₱16.70 billion.

Dividend Yield: 6.4%

Rockwell Land's dividend yield of 6.41% ranks in the top 25% in the PH market, but its sustainability is questionable due to lack of free cash flows and volatile payments over the past decade. Despite a low payout ratio of 18.5%, dividends are not covered by earnings or cash flows. Recent earnings growth, with net income rising to PHP 1.21 billion for Q3, indicates potential for future stability if financial management improves.

- Unlock comprehensive insights into our analysis of Rockwell Land stock in this dividend report.

- Upon reviewing our latest valuation report, Rockwell Land's share price might be too optimistic.

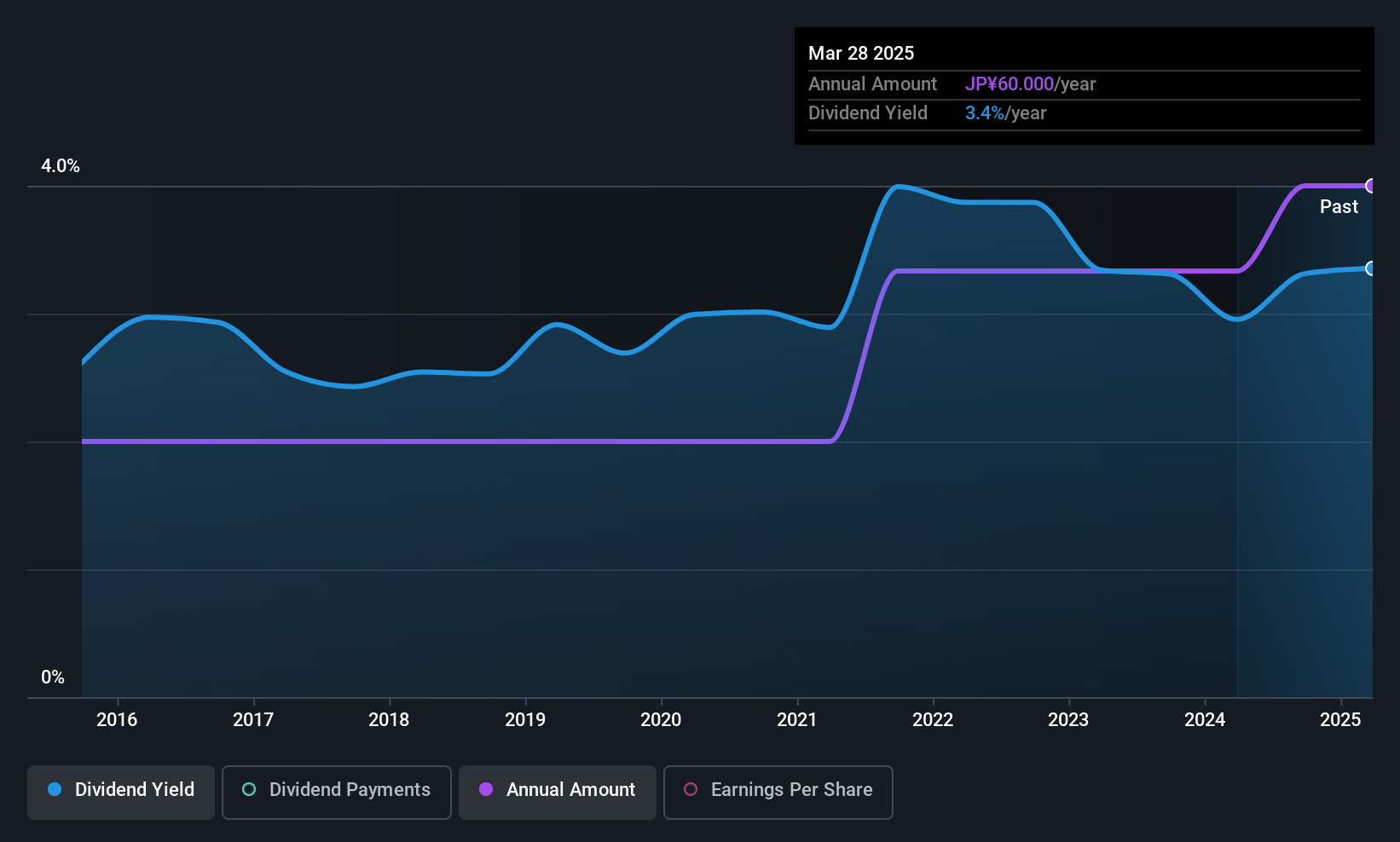

NIPPON PARKING DEVELOPMENTLtd (TSE:2353)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NIPPON PARKING DEVELOPMENT Co., Ltd. offers consulting services for parking lots both in Japan and internationally, with a market cap of ¥84.46 billion.

Operations: NIPPON PARKING DEVELOPMENT Co., Ltd. generates revenue from its Parking Lot Business (¥18.10 billion), Ski Resort Business (¥10.37 billion), and Theme Park Business (¥7.93 billion).

Dividend Yield: 3.3%

NIPPON PARKING DEVELOPMENT Ltd. offers a stable dividend yield of 3.35%, though it falls short of the top tier in Japan. The dividends are well-supported by earnings (payout ratio: 53.2%) and cash flows (cash payout ratio: 78.8%). Recent approval of an ¥8 per share dividend highlights its commitment to shareholders, while strategic buybacks totaling ¥999.97 million reflect a focus on shareholder value enhancement amidst leadership changes effective October 2025.

- Navigate through the intricacies of NIPPON PARKING DEVELOPMENTLtd with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of NIPPON PARKING DEVELOPMENTLtd shares in the market.

Maezawa Kasei Industries (TSE:7925)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Maezawa Kasei Industries Co., Ltd. specializes in the production and sale of water and sewerage-related products as well as environmental equipment, with a market cap of ¥32.87 billion.

Operations: Maezawa Kasei Industries Co., Ltd. generates revenue from Plastic Molding (¥1.06 billion), Pipes and Engineering Plastic (¥21.98 billion), and Water/Environmental Engineering (¥1.94 billion).

Dividend Yield: 3.1%

Maezawa Kasei Industries' dividend yield of 3.08% is below Japan's top quartile, yet it remains reliable and stable over the past decade. The dividends are well-covered by earnings (57.3% payout ratio) and cash flows (48.8% cash payout ratio), with consistent growth noted in recent years. A recent JPY 35 per share dividend increase underscores its commitment to shareholders amidst proposed amendments to its Articles of Incorporation and strategic plans with Maezawa Industries, Inc.

- Delve into the full analysis dividend report here for a deeper understanding of Maezawa Kasei Industries.

- According our valuation report, there's an indication that Maezawa Kasei Industries' share price might be on the expensive side.

Where To Now?

- Unlock our comprehensive list of 1287 Top Global Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报