3 UK Stocks Estimated To Be Trading At Up To 48% Discount

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, a key trading partner. In this environment of uncertainty, identifying undervalued stocks can be crucial for investors seeking potential opportunities, as these stocks may offer value despite broader market pressures.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.266 | £12.30 | 49% |

| Tortilla Mexican Grill (AIM:MEX) | £0.425 | £0.78 | 45.5% |

| PageGroup (LSE:PAGE) | £2.266 | £4.51 | 49.8% |

| Motorpoint Group (LSE:MOTR) | £1.34 | £2.67 | 49.8% |

| Ibstock (LSE:IBST) | £1.396 | £2.67 | 47.7% |

| Gym Group (LSE:GYM) | £1.47 | £2.94 | 49.9% |

| Fintel (AIM:FNTL) | £2.09 | £3.81 | 45.1% |

| Fevertree Drinks (AIM:FEVR) | £8.16 | £15.87 | 48.6% |

| Anglo Asian Mining (AIM:AAZ) | £2.65 | £5.15 | 48.6% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.175 | £4.18 | 48% |

We'll examine a selection from our screener results.

Advanced Medical Solutions Group (AIM:AMS)

Overview: Advanced Medical Solutions Group plc, with a market cap of £469.13 million, develops, manufactures, and distributes products for the surgical, woundcare, and wound-closure markets across the United Kingdom, Germany, Europe, the United States, and internationally.

Operations: The company's revenue is primarily derived from its surgical segment, contributing £175.23 million, and its woundcare segment, which adds £45.07 million.

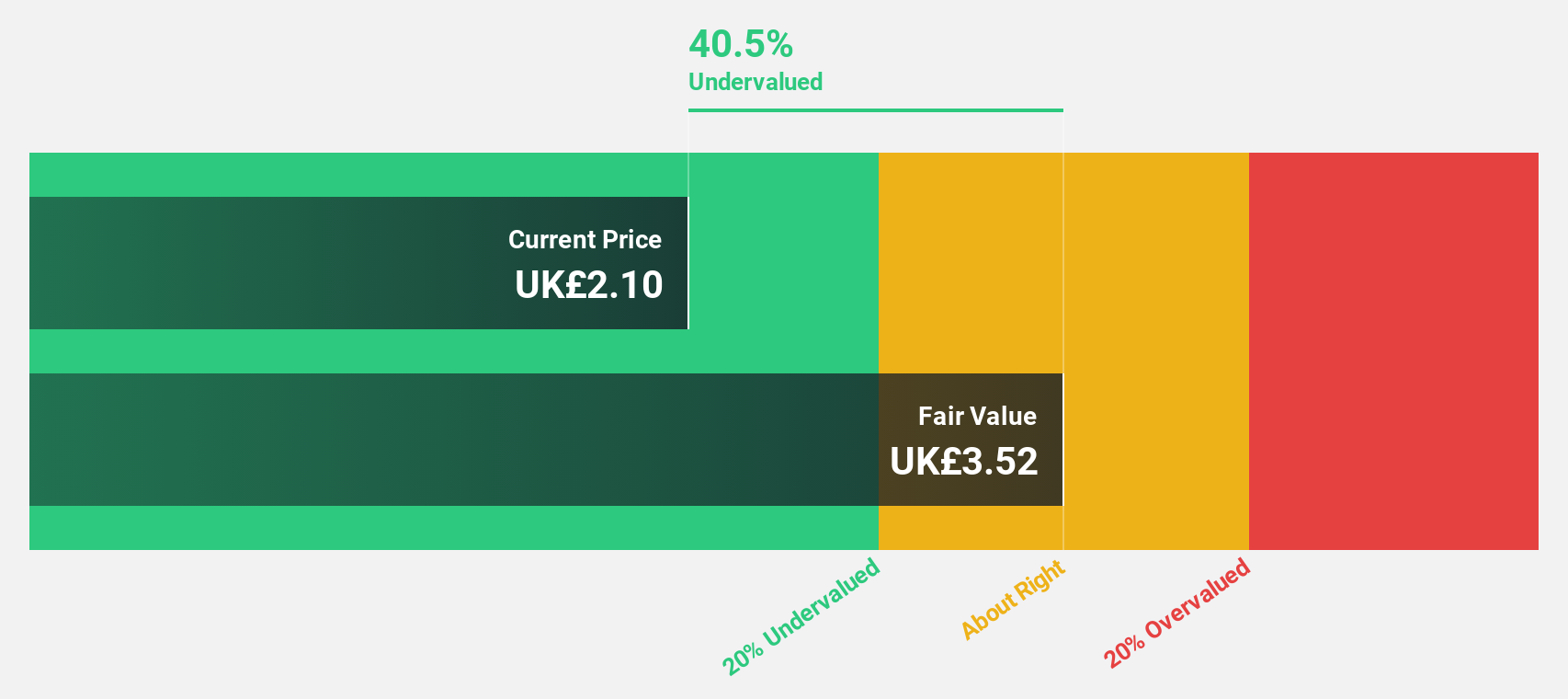

Estimated Discount To Fair Value: 48%

Advanced Medical Solutions Group is trading at £2.18, significantly below its estimated fair value of £4.18, suggesting it may be undervalued based on cash flows. Despite a decrease in profit margins from 8.5% to 4.1%, the company's earnings are forecasted to grow significantly at 33.8% per year, outpacing the UK market's growth rate of 14.2%. Revenue growth is also expected to surpass the market average, indicating potential for future value realization.

- Our comprehensive growth report raises the possibility that Advanced Medical Solutions Group is poised for substantial financial growth.

- Dive into the specifics of Advanced Medical Solutions Group here with our thorough financial health report.

GB Group (LSE:GBG)

Overview: GB Group plc offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and internationally, with a market cap of £608.22 million.

Operations: The company's revenue is derived from three main segments: Identity (£156.59 million), Location (£86.87 million), and Global Fraud Solutions (GFS) (£37.90 million).

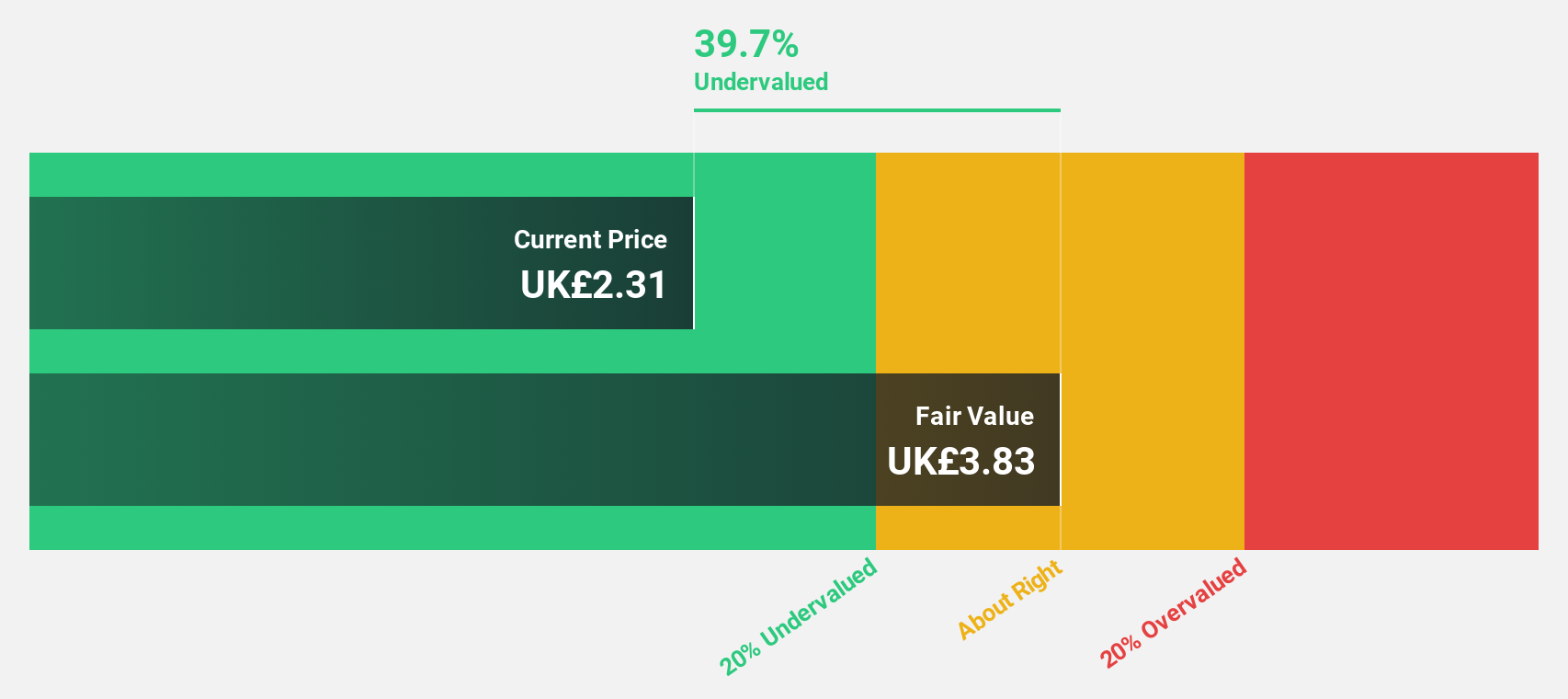

Estimated Discount To Fair Value: 39.2%

GB Group is trading at £2.57, well below its estimated fair value of £4.22, highlighting potential undervaluation based on cash flows. Despite a modest revenue growth forecast of 4.6% annually, the company's earnings are projected to grow significantly at 38.8% per year, outpacing the UK market's average growth rate of 14.2%. Recent inclusion in multiple FTSE indices and an expanded buyback plan further underscore confidence in its financial health and future prospects.

- Our expertly prepared growth report on GB Group implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of GB Group stock in this financial health report.

Wickes Group (LSE:WIX)

Overview: Wickes Group plc is a UK-based retailer specializing in home improvement products and services with a market cap of approximately £548.54 million.

Operations: The company generates revenue of £1.58 billion from its segment focused on retailing home improvement products and services in the UK.

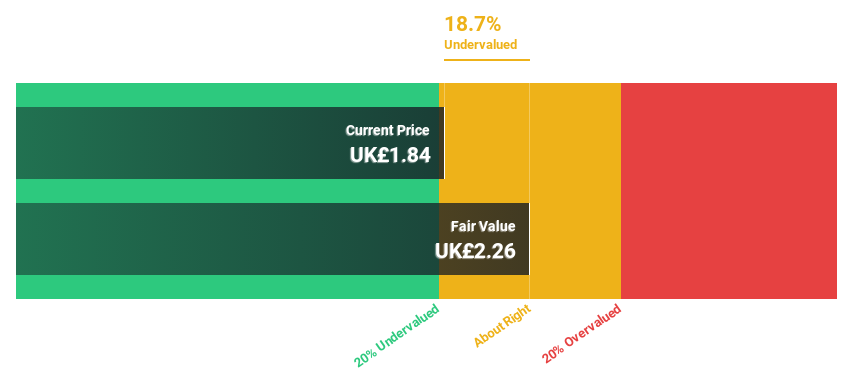

Estimated Discount To Fair Value: 22.5%

Wickes Group is trading at £2.36, significantly below its estimated fair value of £3.04, suggesting potential undervaluation based on cash flows. Despite a slower revenue growth forecast of 4.5% annually, earnings are expected to grow substantially at 25.6% per year, surpassing the UK market's average growth rate of 14.2%. Recent financial results show group revenue reaching £1.27 billion year-to-date, with large one-off items impacting earnings quality and a dividend not well covered by earnings.

- The growth report we've compiled suggests that Wickes Group's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Wickes Group.

Next Steps

- Gain an insight into the universe of 57 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报