3 UK Penny Stocks With Market Caps Over £200M

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over China's economic recovery and its impact on global trade. In such a climate, investors often seek out stocks that can offer potential growth without excessive risk, making penny stocks an area of interest despite their traditionally risky reputation. These smaller or newer companies may provide opportunities for growth at lower price points when they possess strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.625 | £15.71M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.255 | £488.14M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.975 | £159.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.86 | £12.98M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.70 | $406.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.504 | £182.15M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.47 | £40.51M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £184.26M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 304 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Next 15 Group (AIM:NFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Next 15 Group plc, with a market cap of £314.38 million, operates through its subsidiaries to provide customer insight, delivery, engagement, and business transformation services across the United Kingdom, Africa, the United States, Europe, Middle East, and Africa.

Operations: Next 15 Group's revenue segments are not specifically reported, but the company operates in regions including the United Kingdom, Africa, the United States, Europe, and the Middle East.

Market Cap: £314.38M

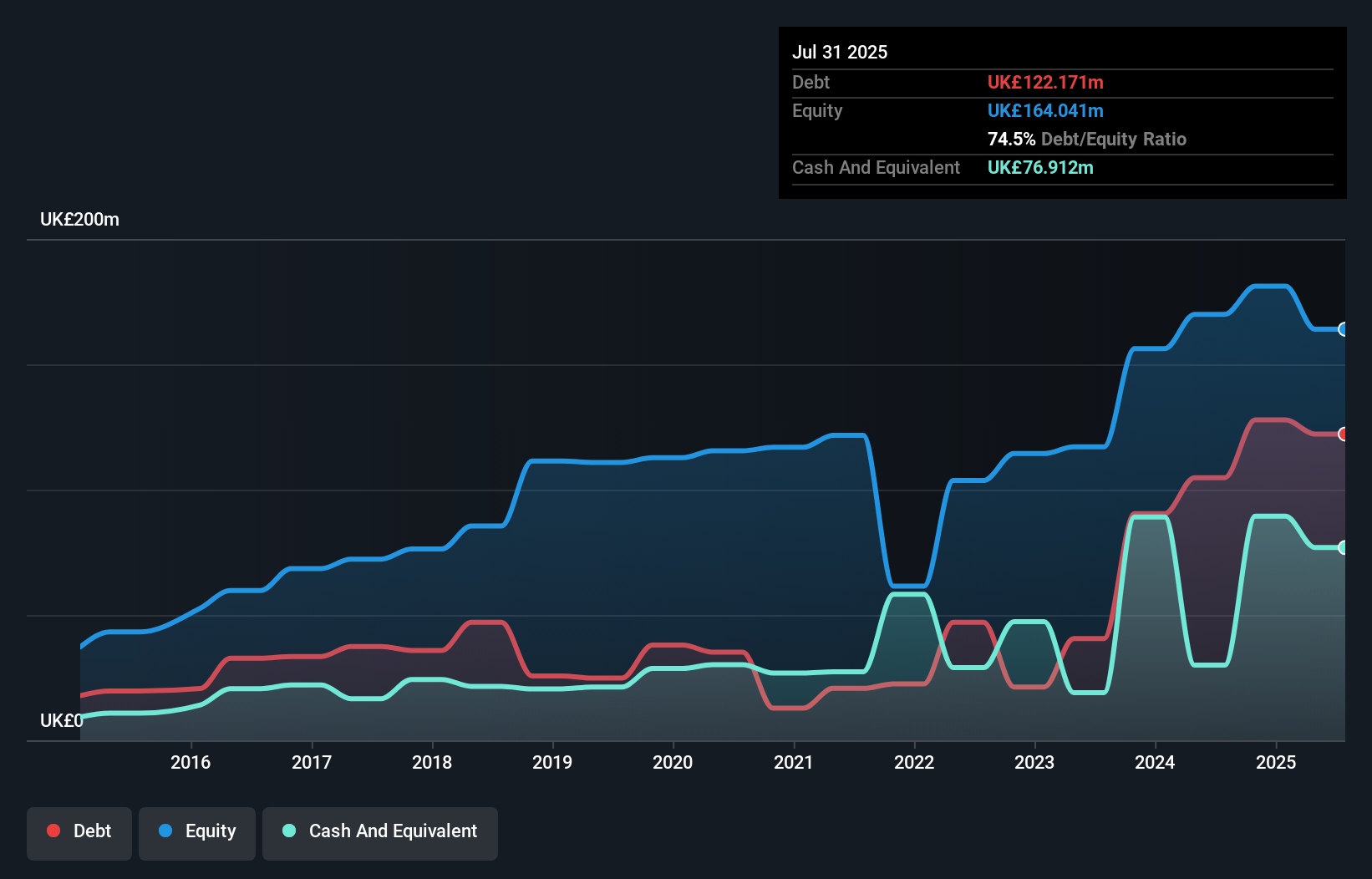

Next 15 Group plc, with a market cap of £314.38 million, recently reported a net loss of £1.45 million for the half year ending July 2025, down from a net income of £22.14 million the previous year. Despite this setback and large one-off losses affecting results, analysts expect earnings to grow significantly by 53.66% annually. The company's debt is well-covered by operating cash flow and interest payments are adequately managed by EBIT, although short-term liabilities exceed short-term assets slightly. Management changes indicate an inexperienced team and board, contributing to share price volatility over recent months.

- Click to explore a detailed breakdown of our findings in Next 15 Group's financial health report.

- Assess Next 15 Group's future earnings estimates with our detailed growth reports.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Baltic Classifieds Group PLC operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania with a market cap of £949.69 million.

Operations: The company's revenue is derived from four main segments: Auto (€31.37 million), Real Estate (€24.40 million), Jobs & Services (€16.57 million), and Generalist (€13.49 million).

Market Cap: £949.69M

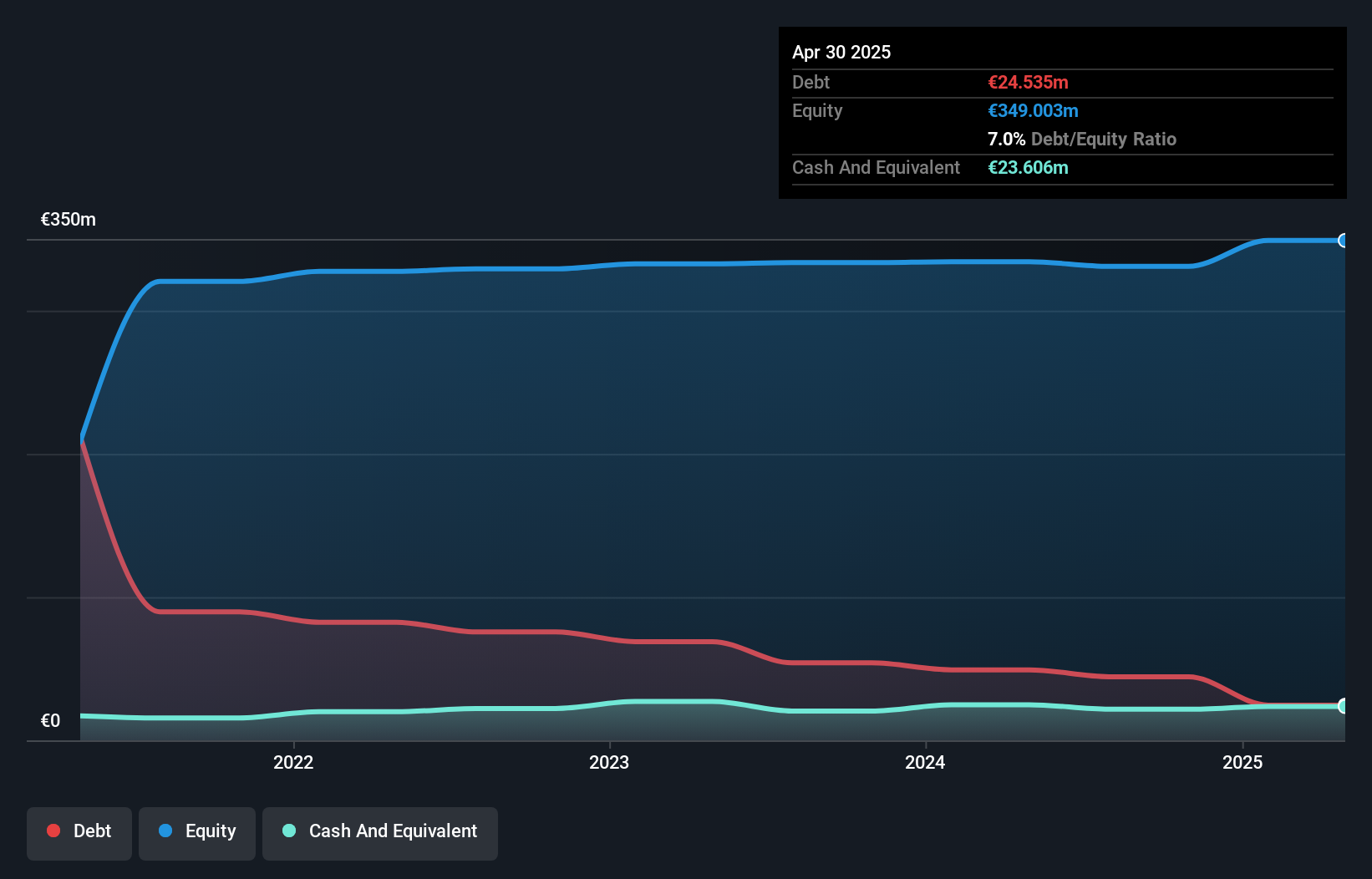

Baltic Classifieds Group PLC, with a market cap of £949.69 million, has shown robust earnings growth of 28.9% over the past year, surpassing industry averages. The company's revenue for the first half of 2025 was €44.84 million, with net income rising to €26.44 million from €21.69 million a year ago. Despite short-term liabilities slightly exceeding assets and low return on equity at 14%, its debt is well-managed and covered by operating cash flow (403.7%). The board and management team are experienced, contributing to stable weekly volatility at 6%. Dividends have been increased for shareholders in recent announcements.

- Unlock comprehensive insights into our analysis of Baltic Classifieds Group stock in this financial health report.

- Examine Baltic Classifieds Group's earnings growth report to understand how analysts expect it to perform.

Henry Boot (LSE:BOOT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities, with a market cap of £295.64 million.

Operations: The company generates revenue through three main segments: property investment and development (£180.58 million), land promotion (£96.95 million), and construction activities (£78.70 million).

Market Cap: £295.64M

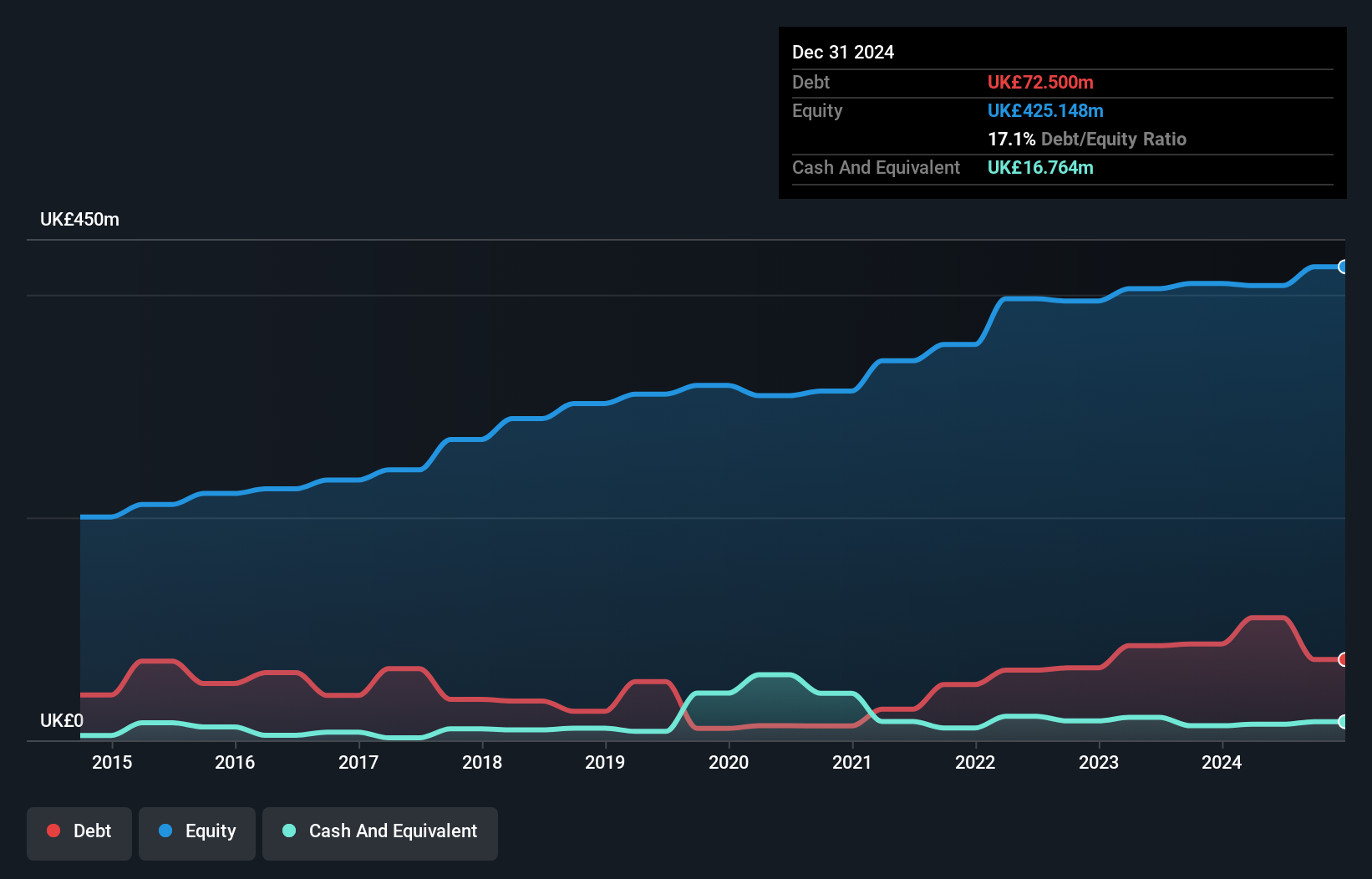

Henry Boot PLC, with a market cap of £295.64 million, operates in property investment and development, land promotion, and construction activities. The company demonstrates stable weekly volatility at 3%, with debt well-covered by operating cash flow (24%). Short-term assets (£427.9M) exceed both short-term (£187.2M) and long-term liabilities (£21.6M), indicating robust financial health. Despite a low return on equity (6.4%) and an unstable dividend track record, earnings have grown significantly by 130.1% over the past year due to large one-off gains impacting results. The management team is seasoned with an average tenure of 7.9 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Henry Boot.

- Understand Henry Boot's earnings outlook by examining our growth report.

Where To Now?

- Discover the full array of 304 UK Penny Stocks right here.

- Looking For Alternative Opportunities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报