Three Undiscovered Gems In The United Kingdom Market

The United Kingdom market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to concerns over weak trade data from China and its impact on global demand. Amidst this backdrop of uncertainty, identifying stocks that demonstrate resilience and potential for growth becomes crucial, especially those that may be undervalued or overlooked in the broader market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 282.42% | 9.69% | 21.24% | ★★★★★☆ |

| Law Debenture | 15.39% | 21.17% | 19.12% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| Foresight Environmental Infrastructure | NA | -24.80% | -27.25% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Mha (AIM:MHA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mha Plc provides financial and business strategy services to enterprises and individuals, with a market capitalization of £393.26 million.

Operations: The company generates revenue primarily from the provision of professional services, amounting to £238.26 million.

Mha Plc, a smaller player in the UK market, has shown mixed performance recently. Despite high-quality earnings and trading at a favorable price-to-earnings ratio of 6.9x compared to the UK's 16.1x, its net profit margin dropped from 36.9% to 23.8%. The company reported sales of £121.31 million for H1 2026, up from £107.2 million last year, but net income fell significantly to £18.05 million from £44.34 million due to rising costs and strategic acquisitions like Baker Tilly South-East Europe Holdings Limited contributing only partially to revenue growth amidst broader economic challenges.

- Click here and access our complete health analysis report to understand the dynamics of Mha.

Explore historical data to track Mha's performance over time in our Past section.

MS INTERNATIONAL (AIM:MSI)

Simply Wall St Value Rating: ★★★★★★

Overview: MS INTERNATIONAL plc, with a market cap of £243.53 million, operates globally in the design, manufacture, construction, and servicing of various engineering products and structures across multiple regions including the UK, Europe, the USA, Asia, and South America.

Operations: The company generates revenue primarily from its Defence and Security segment (£82.45 million), followed by Forgings (£13.77 million) and Petrol Station Superstructures (£13.24 million). The Corporate Branding segment contributes £8.60 million to the overall revenue stream.

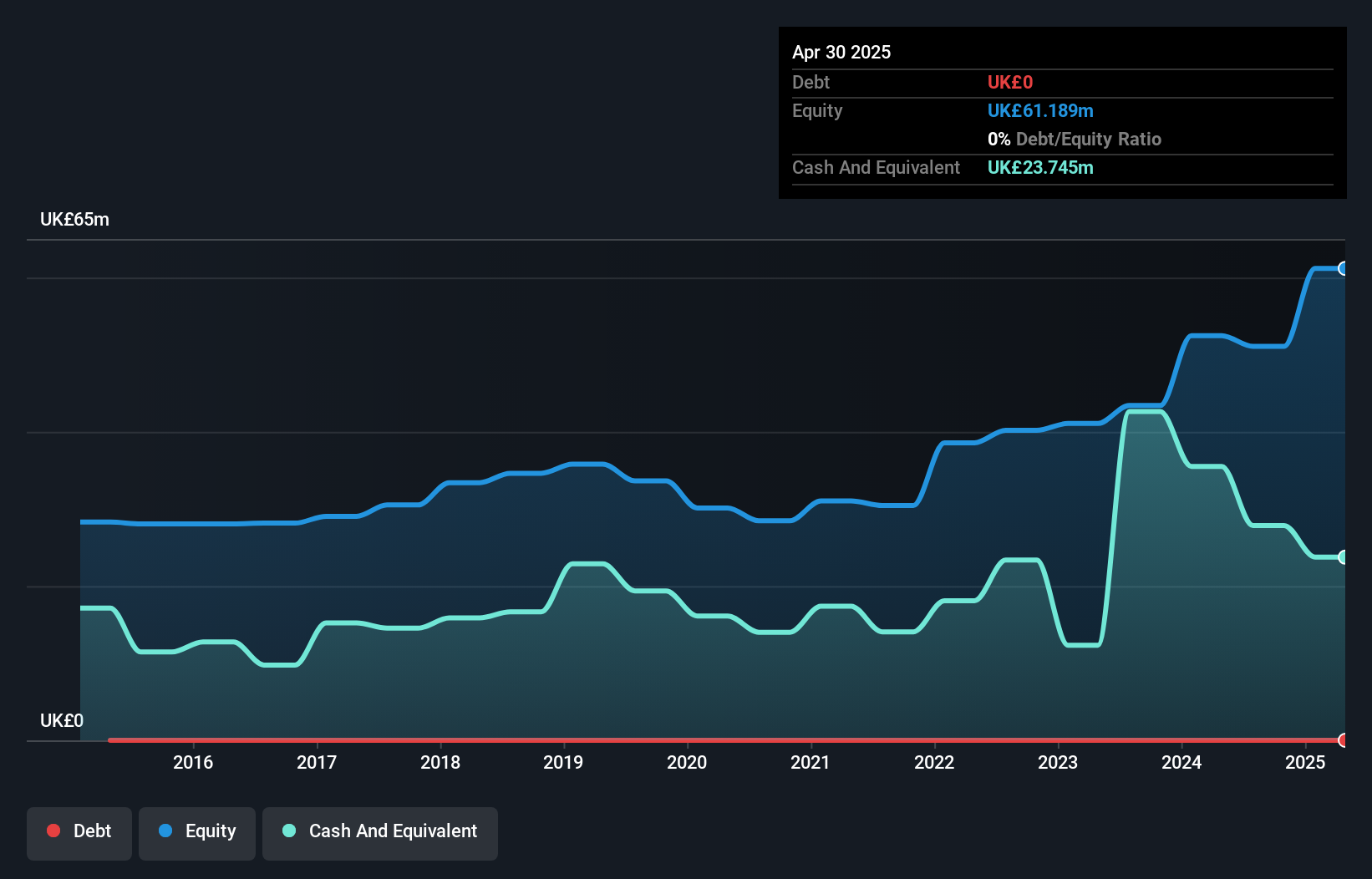

MS International, a nimble player in the Aerospace & Defense sector, showcases a compelling profile with its debt-free status and a price-to-earnings ratio of 16.8x, undercutting the industry average of 22.9x. Over five years, earnings have surged at an impressive annual rate of 53.2%, although last year's growth of 26.4% slightly lagged behind the industry's 28.4%. Recent developments include a $34.5 million contract with the US Navy for gun mounts, highlighting strong international ties and potential for sustained collaboration despite NAVSEA's preference for shorter contracts moving forward.

- Click here to discover the nuances of MS INTERNATIONAL with our detailed analytical health report.

Gain insights into MS INTERNATIONAL's past trends and performance with our Past report.

Science Group (AIM:SAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Science Group plc is a science and technology consultancy and systems business operating in the United Kingdom, other European countries, North America, and Asia, with a market capitalization of £237.73 million.

Operations: Science Group generates revenue primarily from Professional Services (£68.87 million) and Systems - Submarine Atmosphere Management (£31.53 million), with additional contributions from Systems - Audio Chips and Modules (£13.17 million) and Freehold Properties (£3.89 million).

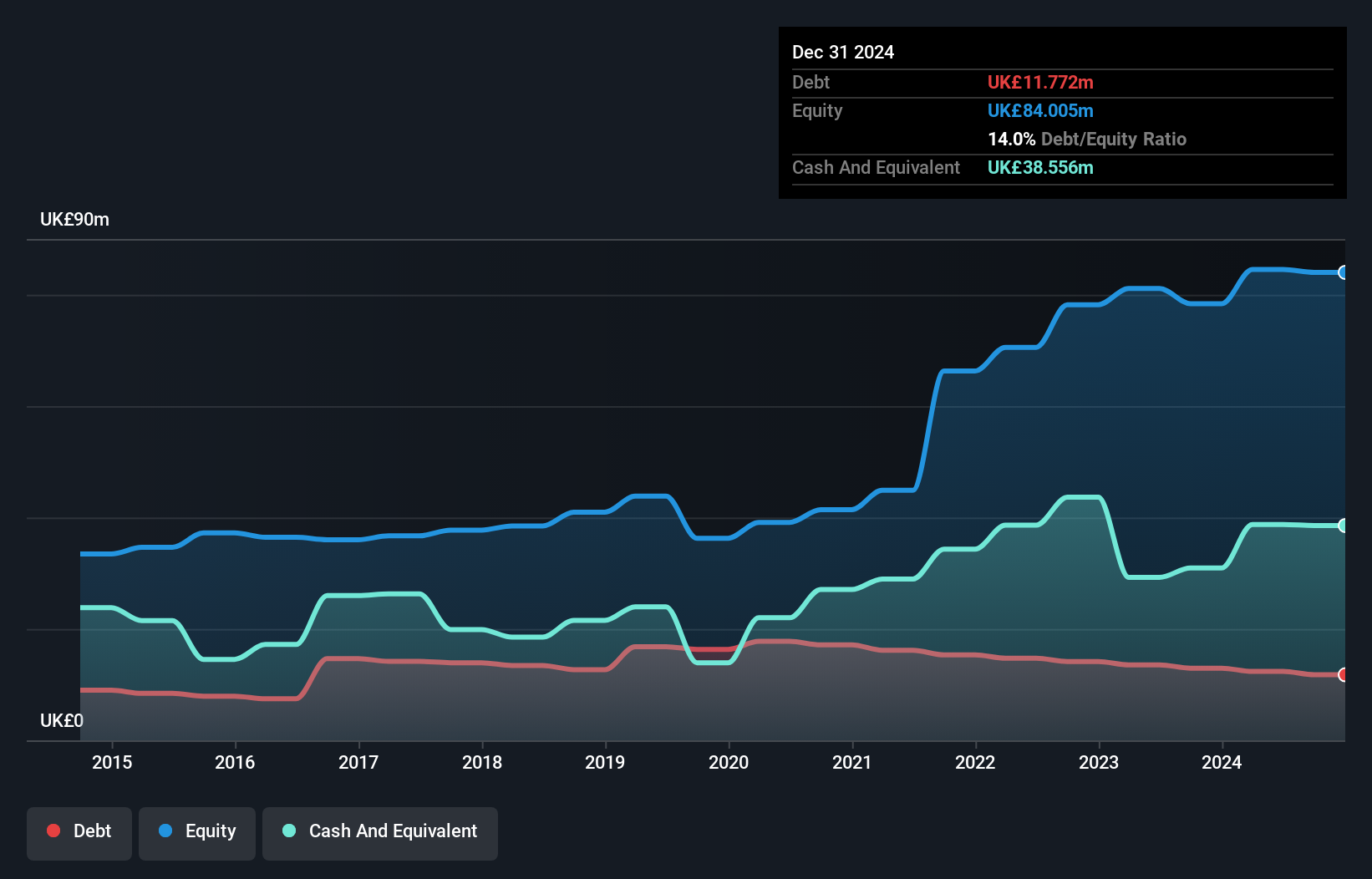

Science Group, a nimble player in the UK market, has seen its earnings soar by 410% over the past year, significantly outpacing the Professional Services industry's 1.7%. This impressive growth is partly due to a notable £24M one-off gain impacting recent financial results. The company seems well-positioned financially with its debt-to-equity ratio dropping from 45.4% to 11.5% over five years and holding more cash than total debt. Trading at about 10.7% below estimated fair value suggests potential for investors, although future earnings are projected to decline by an average of 60% annually over the next three years.

- Navigate through the intricacies of Science Group with our comprehensive health report here.

Evaluate Science Group's historical performance by accessing our past performance report.

Seize The Opportunity

- Unlock our comprehensive list of 55 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报