3 European Undervalued Small Caps With Recent Insider Buying

As the European market experiences a positive shift, with the pan-European STOXX Europe 600 Index rising by 1.60% due to signs of steady economic growth and looser monetary policies, investors are increasingly interested in exploring opportunities within small-cap stocks. In this environment, identifying companies that demonstrate strong fundamentals and potential for growth can be particularly appealing, especially when there is evidence of insider buying which may indicate confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.4x | 0.7x | 42.31% | ★★★★★☆ |

| A.G. BARR | 14.3x | 1.6x | 48.80% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 42.69% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.5x | 0.3x | 40.62% | ★★★★★☆ |

| Eurocell | 16.3x | 0.3x | 39.96% | ★★★★☆☆ |

| Senior | 25.2x | 0.8x | 24.95% | ★★★★☆☆ |

| Tristel | 29.3x | 4.2x | 20.43% | ★★★☆☆☆ |

| Gooch & Housego | 46.8x | 1.1x | 22.13% | ★★★☆☆☆ |

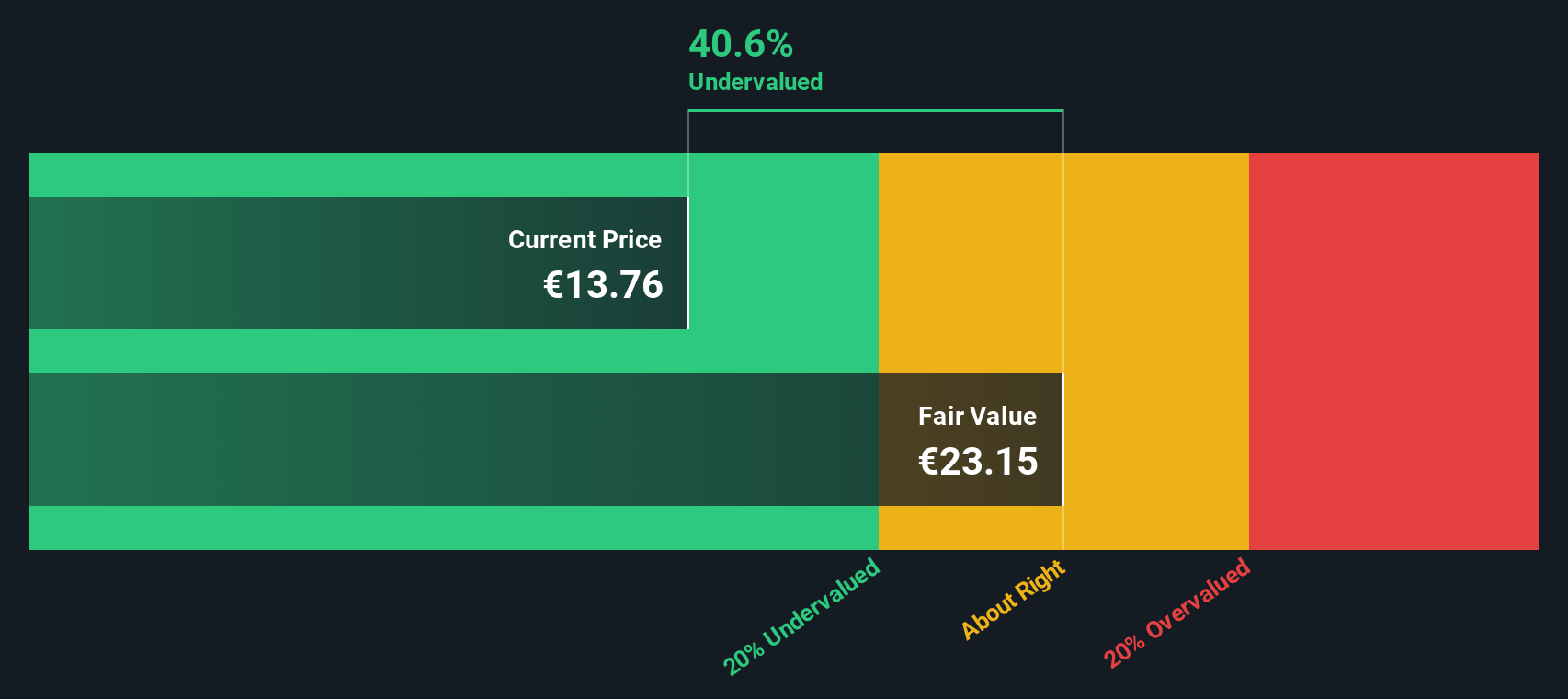

| Kendrion | 29.2x | 0.7x | 41.84% | ★★★☆☆☆ |

| CVS Group | 47.6x | 1.3x | 23.76% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Kendrion (ENXTAM:KENDR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kendrion is a company that specializes in developing, manufacturing, and marketing electromagnetic systems and components for industrial and automotive applications, with a market capitalization of approximately €0.29 billion.

Operations: Kendrion's revenue primarily stems from its operations, with significant costs attributed to COGS and operating expenses. The company's gross profit margin has shown variability, reaching as high as 50.32% in recent periods. Non-operating expenses also impact the financial outcomes, contributing to fluctuations in net income margins over time.

PE: 29.2x

Kendrion, a European company with a market presence in the industrial sector, recently reported an impressive turnaround in its financials. For Q3 2025, they posted a net income of €3.9 million compared to last year's €7 million loss. Insider confidence is evident as executives have shown interest by purchasing shares over recent months. Despite relying on external borrowing for funding, their earnings are projected to grow by 35.87% annually, indicating potential growth opportunities ahead.

- Click to explore a detailed breakdown of our findings in Kendrion's valuation report.

Examine Kendrion's past performance report to understand how it has performed in the past.

FirstGroup (LSE:FGP)

Simply Wall St Value Rating: ★★★★☆☆

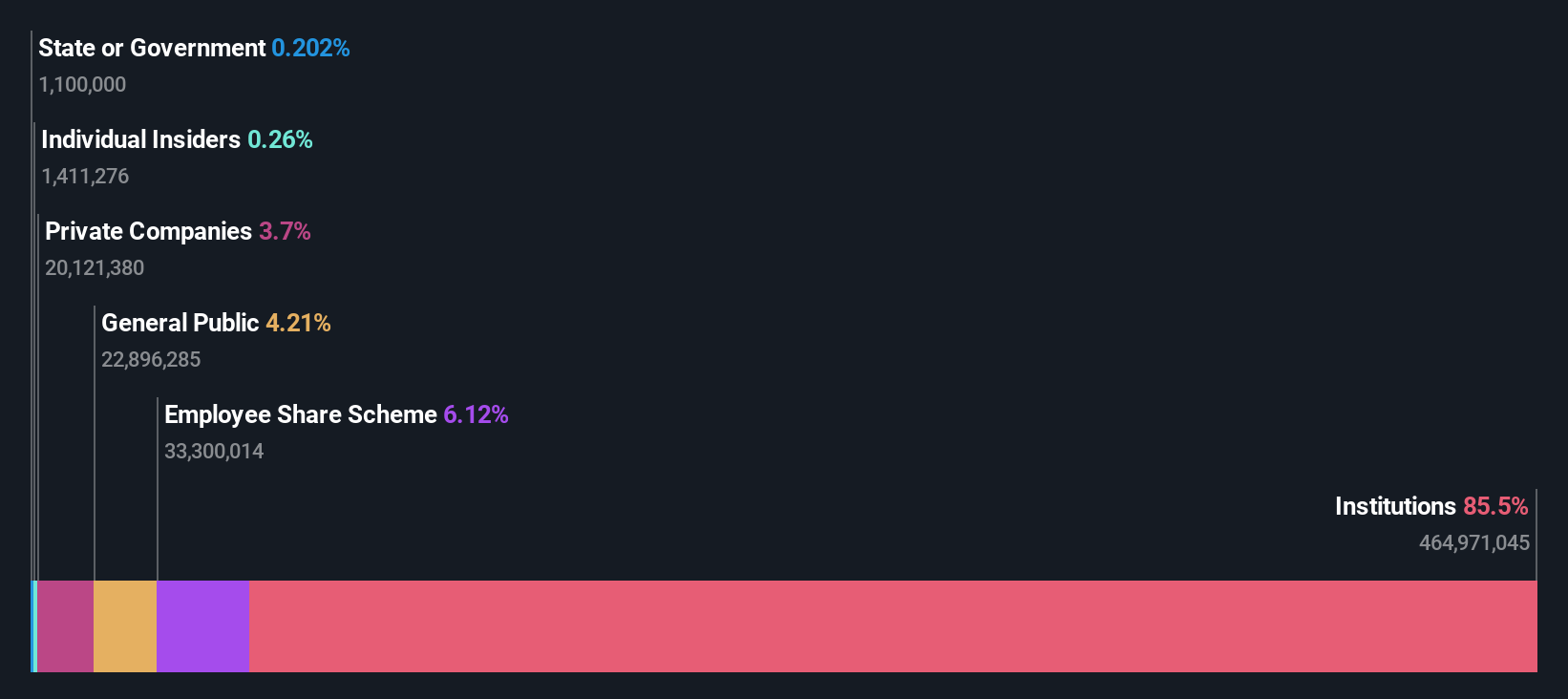

Overview: FirstGroup is a leading UK-based transport company operating in the bus and rail sectors, with a market capitalization of approximately £0.97 billion.

Operations: First Bus and First Rail are the primary revenue segments, contributing £1.27 billion and £3.75 billion respectively. The gross profit margin has seen fluctuations, peaking at 77.56% in September 2020 before stabilizing around the mid-60% range in recent periods. Operating expenses have been a significant cost factor, with depreciation and amortization consistently high over time.

PE: 8.1x

FirstGroup, a smaller European transport company, has seen insider confidence with recent share purchases. From June to October 2025, they repurchased 22.4 million shares for £50 million, indicating management's belief in the company's potential. Despite a slight dip in sales to £2.3 billion for H1 2025 compared to last year, earnings per share rose from GBP 0.092 to GBP 0.099, reflecting operational efficiency improvements. The proposed interim dividend increase aligns with their policy and suggests stable cash flow management amid anticipated earnings decline over the next three years.

- Navigate through the intricacies of FirstGroup with our comprehensive valuation report here.

Evaluate FirstGroup's historical performance by accessing our past performance report.

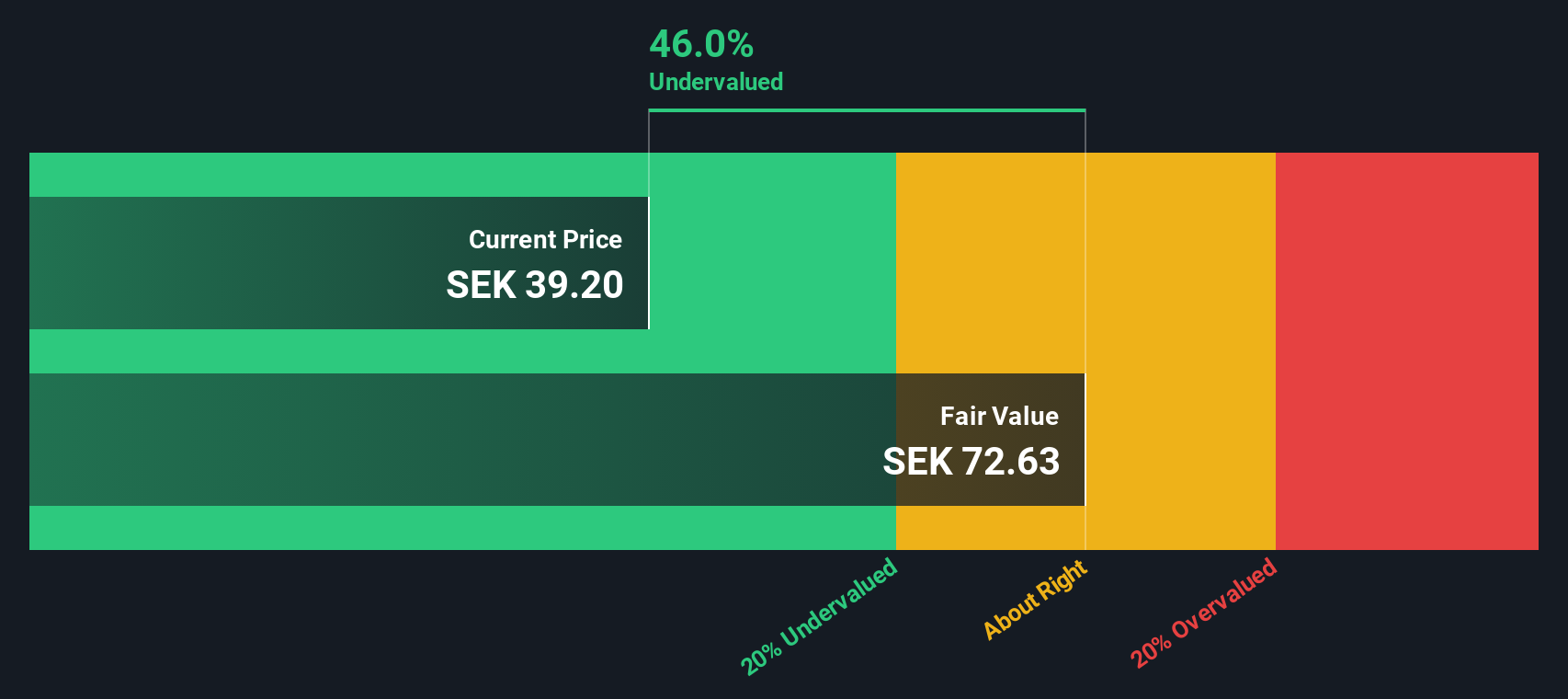

Fagerhult Group (OM:FAG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fagerhult Group is a company that specializes in providing lighting solutions across various segments, including premium, professional, and infrastructure, with a market capitalization of SEK 9.5 billion.

Operations: The company's revenue is primarily driven by segments such as Collection, Premium, and Professional. The gross profit margin has shown a trend of gradual increase over time, reaching 39.92% in the latest period. Operating expenses are significant, with sales and marketing being the largest component. Non-operating expenses also impact financial results significantly.

PE: 27.7x

Fagerhult Group's recent performance highlights its potential as an undervalued European stock. In Q3 2025, sales rose to SEK 2,026.5 million from SEK 1,918.9 million a year prior, while net income climbed to SEK 85.6 million from SEK 54 million. Despite the improvement in earnings per share to SEK 0.49 from SEK 0.31, profit margins have decreased compared to last year at just over three percent now versus nearly five percent previously. The company's reliance on external borrowing poses some risk; however, insider confidence is evident with significant share purchases throughout the past year indicating optimism about future growth prospects despite current financial challenges.

- Click here to discover the nuances of Fagerhult Group with our detailed analytical valuation report.

Assess Fagerhult Group's past performance with our detailed historical performance reports.

Key Takeaways

- Get an in-depth perspective on all 73 Undervalued European Small Caps With Insider Buying by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报