European Penny Stocks To Watch In December 2025

As European markets show signs of steady economic growth and benefit from looser monetary policies, the pan-European STOXX Europe 600 Index has risen by 1.60%, reflecting a positive sentiment across major stock indexes. In this context, penny stocks—often representing smaller or newer companies—remain a relevant investment area despite their seemingly outdated name. These stocks can offer affordability and growth potential, especially when backed by strong financials, making them an intriguing option for investors seeking hidden value in quality companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.518 | €1.56B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.75 | €84.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.00 | SEK182.52M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.37 | €386.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0718 | €7.72M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 295 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

NX Filtration (ENXTAM:NXFIL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NX Filtration N.V. develops, produces, and sells hollow fiber membrane modules across various regions including the Netherlands, Europe, North America, Asia, and internationally with a market cap of €161.97 million.

Operations: The company's revenue is derived from two main segments: Clean Municipal Water, generating €3.85 million, and Sustainable Industrial Water, contributing €6.71 million.

Market Cap: €161.97M

NX Filtration, with a market cap of €161.97 million, operates across multiple regions and focuses on water filtration solutions. Despite being unprofitable and not expected to achieve profitability in the next three years, the company shows potential with forecasted revenue growth of 51.59% annually. It maintains a healthy financial position, as its short-term assets exceed both short- and long-term liabilities, and it has more cash than total debt. The management team is experienced with an average tenure of 3.1 years, although board experience data is insufficient for assessment. Shareholders have not faced significant dilution recently.

- Click here and access our complete financial health analysis report to understand the dynamics of NX Filtration.

- Understand NX Filtration's earnings outlook by examining our growth report.

Polwax (WSE:PWX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Polwax S.A. is involved in the production and distribution of refined and renewable paraffin, waxes, and specialty industrial paraffin compositions, with a market cap of PLN74.04 million.

Operations: The company generates revenue primarily from its Specialty Chemicals segment, which amounted to PLN148.83 million.

Market Cap: PLN74.04M

Polwax S.A., with a market cap of PLN74.04 million, has seen declining revenue, reporting PLN53.99 million for Q3 2025 compared to PLN65.82 million the previous year, alongside a reduced net loss of PLN0.726 million from PLN1.01 million. Despite being unprofitable and experiencing increased losses over five years, Polwax benefits from short-term assets exceeding both short- and long-term liabilities, indicating solid liquidity management without debt concerns. However, its board is relatively inexperienced with an average tenure of 1.4 years and it faces less than a year of cash runway if current growth trends persist.

- Take a closer look at Polwax's potential here in our financial health report.

- Learn about Polwax's historical performance here.

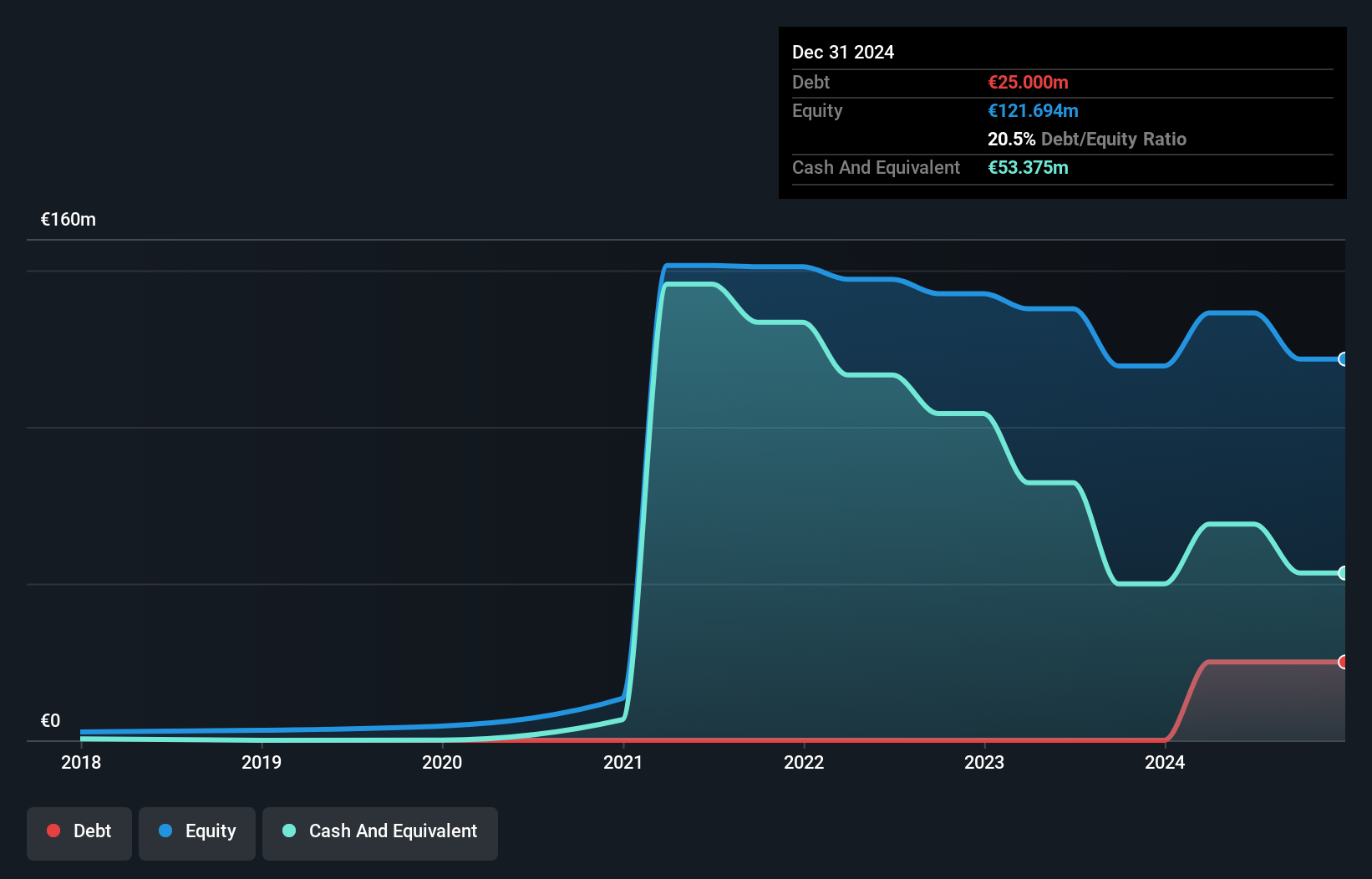

7C Solarparken (XTRA:HRPK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 7C Solarparken AG operates in the sale of electricity within Germany and Belgium, with a market capitalization of €125.82 million.

Operations: The company generates revenue primarily from the sale of electricity, amounting to €67.63 million.

Market Cap: €125.82M

7C Solarparken, with a market cap of €125.82 million, primarily generates revenue from electricity sales totaling €67.63 million. Despite being unprofitable and having a high net debt to equity ratio of 42.1%, its short-term assets (€114.2M) comfortably cover short-term liabilities (€49.2M), though not long-term liabilities (€245.3M). The company has managed to reduce its debt significantly over five years and maintains well-covered interest payments with EBIT covering interest 4.1 times over. Forecasts suggest strong earnings growth ahead, while the experienced board and management team offer stability amidst volatility in returns.

- Navigate through the intricacies of 7C Solarparken with our comprehensive balance sheet health report here.

- Explore 7C Solarparken's analyst forecasts in our growth report.

Taking Advantage

- Dive into all 295 of the European Penny Stocks we have identified here.

- Contemplating Other Strategies? This technology could replace computers: discover the 29 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报