European Growth Companies With High Insider Ownership In December 2025

As European markets show signs of steady economic growth and benefit from looser monetary policies, the pan-European STOXX Europe 600 Index has risen by 1.60%, reflecting a positive sentiment across major stock indexes. This environment highlights the importance of identifying growth companies with high insider ownership, as such stocks may offer unique insights into potential market opportunities amid evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Let's review some notable picks from our screened stocks.

MilDef Group (OM:MILDEF)

Simply Wall St Growth Rating: ★★★★★★

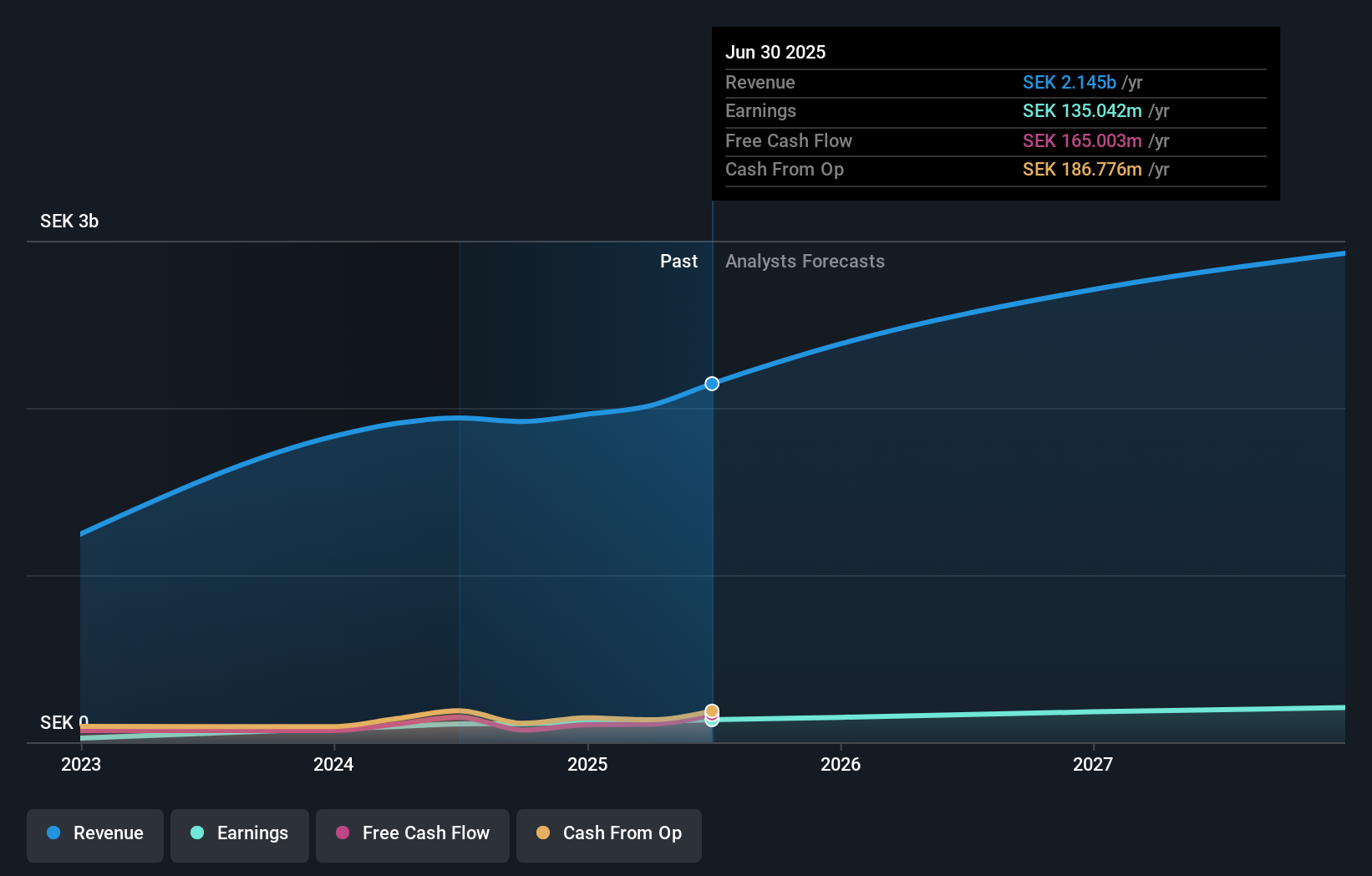

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions across various countries including Sweden, Norway, and the United States, with a market cap of SEK5.79 billion.

Operations: The company's revenue is primarily derived from its Computer Hardware segment, which generated SEK1.68 billion.

Insider Ownership: 13.7%

MilDef Group's revenue is forecast to grow at 29.2% annually, significantly outpacing the Swedish market, with earnings expected to rise by 83% per year. The company trades below its estimated fair value and analysts agree on a potential stock price increase of nearly 100%. Recent developments include a SEK 320 million order under a SEK 2.8 billion framework agreement and expansion into new facilities in Rosersberg, enhancing capacity for defense-related integration services amid growing demand.

- Take a closer look at MilDef Group's potential here in our earnings growth report.

- Our valuation report here indicates MilDef Group may be undervalued.

Nordrest Holding (OM:NREST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordrest Holding AB (publ) is a foodservice company operating in Sweden and internationally, with a market capitalization of SEK3.05 billion.

Operations: The company generates revenue primarily through its restaurants segment, which accounts for SEK2.31 billion.

Insider Ownership: 31.1%

Nordrest Holding shows promising growth potential, with earnings forecast to grow at 18% per year, outpacing the Swedish market. Despite revenue growth projections of 11.1% annually being below 20%, they surpass the broader market's expectations. The company's recent financial performance is strong, with third-quarter revenue increasing to SEK 588.98 million and net income rising to SEK 29.07 million year-over-year. Trading significantly below estimated fair value adds investment appeal amidst high return on equity forecasts of very high levels in three years' time.

- Click here and access our complete growth analysis report to understand the dynamics of Nordrest Holding.

- The analysis detailed in our Nordrest Holding valuation report hints at an inflated share price compared to its estimated value.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★★☆

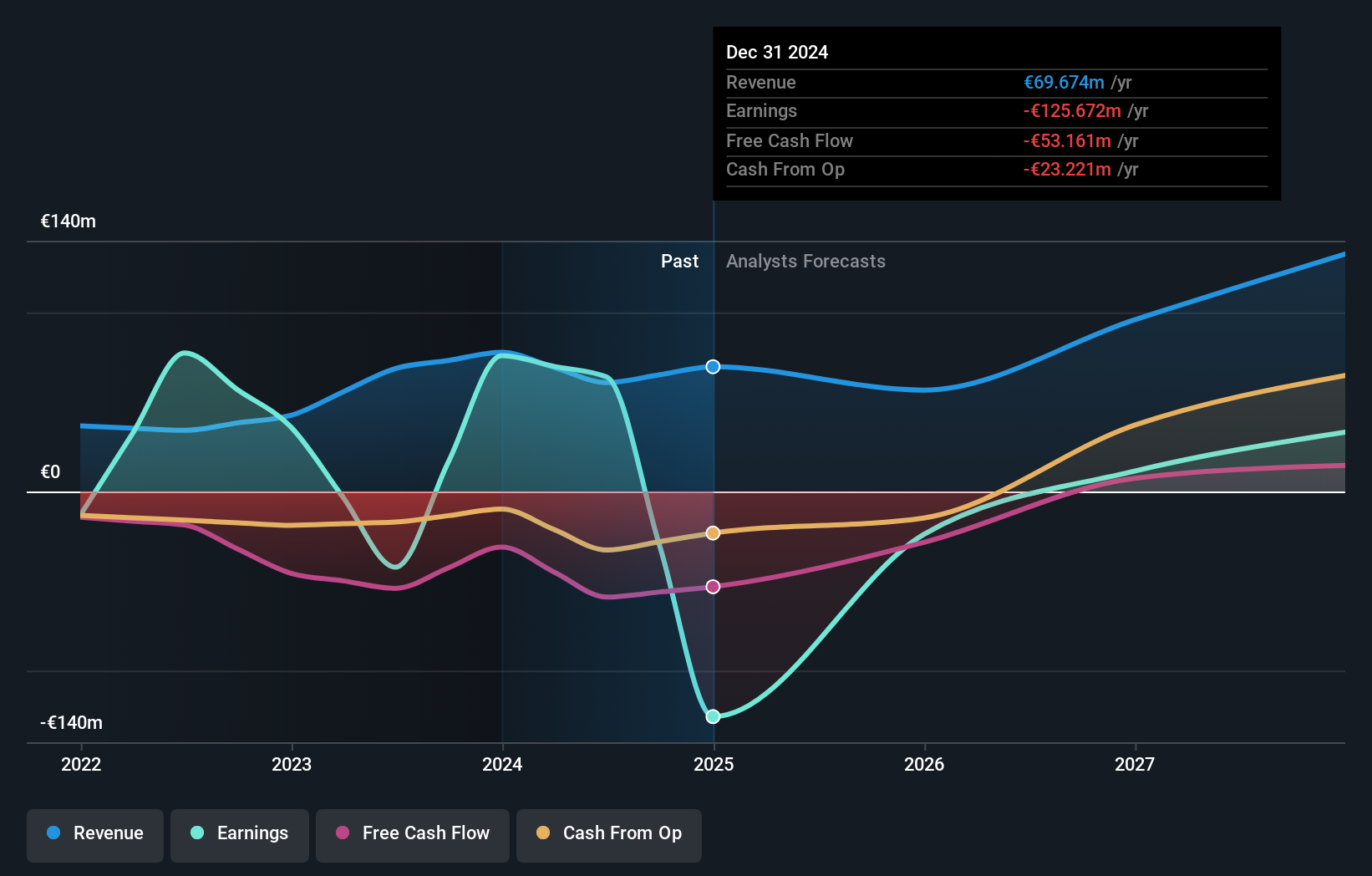

Overview: Formycon AG is a biotechnology company focused on developing biosimilar drugs in Germany and Switzerland, with a market cap of €438.96 million.

Operations: The company's revenue comes entirely from its biotechnology segment, totaling €48.07 million.

Insider Ownership: 14.2%

Formycon demonstrates significant growth potential, with revenue projected to increase by 26.7% annually, outpacing the German market. The company is expected to achieve profitability within three years, surpassing average market growth rates. Recent strategic partnerships for biosimilars like FYB206 and FYB203 enhance its commercial prospects despite recent removal from the Germany SDAX Index. However, volatility in share price and low forecasted return on equity could pose challenges for investors seeking stable returns.

- Dive into the specifics of Formycon here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Formycon is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Discover the full array of 211 Fast Growing European Companies With High Insider Ownership right here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报