BASSAC Société anonyme And 2 Other Undiscovered Gems with Promising Potential

As the European market shows signs of steady economic growth and benefits from looser monetary policy, the pan-European STOXX Europe 600 Index has climbed 1.60%, reflecting a positive sentiment across major stock indexes. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding, as they may thrive amid these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

BASSAC Société anonyme (ENXTPA:BASS)

Simply Wall St Value Rating: ★★★★☆☆

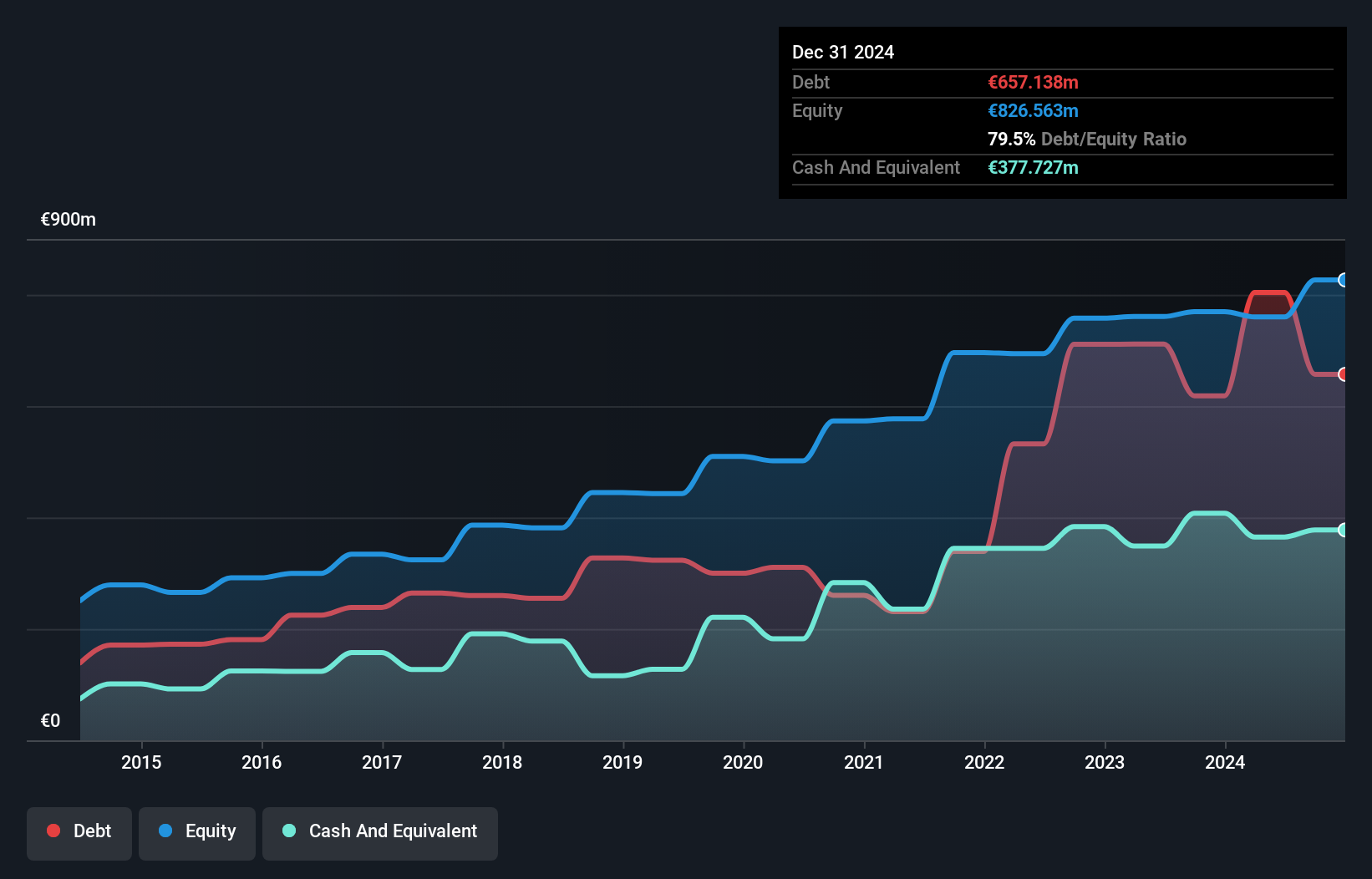

Overview: BASSAC Société anonyme is a real estate development company operating mainly in France, Belgium, Germany, and Spain with a market capitalization of €817.23 million.

Operations: With a market capitalization of €817.23 million, the company's revenue is primarily derived from its real estate development activities across France, Belgium, Germany, and Spain. The financial performance shows a notable trend in net profit margin over recent periods.

BASSAC, a promising player in the real estate sector, has demonstrated impressive earnings growth of 76.7% over the past year, outpacing the industry average of 14.9%. The company trades at a significant discount, about 39.7% below its estimated fair value, suggesting potential upside for investors. Despite a rise in debt to equity from 61.9% to 81.2% over five years, BASSAC maintains a satisfactory net debt to equity ratio of 23.4%, with interest payments well covered by EBIT at 5.8x coverage. High-quality earnings and positive free cash flow further bolster its investment appeal.

- Get an in-depth perspective on BASSAC Société anonyme's performance by reading our health report here.

Gain insights into BASSAC Société anonyme's past trends and performance with our Past report.

Bahnhof (OM:BAHN B)

Simply Wall St Value Rating: ★★★★★★

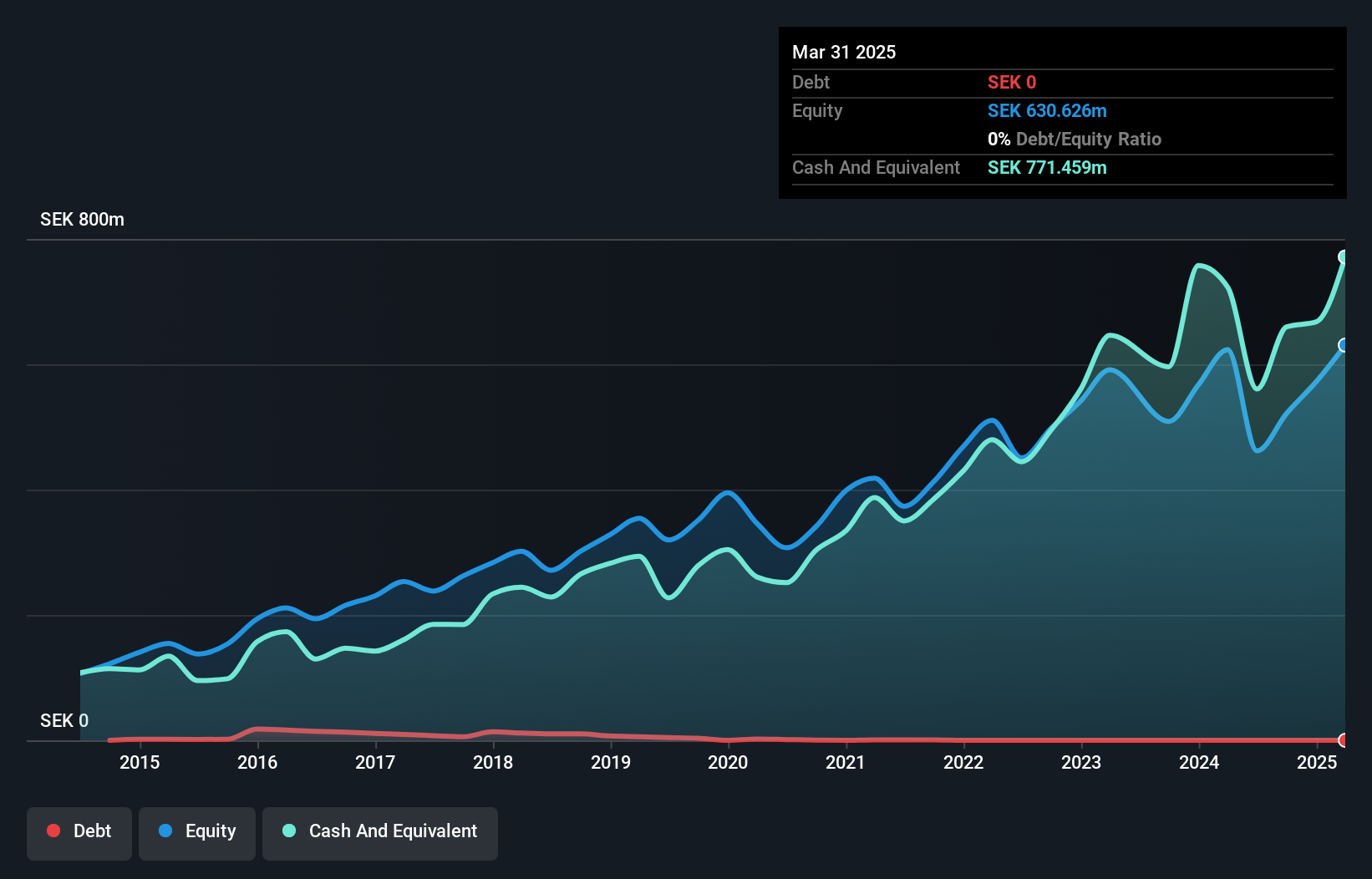

Overview: Bahnhof AB (publ) is a company that offers internet services to both individuals and businesses in Sweden and internationally, with a market capitalization of approximately SEK5.82 billion.

Operations: Bahnhof generates revenue primarily from providing internet services to individuals and businesses. The company reported a net profit margin of 13.5% in the latest fiscal period, reflecting its efficiency in managing costs relative to its revenue generation.

Bahnhof, a nimble player in the telecom space, has shown resilience despite recent challenges. The company reported sales of SEK 561.13 million for the third quarter, up from SEK 511.41 million last year, though net income dipped slightly to SEK 56.91 million from SEK 60.05 million previously. Its debt-free status provides financial flexibility and a robust foundation for future growth, with earnings expected to rise by 9% annually despite past negative earnings growth of -3%. High-quality past earnings and consistent free cash flow generation further underscore its solid operational footing in an evolving industry landscape.

- Click here to discover the nuances of Bahnhof with our detailed analytical health report.

Examine Bahnhof's past performance report to understand how it has performed in the past.

Newag (WSE:NWG)

Simply Wall St Value Rating: ★★★★★★

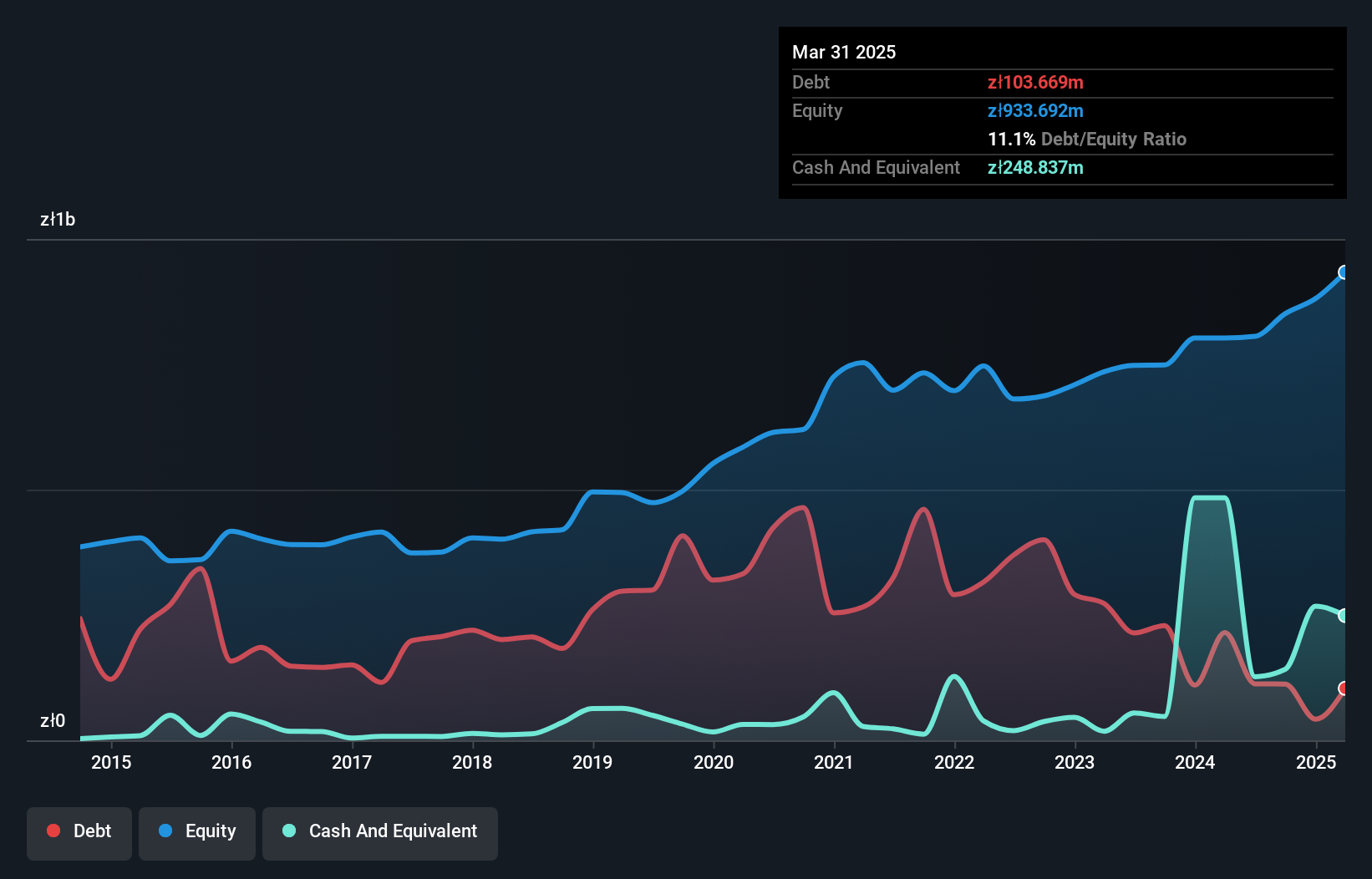

Overview: Newag S.A. is a Polish company that specializes in the production and sale of railway locomotives and rolling stock, with a market capitalization of PLN4.29 billion.

Operations: Newag S.A. generates revenue primarily from repair services, modernization of rolling stock, and production of rolling stock and control systems, amounting to PLN2.30 billion. It also receives income from activities of financial holdings totaling PLN90.65 million.

Newag has shown impressive financial performance, with earnings growth of 115% over the past year, significantly outpacing the machinery industry's 6.8%. The company reported a robust net income of PLN 153.31 million for Q3 2025, up from PLN 45.14 million in the previous year, with sales reaching PLN 924.9 million compared to PLN 564.97 million last year. Trading at a compelling value, Newag's stock is priced at approximately 43% below its estimated fair value and boasts high-quality earnings backed by strong cash flow and manageable debt levels, as evidenced by a reduced debt-to-equity ratio from 74.8% to just under nine percent over five years.

- Click here and access our complete health analysis report to understand the dynamics of Newag.

Understand Newag's track record by examining our Past report.

Make It Happen

- Discover the full array of 303 European Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报