Market Participants Recognise Grenergy Renovables, S.A.'s (BME:GRE) Revenues Pushing Shares 27% Higher

Grenergy Renovables, S.A. (BME:GRE) shareholders have had their patience rewarded with a 27% share price jump in the last month. The annual gain comes to 166% following the latest surge, making investors sit up and take notice.

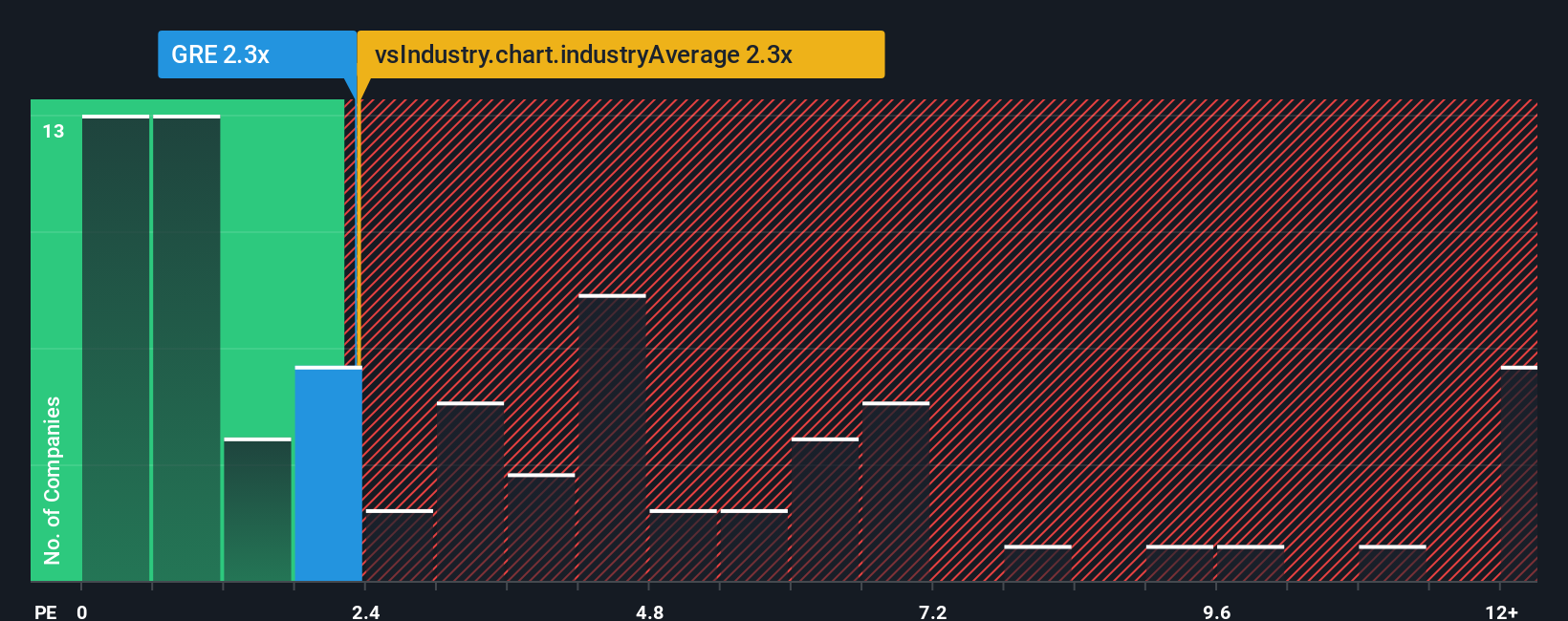

In spite of the firm bounce in price, it's still not a stretch to say that Grenergy Renovables' price-to-sales (or "P/S") ratio of 2.3x right now seems quite "middle-of-the-road" compared to the Renewable Energy industry in Spain, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Grenergy Renovables

How Grenergy Renovables Has Been Performing

Grenergy Renovables certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Grenergy Renovables will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Grenergy Renovables?

In order to justify its P/S ratio, Grenergy Renovables would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 220% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 0.5% per year during the coming three years according to the eleven analysts following the company. That's shaping up to be similar to the 1.7% per year growth forecast for the broader industry.

With this information, we can see why Grenergy Renovables is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Grenergy Renovables' P/S Mean For Investors?

Its shares have lifted substantially and now Grenergy Renovables' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Grenergy Renovables maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Grenergy Renovables (1 is a bit unpleasant) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报