Asian Market Stocks That May Be Trading Below Their Estimated Value

As the Bank of Japan raises interest rates to their highest level in three decades and Chinese markets show mixed signals amid lackluster economic growth, investors are closely watching the Asian markets for potential opportunities. In this environment, identifying stocks that may be trading below their estimated value can offer a strategic advantage, particularly as market dynamics shift and valuations are reassessed.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xizang Gaozheng Civil Explosives (SZSE:002827) | CN¥39.70 | CN¥77.76 | 48.9% |

| Takara Bio (TSE:4974) | ¥808.00 | ¥1575.00 | 48.7% |

| Shuangdeng Group (SEHK:6960) | HK$14.97 | HK$29.65 | 49.5% |

| NEXON Games (KOSDAQ:A225570) | ₩12270.00 | ₩24531.27 | 50% |

| Kuraray (TSE:3405) | ¥1601.00 | ¥3165.02 | 49.4% |

| KIYO LearningLtd (TSE:7353) | ¥691.00 | ¥1378.97 | 49.9% |

| Forth Corporation (SET:FORTH) | THB5.65 | THB11.11 | 49.2% |

| CURVES HOLDINGS (TSE:7085) | ¥807.00 | ¥1578.17 | 48.9% |

| Cowell e Holdings (SEHK:1415) | HK$27.98 | HK$55.43 | 49.5% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥264.78 | CN¥516.05 | 48.7% |

Let's take a closer look at a couple of our picks from the screened companies.

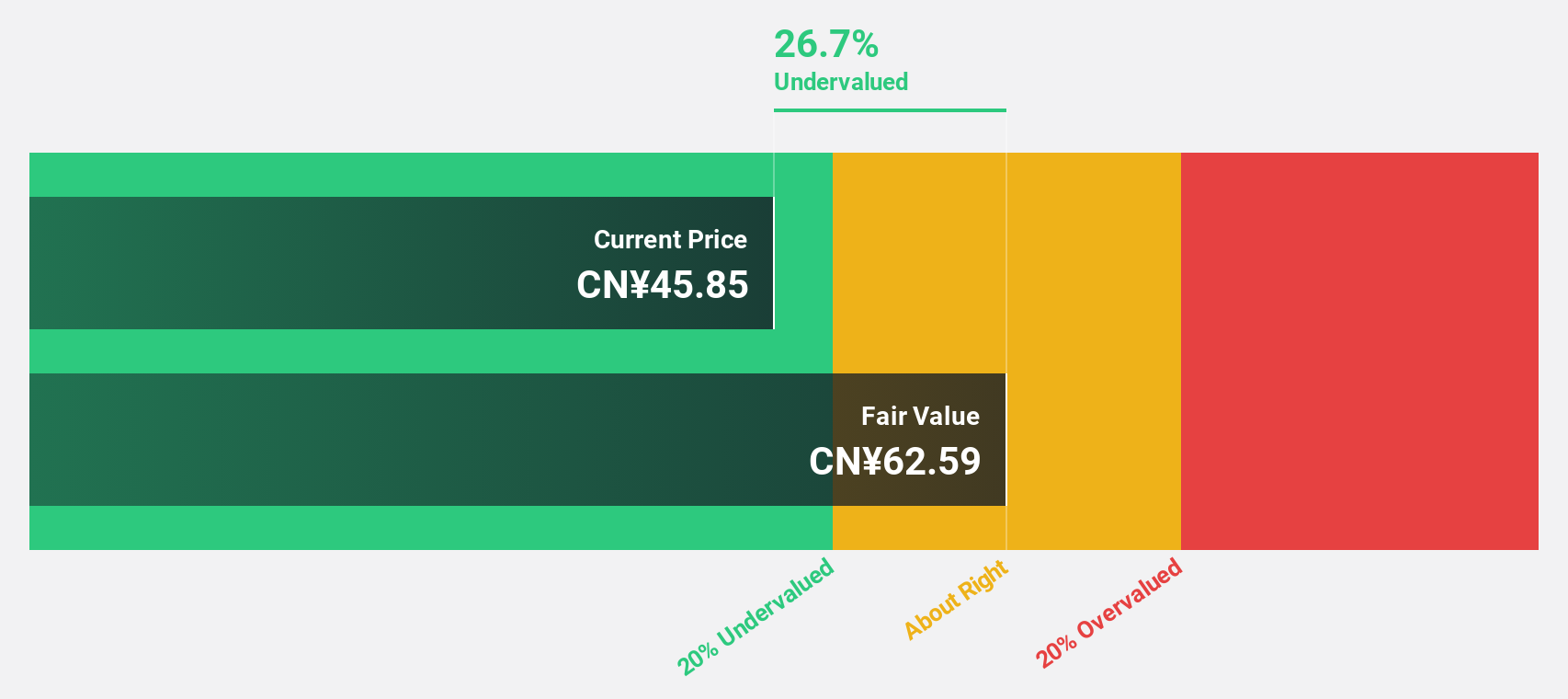

Wuxi Longsheng TechnologyLtd (SZSE:300680)

Overview: Wuxi Longsheng Technology Co., Ltd specializes in the research, development, production, sales, and service of automotive parts products both in China and internationally, with a market cap of CN¥12.08 billion.

Operations: Wuxi Longsheng Technology Co., Ltd focuses on the innovation, manufacturing, distribution, and support of automotive components across domestic and global markets.

Estimated Discount To Fair Value: 16.9%

Wuxi Longsheng Technology Ltd. appears undervalued, trading at CN¥53.52, below its estimated fair value of CN¥64.38. Recent earnings show robust growth with net income rising to CNY 210.27 million from CNY 153.6 million year-over-year, despite high share price volatility and low future return on equity forecasts (17.6%). Earnings and revenue are expected to grow significantly over the next three years, outpacing the broader Chinese market's growth rates.

- Upon reviewing our latest growth report, Wuxi Longsheng TechnologyLtd's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Wuxi Longsheng TechnologyLtd.

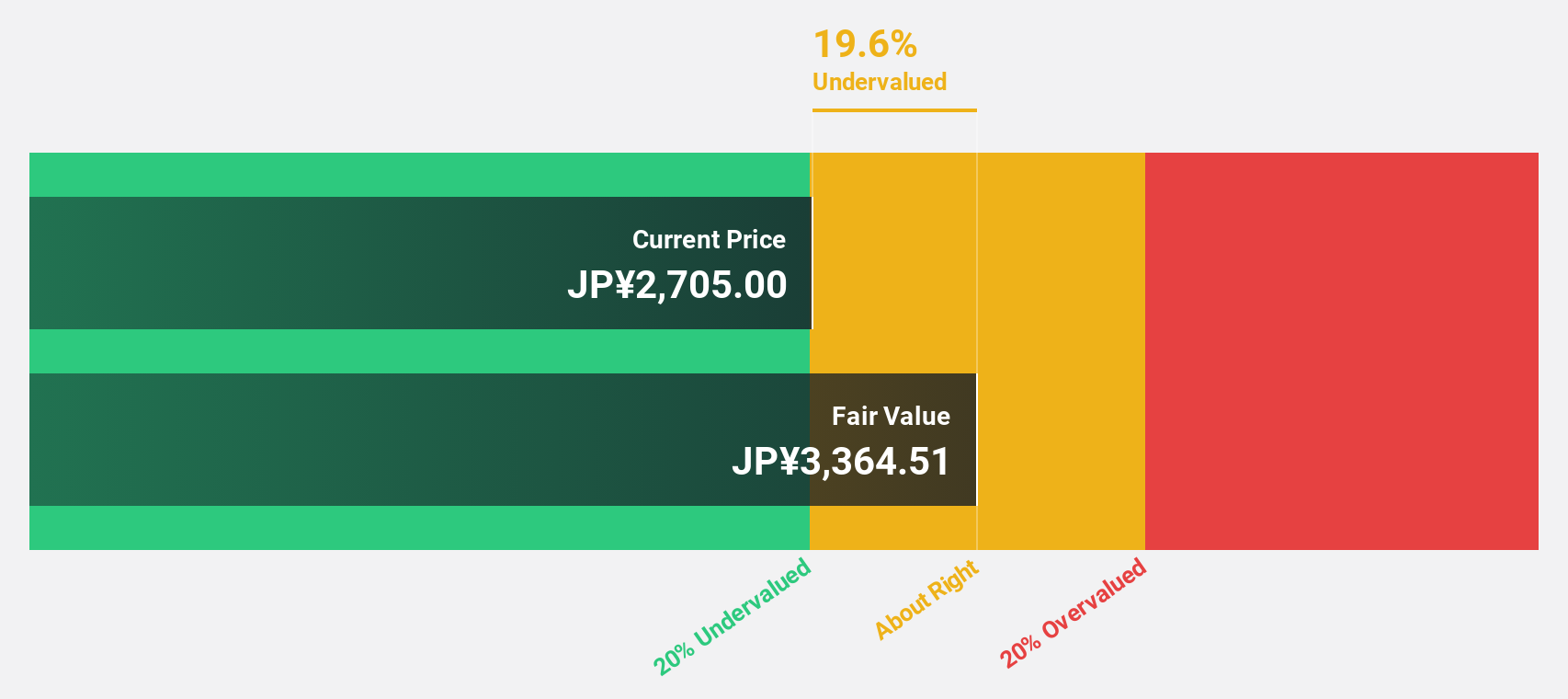

Socionext (TSE:6526)

Overview: Socionext Inc. is a company that designs, develops, manufactures, and sells system-on-chip (SoC) solutions and services globally, with a market cap of ¥387.28 billion.

Operations: Socionext generates revenue through its global design, development, manufacturing, and sales of system-on-chip (SoC) solutions and services.

Estimated Discount To Fair Value: 29.9%

Socionext is trading at ¥2210, significantly below its estimated fair value of ¥3153.5, indicating potential undervaluation based on cash flows. Despite a revised earnings guidance and recent product innovations like Flexlets, the company faces challenges with declining profit margins and high share price volatility. Earnings are forecast to grow 31.6% annually over the next three years, outpacing the Japanese market's growth rate of 8.5%, though dividends remain inadequately covered by free cash flows.

- Our comprehensive growth report raises the possibility that Socionext is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Socionext's balance sheet health report.

Nan Ya Printed Circuit Board (TWSE:8046)

Overview: Nan Ya Printed Circuit Board Corporation manufactures and sells printed circuit boards (PCBs) globally, including in Taiwan, the United States, Mainland China, and Korea, with a market cap of NT$154.43 billion.

Operations: The company's revenue segments include NT$14.39 billion from Asia, NT$30.35 million from America, and NT$26.67 billion domestically.

Estimated Discount To Fair Value: 34.9%

Nan Ya Printed Circuit Board is trading at NT$239, significantly below its estimated fair value of NT$367.2, highlighting potential undervaluation based on cash flows. The company reported substantial revenue growth in the third quarter, with sales reaching NT$10.97 billion compared to NT$9.19 billion the previous year. Earnings are projected to grow significantly over the next three years, surpassing Taiwan's market growth rate despite recent high share price volatility and a forecasted low return on equity of 14.1%.

- Our earnings growth report unveils the potential for significant increases in Nan Ya Printed Circuit Board's future results.

- Unlock comprehensive insights into our analysis of Nan Ya Printed Circuit Board stock in this financial health report.

Turning Ideas Into Actions

- Click here to access our complete index of 270 Undervalued Asian Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报