Shandong Longji MachineryLtd And 2 Other Undiscovered Gems With Strong Fundamentals

In recent weeks, global market sentiment has been influenced by a mix of economic signals, with the Bank of Japan raising interest rates to levels not seen in three decades and China's economy showing signs of lackluster growth. Amid these broad market dynamics, investors are increasingly turning their attention to small-cap stocks in Asia that demonstrate strong fundamentals and resilience. Identifying such stocks often involves looking for companies with solid financial health and growth potential, particularly in markets experiencing economic shifts or volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NS United Kaiun Kaisha | 44.97% | 10.62% | 10.49% | ★★★★★★ |

| Ohashi Technica | NA | 6.82% | -2.11% | ★★★★★★ |

| AOKI Holdings | 21.00% | 6.54% | 55.73% | ★★★★★★ |

| Chuo WarehouseLtd | 12.82% | 2.30% | 6.14% | ★★★★★★ |

| Center International GroupLtd | 13.20% | -0.33% | -19.78% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 2.72% | 37.80% | ★★★★★★ |

| Jiangsu Lianfa TextileLtd | 16.06% | 0.19% | -13.07% | ★★★★★☆ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 4.59% | 17.51% | 3.97% | ★★★★★☆ |

| Akatsuki | 238.26% | 10.43% | 16.51% | ★★★★☆☆ |

| Bank of Iwate | 120.42% | 2.34% | 16.38% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Shandong Longji MachineryLtd (SZSE:002363)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Longji Machinery Co., Ltd, along with its subsidiaries, focuses on the research, development, production, and sale of automotive brake components both in China and internationally, with a market capitalization of CN¥4.30 billion.

Operations: Longji Machinery generates revenue primarily through the sale of automotive brake components. The company's financial performance is influenced by its ability to manage production costs effectively, impacting its net profit margin.

Shandong Longji Machinery, a smaller player in the machinery sector, has shown promising financial resilience. Over the past year, its earnings surged by 29.7%, outpacing the Auto Components industry's growth of 8%. With a debt-to-equity ratio reduced from 6.5% to 2.6% over five years, it seems financially prudent and boasts high-quality earnings. Despite a revenue dip to ¥1,498 million from ¥1,704 million last year, net income rose to ¥41 million from ¥36 million. Recent amendments to company bylaws indicate strategic governance adjustments that could influence its future trajectory positively in this competitive landscape.

- Dive into the specifics of Shandong Longji MachineryLtd here with our thorough health report.

Understand Shandong Longji MachineryLtd's track record by examining our Past report.

Beijing Highlander Digital Technology (SZSE:300065)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Highlander Digital Technology Co., Ltd. operates in the technology sector, focusing on digital solutions and services, with a market cap of CN¥13.16 billion.

Operations: Beijing Highlander Digital Technology generates revenue primarily through its digital solutions and services. The company has a market cap of CN¥13.16 billion.

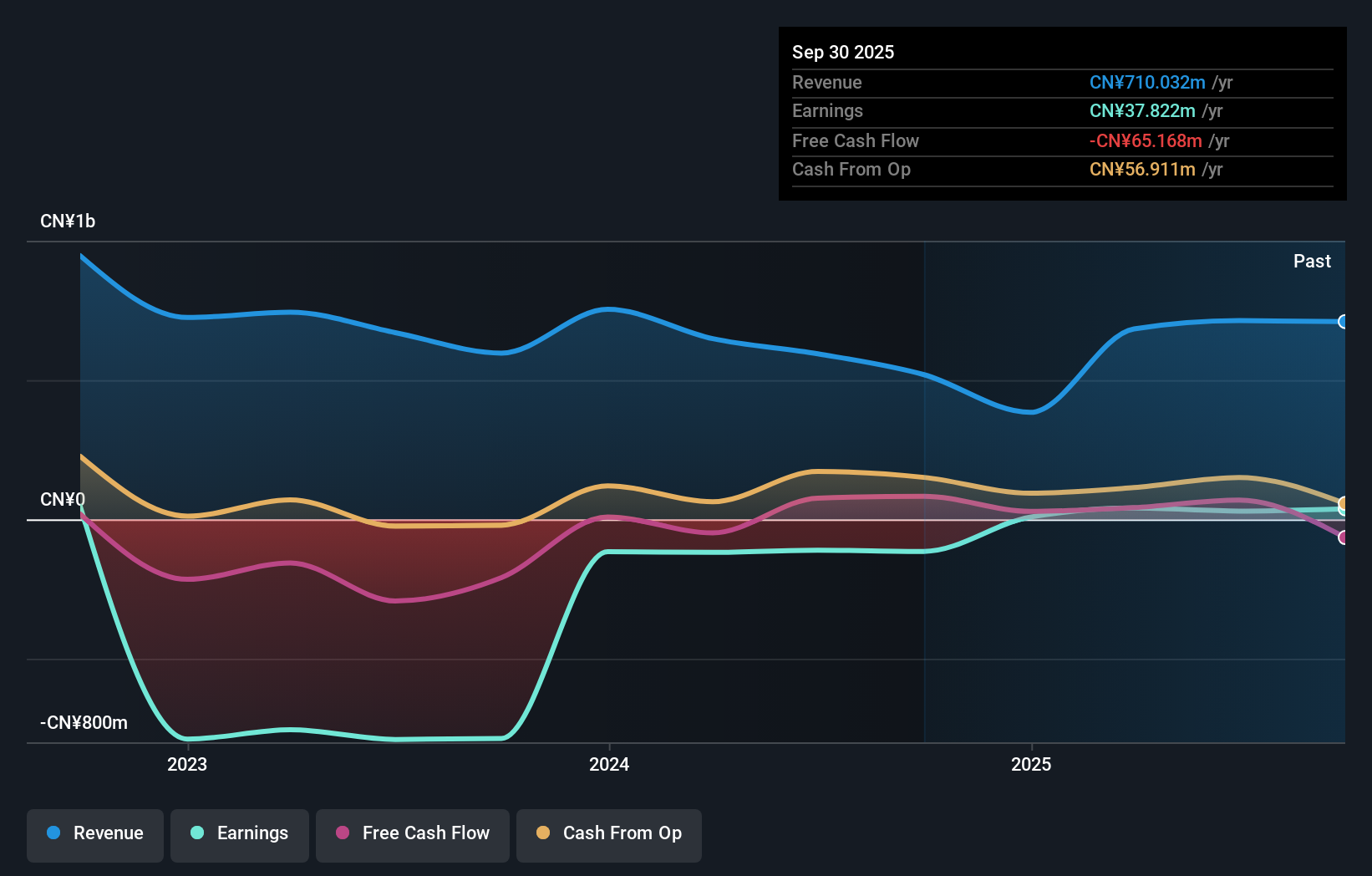

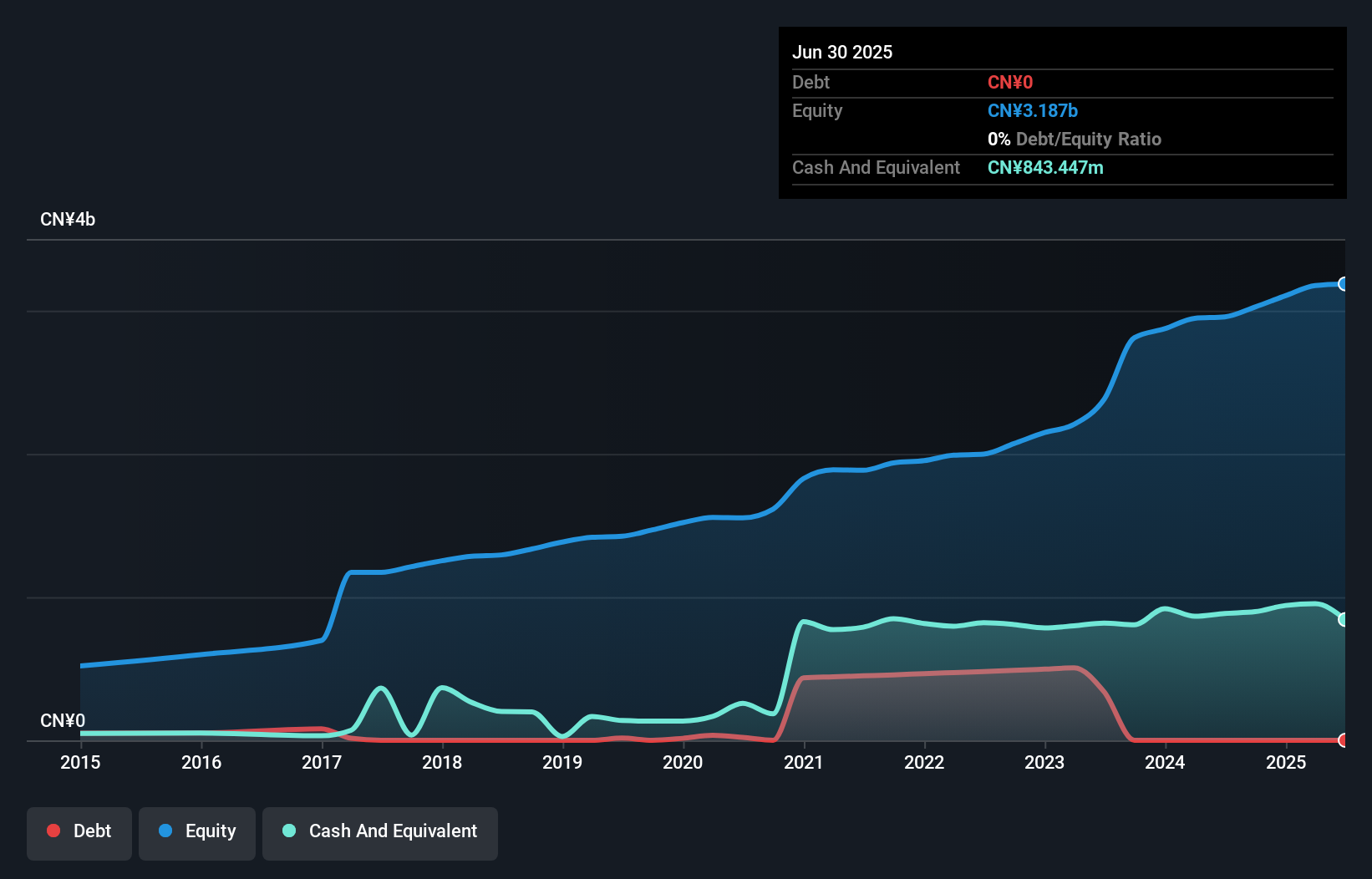

Beijing Highlander Digital Technology, a promising player in the tech sector, has shown robust growth recently. The company reported sales of CNY 579.82 million for the first nine months of 2025, up from CNY 253.72 million last year, reflecting a significant surge in revenue. Net income also rose to CNY 39.81 million from CNY 10.19 million previously, indicating improved profitability with basic earnings per share climbing to CNY 0.0553 from CNY 0.0141 a year ago. Notably, its debt-to-equity ratio has decreased significantly over five years to just 2.2%, showcasing effective financial management and stability amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Beijing Highlander Digital Technology's health report.

Learn about Beijing Highlander Digital Technology's historical performance.

Wuxi Best Precision Machinery (SZSE:300580)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Best Precision Machinery Co., Ltd. focuses on the research, development, production, and sale of precision parts, intelligent equipment, and tooling products both in China and internationally with a market cap of CN¥12.33 billion.

Operations: The company generates revenue primarily through the sale of precision parts, intelligent equipment, and tooling products. Its financial performance is influenced by its gross profit margin trend, which has shown variability over recent periods.

Wuxi Best Precision Machinery, a nimble player in the auto components sector, showcases solid financial health with no debt and a favorable price-to-earnings ratio of 41.1x, sitting below the CN market average of 44.5x. Over the past five years, earnings have grown steadily at 11.3% annually, though recent growth slightly lagged behind industry peers at 7.8%. The firm reported nine-month sales reaching CNY 1.12 billion and net income of CNY 236 million by September 2025, indicating steady performance with basic earnings per share rising to CNY 0.47 from CNY 0.45 last year.

Taking Advantage

- Discover the full array of 2497 Asian Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报