Exploring Hidden Gems in the Middle East with Strong Potential

Despite recent declines in Gulf markets driven by lower oil prices and thin trading volumes, the Middle East remains a region of interest for investors seeking opportunities beyond traditional sectors. In this environment, identifying stocks with strong fundamentals and growth potential can be key to navigating market fluctuations and uncovering hidden gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Gen Ilac Ve Saglik Urunleri Sanayi Ve Ticaret Anonim Sirketi (IBSE:GENIL)

Simply Wall St Value Rating: ★★★★★★

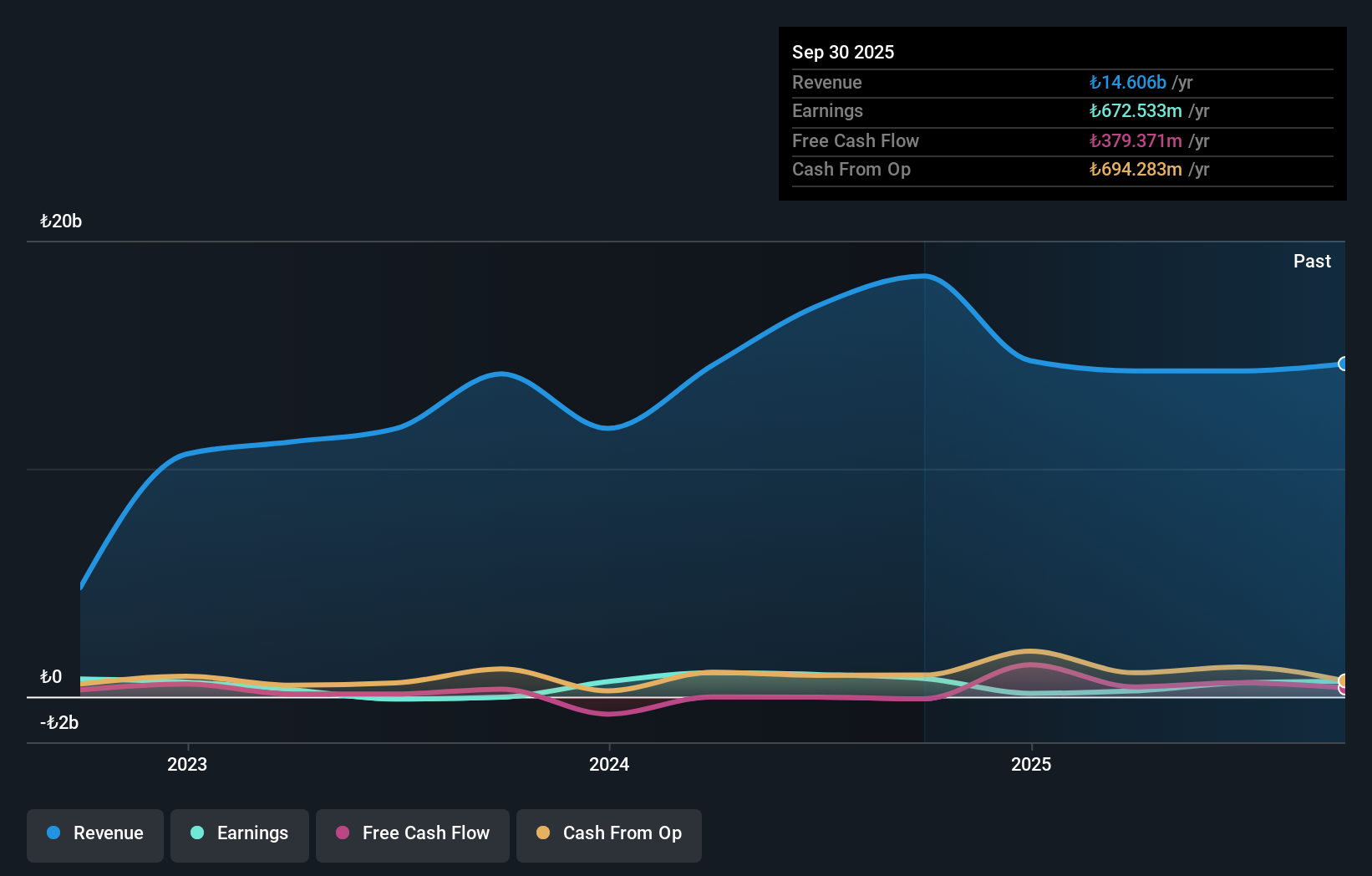

Overview: Gen Ilac Ve Saglik Urunleri Sanayi Ve Ticaret Anonim Sirketi is a pharmaceutical company that manufactures and supplies products for the treatment of rare diseases and disorders globally, with a market cap of TRY54.60 billion.

Operations: Gen Ilac generates revenue primarily through the buying and selling of human medicines and health products, amounting to TRY14.61 billion. The company's financial performance is reflected in a notable net profit margin trend, which offers insights into its profitability dynamics.

Gen Ilac, a smaller player in the pharmaceuticals sector, showcases a satisfactory financial position with its net debt to equity ratio at 18.6%, down from 30.3% five years ago. Despite facing negative earnings growth of -15.4% last year, its interest payments are well covered by EBIT at 7.4x coverage, reflecting strong operational efficiency. Recent earnings results highlight an increase in third-quarter sales to TRY 5,351 million and net income reaching TRY 215.77 million compared to TRY 148.99 million previously, suggesting resilience amidst industry challenges and potential for future improvement in profitability metrics like net profit margin or gross profit margin if relevant data were available.

Pera Yatirim Holding Anonim Sirketi (IBSE:TEHOL)

Simply Wall St Value Rating: ★★★★★★

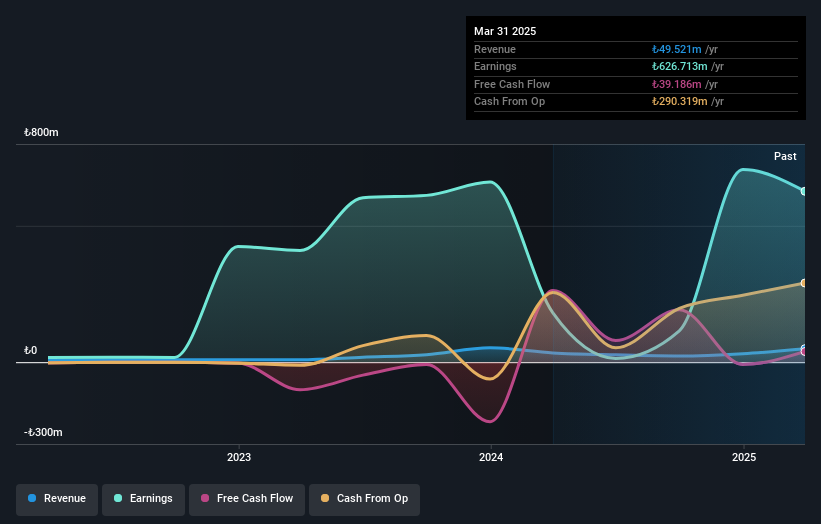

Overview: Pera Yatirim Holding Anonim Sirketi, trading under the ticker IBSE:TEHOL, is a publicly owned real estate investment trust with a market capitalization of TRY37.98 billion.

Operations: The primary revenue stream for Pera Yatirim Holding comes from creating and developing a real estate portfolio, generating TRY77.19 million. The company's financial performance can be further analyzed by examining its gross profit margin or net profit margin trends over time.

Pera Yatirim Holding, a small player in the Middle East market, has shown impressive financial dynamics with earnings surging by 173% over the past year. Despite its size, it stands out with a debt-to-equity ratio improvement from 54.4% to 11.4% in five years and maintains more cash than total debt, indicating robust financial health. However, revenue remains modest at TRY77M. The company's Price-To-Earnings ratio of 25.9x undercuts the industry average of 35.3x, suggesting potential value for investors seeking opportunities beyond mainstream picks while navigating its share price volatility in recent months.

Telsys (TASE:TLSY)

Simply Wall St Value Rating: ★★★★★★

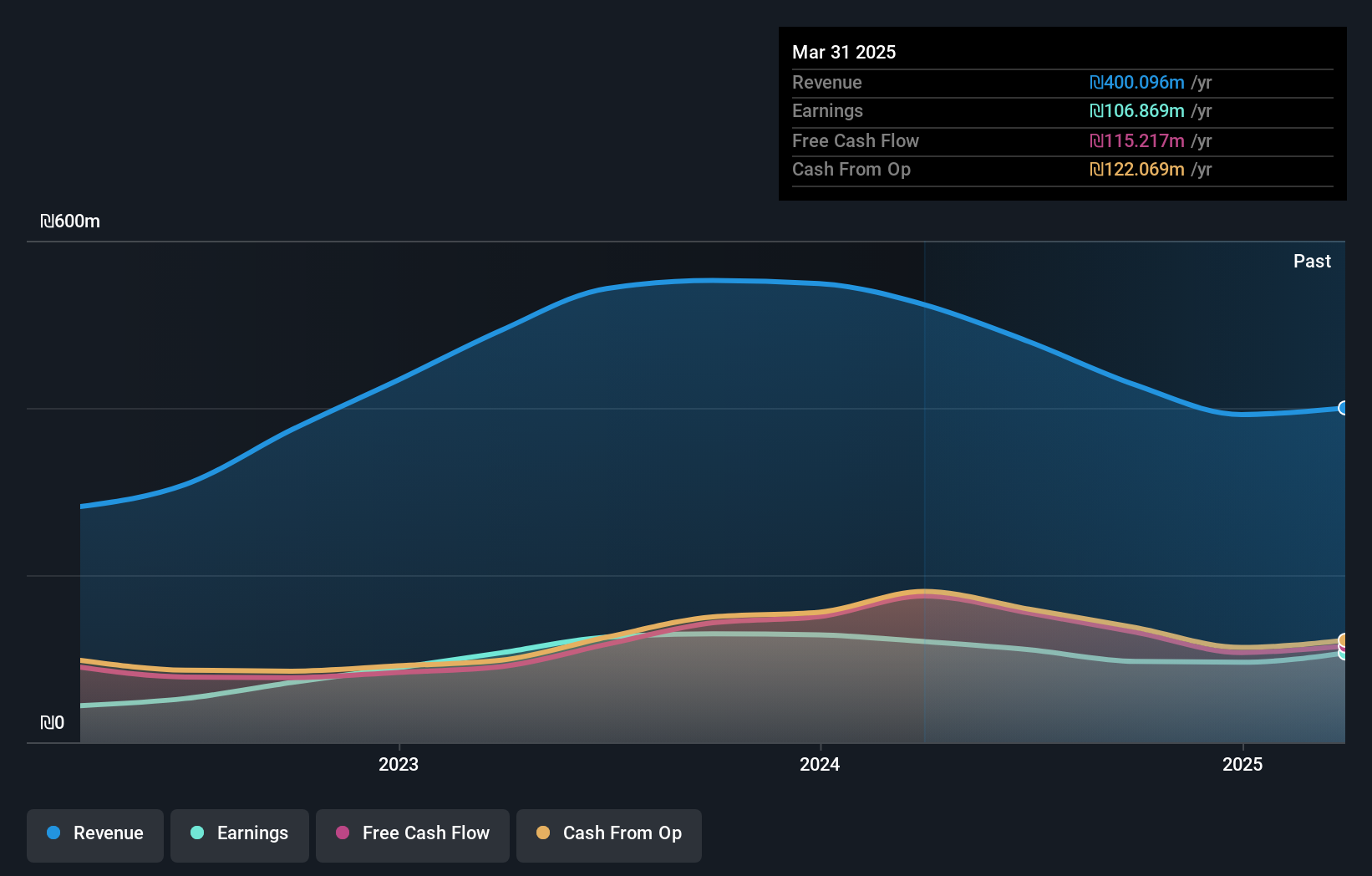

Overview: Telsys Ltd. is involved in the marketing and distribution of electronic components and open tools within Israel, with a market cap of ₪2.02 billion.

Operations: Telsys generates revenue primarily from its SOM Sector and Distribution segments, with contributions of ₪280.68 million and ₪175.60 million respectively.

Telsys, a smaller player in the electronics sector, has shown impressive financial performance with earnings growth of 29.1% over the past year, outpacing the industry average of 15.2%. The company reported third-quarter sales of ILS 114.56 million and net income of ILS 31.46 million, reflecting strong operational results compared to last year. Its debt-to-equity ratio has improved slightly from 10.6 to 10.2 over five years, highlighting prudent financial management while trading at a discount of about 10.8% below its fair value estimate suggests potential upside for investors seeking value opportunities in this market segment.

- Navigate through the intricacies of Telsys with our comprehensive health report here.

Gain insights into Telsys' past trends and performance with our Past report.

Where To Now?

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 177 more companies for you to explore.Click here to unveil our expertly curated list of 180 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报