3 Middle Eastern Dividend Stocks Yielding Up To 4.4%

As most Gulf markets experience a downturn due to declining oil prices, investors are cautiously navigating the region's financial landscape. In such an environment, dividend stocks can offer a measure of stability and income, providing potential benefits for those looking to balance their portfolios amidst market fluctuations.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.65% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.20% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.63% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.76% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.51% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.04% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.59% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.40% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.08% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.33% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Middle Eastern Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

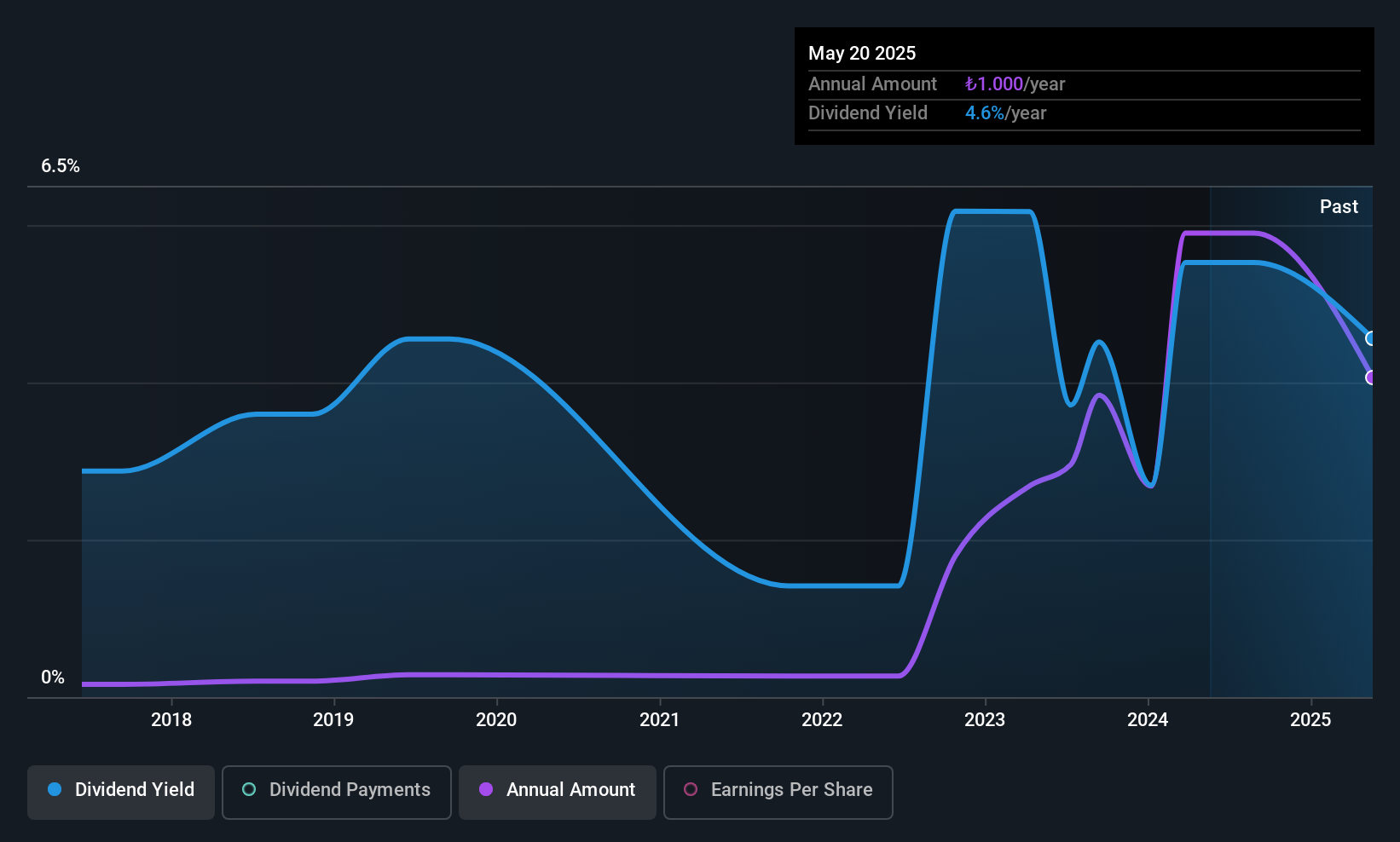

Ege Profil Ticaret ve Sanayi Anonim Sirketi (IBSE:EGPRO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ege Profil Ticaret ve Sanayi Anonim Sirketi manufactures and distributes plastic pipes, spare parts, and various profiles and plastic goods both in Turkey and internationally, with a market cap of TRY13.07 billion.

Operations: Ege Profil Ticaret ve Sanayi Anonim Sirketi generates revenue primarily from its Building Products segment, amounting to TRY8.98 billion.

Dividend Yield: 4.2%

Ege Profil Ticaret ve Sanayi Anonim Sirketi's dividend yield of 4.17% ranks in the top 25% of the Turkish market, supported by a payout ratio of 72.9%, indicating dividends are covered by earnings. However, its dividend history is less stable, with volatility over its nine-year payment period. Recent earnings showed an increase in net income to TRY 365.4 million for Q3 despite a slight decrease in sales, suggesting potential resilience amidst fluctuating revenues.

- Click here to discover the nuances of Ege Profil Ticaret ve Sanayi Anonim Sirketi with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Ege Profil Ticaret ve Sanayi Anonim Sirketi's current price could be inflated.

Al-Babtain Power and Telecommunications (SASE:2320)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al-Babtain Power and Telecommunications Company, along with its subsidiaries, manufactures lighting poles, power transmission towers, accessories, and communication towers in the United Arab Emirates, Saudi Arabia, and Egypt; it has a market cap of SAR4.25 billion.

Operations: Al-Babtain Power and Telecommunications Company's revenue is primarily derived from the Towers and Metal Structures Sector (SAR1.40 billion), followed by Columns and Lighting (SAR552.34 million), Design, Supply and Installation (SAR427.34 million), and the Solar Energy Sector (SAR391.54 million).

Dividend Yield: 3%

Al-Babtain Power and Telecommunications offers a dividend yield of 3.01%, which is below the top tier in the Saudi Arabian market. Despite volatile dividend history, its payout ratio of 48.2% indicates dividends are well-covered by earnings, complemented by a cash payout ratio of 28.5%. Recent Q3 results showed net income increased to SAR 127.31 million, reflecting strong earnings growth despite stable sales figures, supporting its ability to maintain dividend distributions amidst financial challenges.

- Get an in-depth perspective on Al-Babtain Power and Telecommunications' performance by reading our dividend report here.

- Our valuation report unveils the possibility Al-Babtain Power and Telecommunications' shares may be trading at a discount.

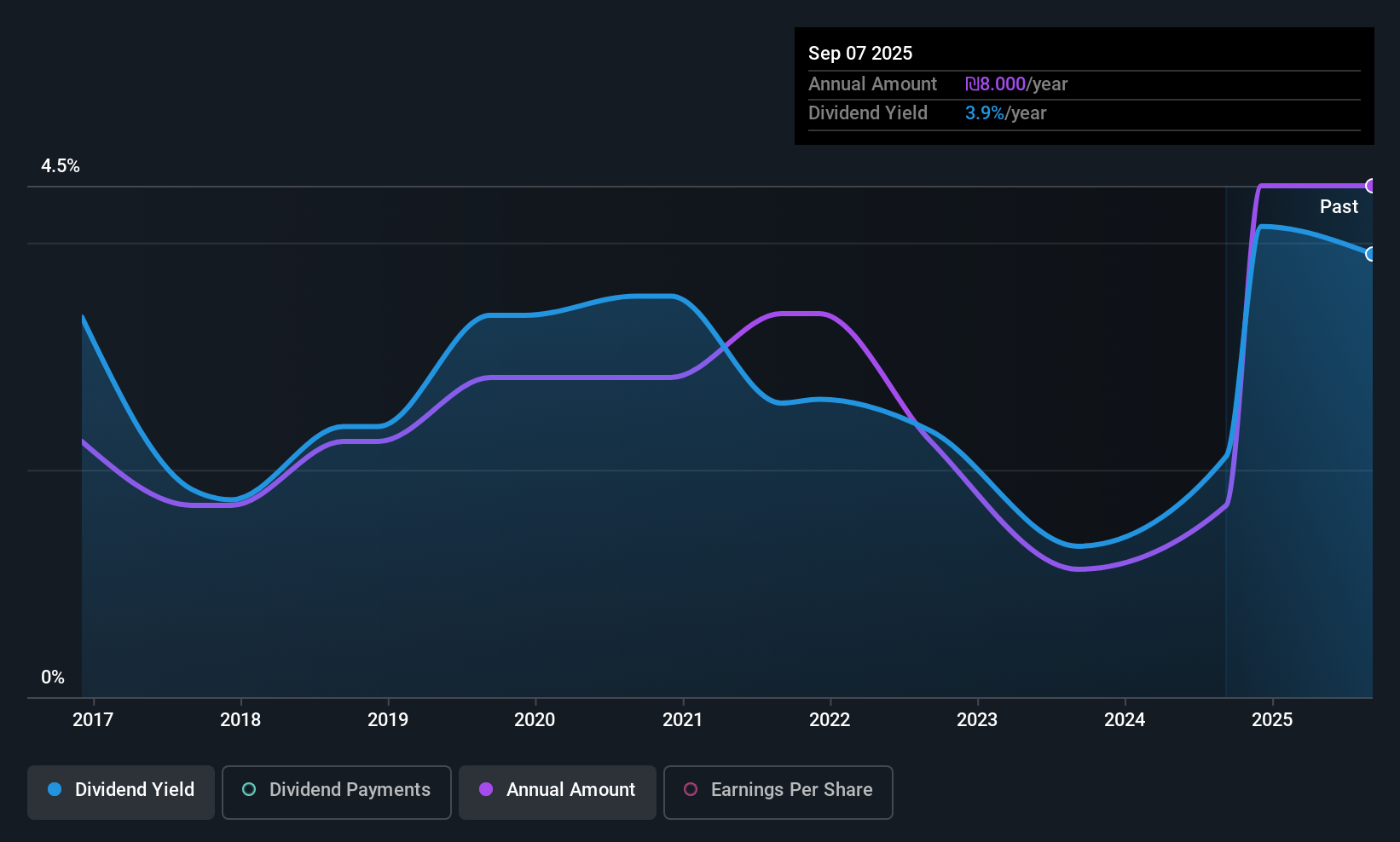

Plasson Industries (TASE:PLSN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Plasson Industries Ltd develops, manufactures, and markets technical products both in Israel and internationally with a market cap of ₪1.73 billion.

Operations: Plasson Industries Ltd generates revenue from its key segments, including Products for Animals at ₪684.24 million and Connection Accessories for Plumbing at ₪926.53 million.

Dividend Yield: 4.4%

Plasson Industries' dividend yield of 4.42% is lower than the top tier in the IL market, with a history of volatility over the past decade. However, its dividends are well-covered by both earnings and cash flows, with payout ratios of 50.1% and 48.2%, respectively. Recent Q3 results showed sales increased to ILS 477.24 million, while net income rose to ILS 51.52 million, indicating robust financial performance that supports its dividend sustainability despite past inconsistencies.

- Unlock comprehensive insights into our analysis of Plasson Industries stock in this dividend report.

- Upon reviewing our latest valuation report, Plasson Industries' share price might be too pessimistic.

Next Steps

- Unlock more gems! Our Top Middle Eastern Dividend Stocks screener has unearthed 56 more companies for you to explore.Click here to unveil our expertly curated list of 59 Top Middle Eastern Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报