Conagra Brands (CAG) Valuation After Net Loss, Impairment Charges and Shifting Packaged Food Demand

Conagra Brands (CAG) just posted a tough quarter, swinging to a large net loss as sales slipped and nearly $1 billion of goodwill and brand value was written down. This underscores how its challenges are deepening.

See our latest analysis for Conagra Brands.

The latest batch of impairments and softer sales comes after a tough stretch, with the share price at $17.08 and a steep year to date share price return of around negative 38 percent. The five year total shareholder return of roughly negative 41 percent shows that momentum has been fading for a while rather than just this quarter.

If this kind of reset has you reconsidering where you look for opportunities, it could be a good moment to explore fast growing stocks with high insider ownership as a way to uncover companies where management has meaningful skin in the game.

With shares now trading at a steep discount to many valuation models, but profits under pressure and analysts firmly on the sidelines, is Conagra quietly setting up a value opportunity, or is the market correctly pricing in weaker growth ahead?

Most Popular Narrative: 16% Undervalued

With the narrative fair value sitting around $20.22 versus a $17.08 last close, the story leans toward upside even as fundamentals look muted.

Ongoing productivity improvements, equal to 4% of cost of goods sold, can offset inflationary pressures, supporting margin expansion and helping to boost net earnings.

Want to see how modest top line expectations still back a higher price tag? The secret lies in future margins, cash generation, and a surprisingly patient valuation multiple.

Result: Fair Value of $20.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering inflation, shifting consumer sentiment, and supply chain costs could squeeze margins and challenge the case for multiple expansion and steady earnings support.

Find out about the key risks to this Conagra Brands narrative.

Another Angle on Valuation

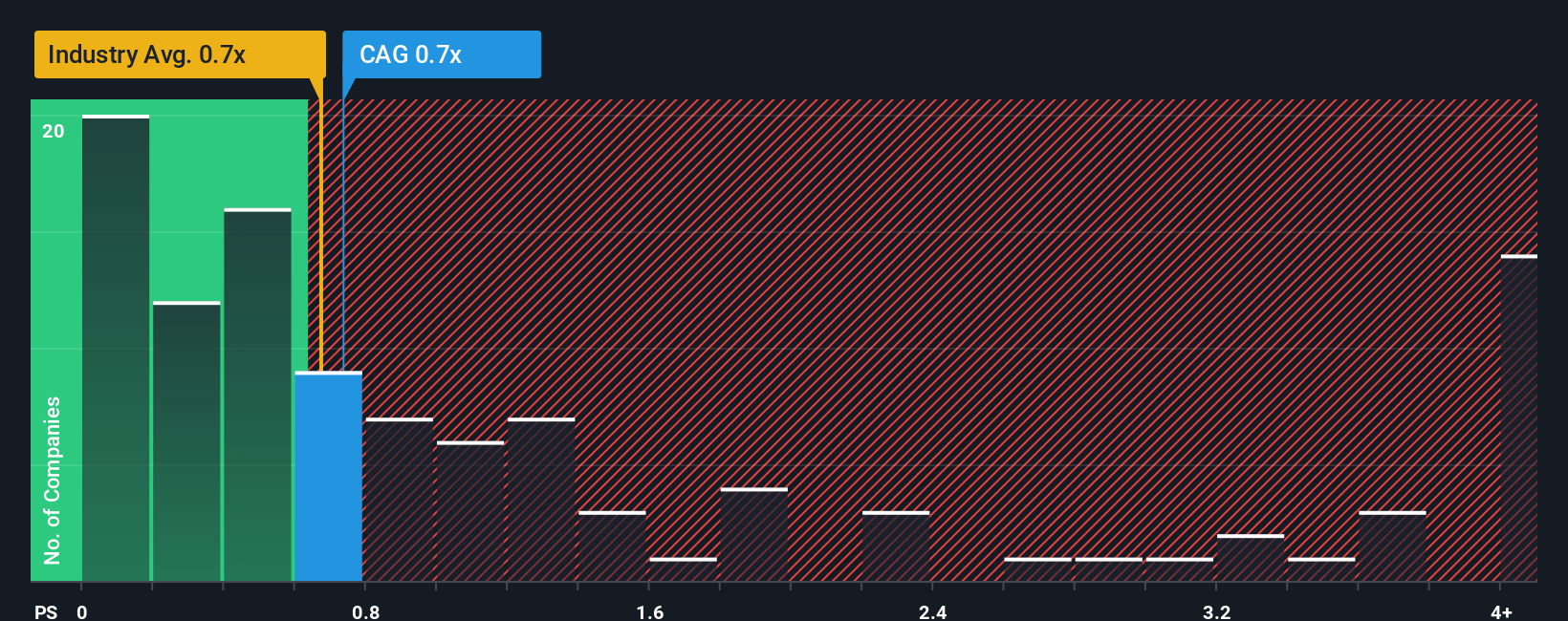

On a simple sales multiple, Conagra looks restrained, trading at 0.7 times revenue versus a fair ratio of 0.8 and broadly in line with the US food sector and peers at 0.7. That leaves only a thin margin of safety, so how much mispricing is really left for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Conagra Brands Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized outlook in just a few minutes: Do it your way.

A great starting point for your Conagra Brands research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street to work for you by scanning fresh opportunities that match your style instead of settling for the usual names.

- Target reliable income by reviewing these 10 dividend stocks with yields > 3% that can strengthen your portfolio with consistent cash returns.

- Capitalize on structural growth by assessing these 29 healthcare AI stocks transforming how medicine, diagnostics, and patient care are delivered.

- Position yourself early in emerging digital trends by analyzing these 80 cryptocurrency and blockchain stocks shaping the future of finance and infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报