Taking a Fresh Look at e.l.f. Beauty’s (ELF) Valuation After Its Recent Share Price Pullback

e.l.f. Beauty (ELF) has quietly pulled back, with shares down roughly 38% over the past 3 months and more than 37% over the past year, even as revenue and earnings keep growing.

See our latest analysis for e.l.f. Beauty.

That pullback has taken the latest share price to about $79.76, and while the 30 day share price return is back in positive territory, the much weaker 1 year total shareholder return suggests momentum has clearly cooled even as fundamentals appear strong.

If you are weighing where to put fresh capital in this part of the market, it is worth scanning fast growing stocks with high insider ownership for other high potential names to research next.

With the shares now trading well below analyst targets despite double digit revenue and profit growth, the key question is whether e.l.f. Beauty is quietly becoming undervalued or if the market is already pricing in its next leg of expansion.

Most Popular Narrative Narrative: 34.5% Undervalued

With e.l.f. Beauty last closing at $79.76 against a narrative fair value of $121.71, the spread points to meaningful upside if the story plays out.

The company is highly effective at leveraging influencer marketing, social media virality, and community driven innovation, enabling lower customer acquisition costs and highly efficient brand building, supporting both top line growth and sustainable net margin expansion. Continued investment in digital platforms, ERP/SAP implementation, and supply chain optimization should improve operational efficiencies and support scalable growth, helping to expand EBITDA margins and free cash flow over time.

Want to see the math behind this optimism? The narrative leans on powerful revenue momentum, rising margins, and a future earnings multiple more often seen in market darlings.

Result: Fair Value of $121.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimistic path could be derailed if tariff pressures on Chinese manufacturing squeeze margins or if heightened competition slows e.l.f. Beauty's market share gains.

Find out about the key risks to this e.l.f. Beauty narrative.

Another View: Valuation Signals Are Mixed

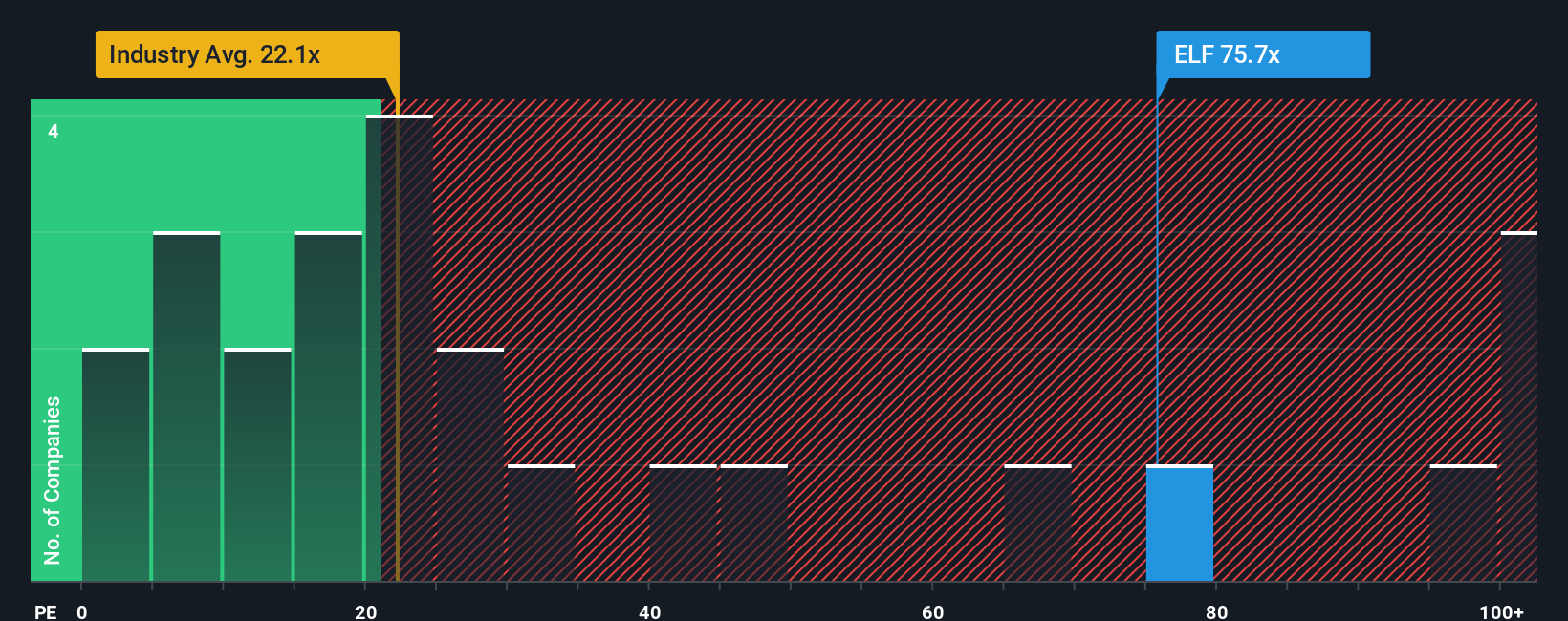

While the narrative fair value implies upside, our earnings based lens paints a tougher picture. At 58.1 times earnings versus 22.1 times for the industry and a fair ratio of 42.2 times, e.l.f. Beauty screens as richly priced, raising the question: is growth already baked in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own e.l.f. Beauty Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your e.l.f. Beauty research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the market moves without you, put Simply Wall Street's powerful screener to work and line up your next high conviction opportunities today.

- Capture potential mispricings by targeting companies trading below intrinsic value through these 901 undervalued stocks based on cash flows and position yourself ahead of a possible re rating.

- Capitalize on the AI revolution by scanning these 24 AI penny stocks for innovators turning machine learning breakthroughs into real revenue power.

- Strengthen your income stream by looking at these 10 dividend stocks with yields > 3% that can add resilient yield to your portfolio when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报