Pacira BioSciences (PCRX): How the New PROBE Consortium Partnership Shapes Its Current Valuation

Pacira BioSciences (PCRX) just joined the PROBE Consortium, a European Innovative Health Initiative backed effort that uses AI and massive real world osteoarthritis datasets, and that move gives fresh context to the stock.

See our latest analysis for Pacira BioSciences.

The PROBE announcement lands at a time when sentiment around Pacira is quietly improving. A roughly 9 percent 1 month share price return has helped extend its strong year to date share price gains, even though the 3 year total shareholder return remains deeply negative. This suggests momentum is rebuilding from a low base rather than peaking.

If Pacira's move in osteoarthritis analytics has you thinking more broadly about healthcare innovation, this could be a good moment to scout other potential opportunities across healthcare stocks.

Yet with Pacira still trading below consensus price targets despite solid revenue and earnings growth, investors now face a key question: is this a timely entry point, or is the market already discounting future gains?

Most Popular Narrative: 10.3% Undervalued

With Pacira shares last closing at $26.02 versus a most popular narrative fair value of $29, the market is seen lagging improving fundamentals.

The analysts have a consensus price target of $29.0 for Pacira BioSciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $36.0, and the most bearish reporting a price target of just $23.0.

Want to see what kind of revenue climb, margin rebuild, and profit multiple shift could justify that upside gap? The narrative lays out a surprisingly ambitious earnings path, plus a valuation reset that leans on richer profitability rather than aggressive sales projections. Curious how those moving parts combine into one fair value number?

Result: Fair Value of $29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected uptake of EXPAREL, or pricing pressure from payers and group purchasing organizations, could derail those margin and earnings assumptions.

Find out about the key risks to this Pacira BioSciences narrative.

Another View: High Multiple, Higher Expectations

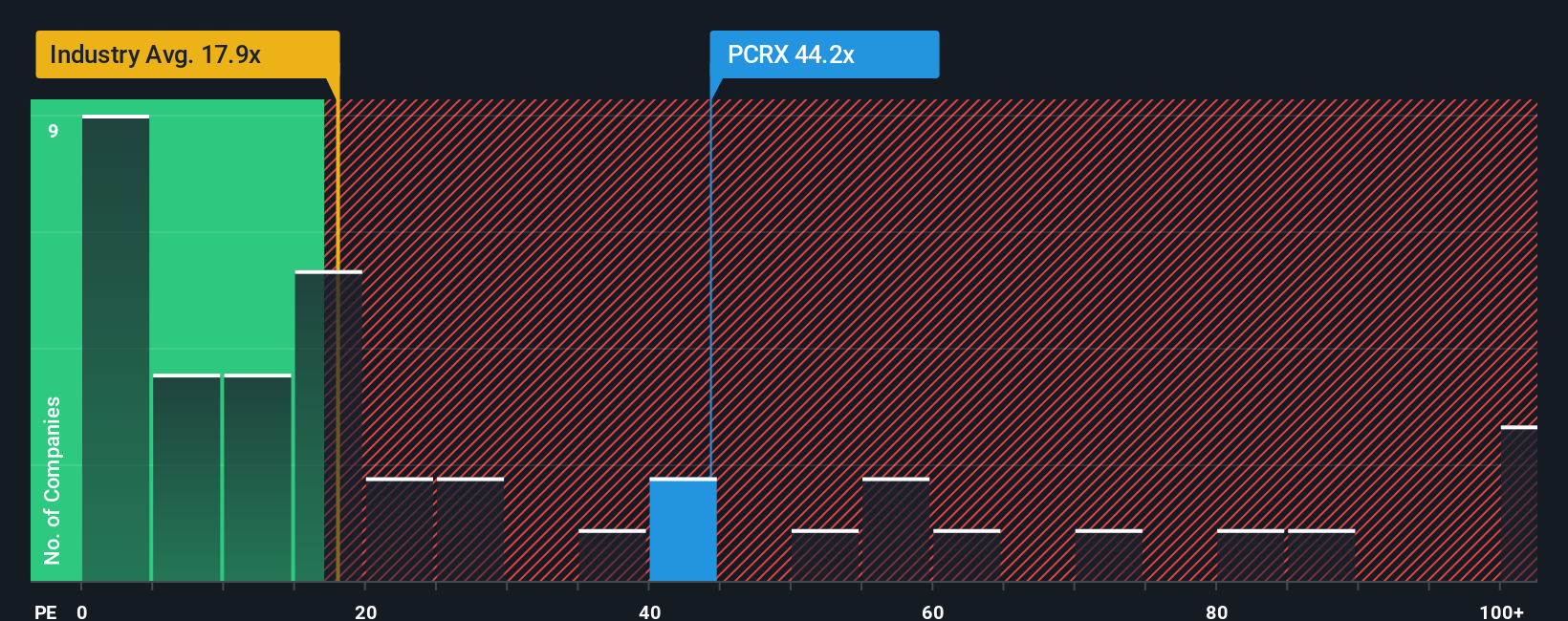

While the narrative fair value points to upside, Pacira's current price implies a price to earnings ratio of about 52 times, versus an industry average near 20 times and a fair ratio of roughly 22 times. That gap suggests the real risk may be paying upfront for growth that still has to arrive.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pacira BioSciences Narrative

If you would rather stress test the assumptions yourself and follow your own process, you can build a personalized Pacira narrative in minutes: Do it your way.

A great starting point for your Pacira BioSciences research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in your next set of opportunities by putting the Simply Wall St Screener to work across themes most investors overlook.

- Capitalize on overlooked value by targeting companies that look mispriced using these 901 undervalued stocks based on cash flows and position yourself ahead of a potential re rating.

- Ride structural shifts in medicine by zeroing in on innovators powered by algorithms and data through these 29 healthcare AI stocks, before their breakthroughs become consensus.

- Unlock asymmetrical upside potential by filtering for high conviction opportunities among these 3622 penny stocks with strong financials, where even small moves can reshape your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报