Is Extending MDU’s US$200 Million Credit Facility to 2030 Altering The Investment Case For MDU (MDU)?

- On December 11, 2025, MDU Resources Group, Inc. amended and restated its five-year revolving credit agreement, extending the US$200,000,000 facility’s maturity from May 31, 2028 to December 11, 2030, with options to increase commitments by up to US$50,000,000 and maintain subfacilities for standby letters of credit and swingline loans.

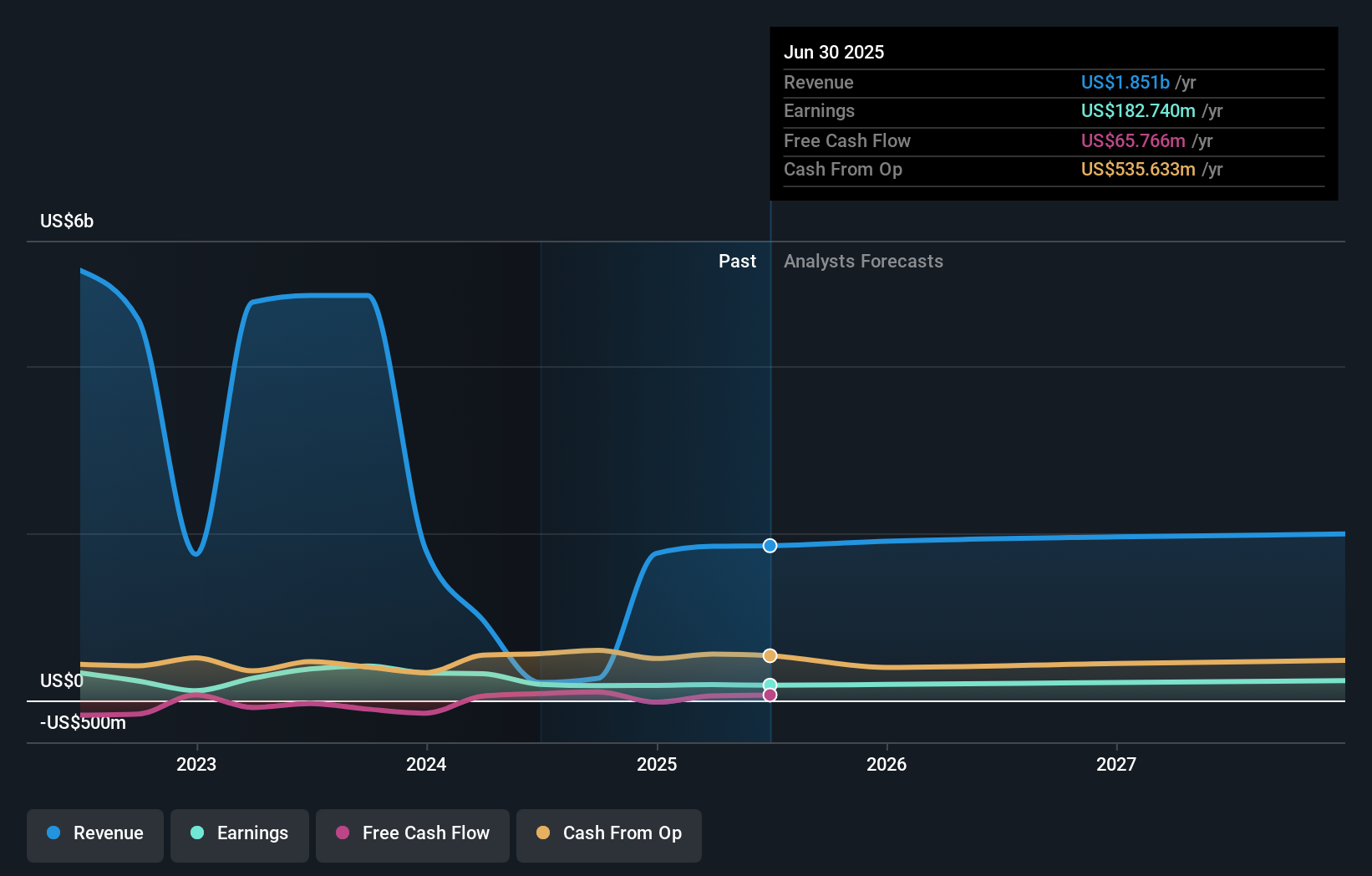

- This longer-dated access to bank funding, tied to leverage covenants and ratings-based pricing, arrives as MDU contends with multi‑year sales declines, weak free cash flow, and a very high net‑debt‑to‑EBITDA ratio that heighten concerns about balance sheet resilience.

- We’ll now examine how extending this revolving credit facility’s maturity to 2030 may reshape MDU Resources Group’s overall investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

MDU Resources Group Investment Narrative Recap

To own MDU Resources today, you have to believe that its regulated utility and pipeline footprint can support steady earnings while the balance sheet gradually improves. Extending the US$200,000,000 revolving credit facility to 2030 modestly eases near term liquidity pressure, but does not change the key near term catalyst around execution on earnings guidance or the biggest risk from high leverage and weak free cash flow.

The recent US$200,000,000 follow on equity offering is particularly relevant here, as it directly interacts with the expanded credit access. Together, fresh equity capital and extended bank commitments frame how MDU might fund required infrastructure investment without relying solely on additional debt, which matters for both its earnings guidance and concerns about potential shareholder dilution.

Yet even with this added flexibility, investors should be aware that the combination of high net debt and required capital spending could still...

Read the full narrative on MDU Resources Group (it's free!)

MDU Resources Group's narrative projects $2.0 billion revenue and $233.0 million earnings by 2028.

Uncover how MDU Resources Group's forecasts yield a $20.80 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community value MDU Resources between US$16.35 and US$24.00 per share, reflecting a wide spread of expectations. You can weigh these views against the company’s high leverage and funding demands, which may shape how its investment story unfolds over time.

Explore 3 other fair value estimates on MDU Resources Group - why the stock might be worth as much as 22% more than the current price!

Build Your Own MDU Resources Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MDU Resources Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MDU Resources Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MDU Resources Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报