Stronger Medical And Energy Outlook Might Change The Case For Investing In Air Water (TSE:4088)

- Air Water Inc. reported its latest quarterly results on 23 December 2025, with analysts ahead of the release expecting earnings per share to exceed prior estimates and revenue to be supported by growth in its medical and energy businesses.

- Meyka AI’s B+ grade and general buy-oriented stance toward Air Water highlighted growing confidence in the company’s positioning across these expanding sectors.

- We’ll now examine how optimism around Air Water’s medical and energy growth prospects shapes the company’s broader investment narrative for investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Air Water's Investment Narrative?

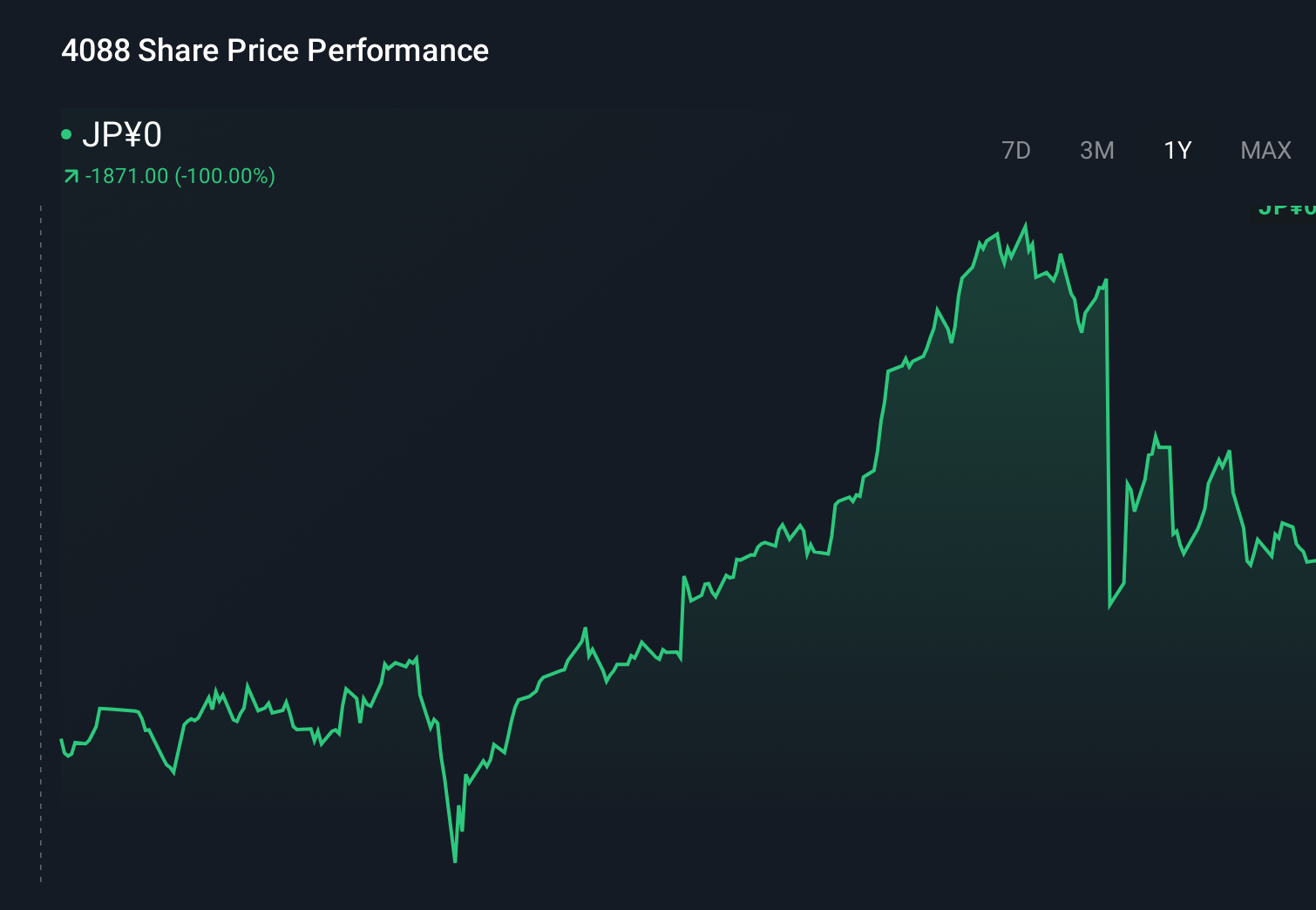

To own Air Water, you have to believe its shift toward medical and energy can steadily improve earnings quality while the company manages governance and balance sheet issues in the background. The latest earnings expectations, with analysts looking for EPS to beat prior estimates and Meyka AI assigning a B+ with a buy-leaning view, broadly support the existing near-term catalyst of profit growth from these segments rather than changing the story outright. Short term, a positive surprise could reduce some concern around slower forecast revenue growth versus the wider Japanese market and justify the recent share price recovery after a volatile three months. The bigger unresolved risks still sit around high debt, dividend coverage and ongoing board turnover, which the current news flow does little to directly address.

However, one governance risk in particular is worth understanding before getting too comfortable with the stock. Air Water's shares are on the way up, but they could be overextended by 36%. Uncover the fair value now.Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community cluster tightly between ¥1,671.78 and ¥1,794.49, showing how even a small sample can disagree on upside. Set those against the current focus on medical and energy earnings momentum and governance changes, and you can see why different investors may read the same story very differently.

Explore 2 other fair value estimates on Air Water - why the stock might be worth as much as ¥1794!

Build Your Own Air Water Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Water research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Air Water research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Water's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报