TKO Group Holdings (TKO): Revisiting Valuation After Major Buybacks and Upgraded Growth Expectations

TKO Group Holdings (TKO) just wrapped an $800 million accelerated share repurchase and rolled out a fresh plan to buy back another $174 million, a capital return signal that investors are clearly taking seriously.

See our latest analysis for TKO Group Holdings.

The buybacks come as TKO trades near record highs at $217.98, with a roughly 20% 1 month share price return contributing to a strong year to date share price gain. This suggests momentum is still building as investors reassess its growth and risk profile.

If this kind of momentum has your attention, it may be a good time to see what else is moving and explore fast growing stocks with high insider ownership.

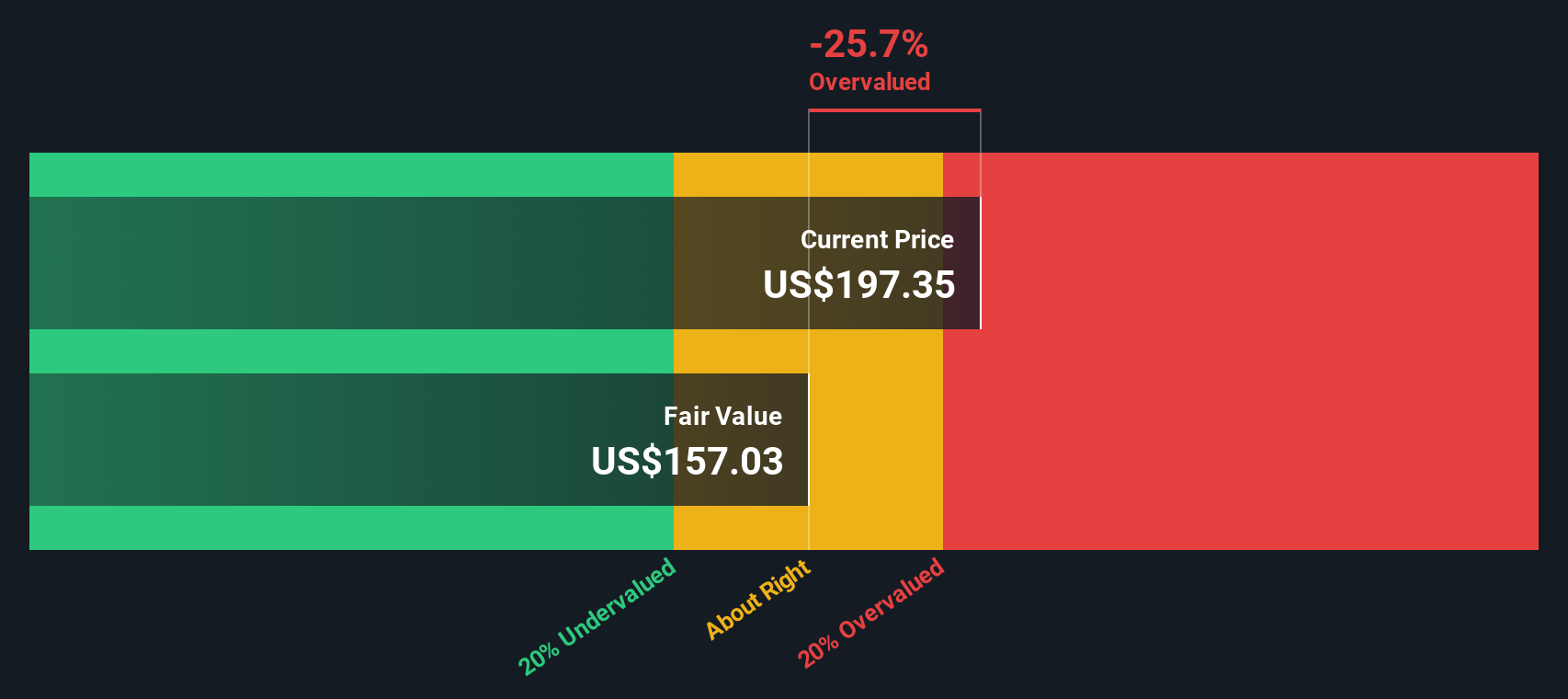

With shares already near analysts’ targets and trading at record highs, the key question now is whether TKO is still trading below its true earnings power, or if the market has already priced in the next leg of growth.

Price-to-Earnings of 75.2x: Is it justified?

On a headline basis, TKO's 75.2x price-to-earnings multiple at a $217.98 share price signals a rich valuation even after the recent rally.

The price-to-earnings ratio compares what investors are willing to pay today for each dollar of current earnings. This can be particularly relevant for a fast growing, content driven entertainment business like TKO. At over 75 times earnings, the market is clearly baking in strong future profit expansion rather than paying for current profitability alone.

Against peers, that enthusiasm cuts both ways. TKO screens cheaper than its immediate peer group, which trades nearer 95x earnings. However, it is still dramatically more expensive than the broader US Entertainment industry average of 20.8x and the estimated fair price-to-earnings ratio of 35.4x that our model suggests the market could drift toward over time.

Explore the SWS fair ratio for TKO Group Holdings

Result: Price-to-earnings of 75.2x (OVERVALUED)

However, several risks remain, including content fatigue, regulatory scrutiny of combat sports, and any slowdown in live event demand, which could pressure margins and growth expectations.

Find out about the key risks to this TKO Group Holdings narrative.

Another View: SWS DCF Model Paints a Tighter Picture

Our DCF model tells a more measured story, putting fair value around $220.79, just 1.3% above the current $217.98 price. That suggests TKO may be only modestly undervalued and leaves little room for error if growth or margins disappoint.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TKO Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TKO Group Holdings Narrative

If our view does not fully align with yours or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your TKO Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop your research with TKO. Use the Simply Wall Street Screener to uncover fresh opportunities across themes that could reshape your portfolio returns.

- Capitalize on mispriced potential by targeting companies trading below their cash flow value with these 901 undervalued stocks based on cash flows before the market catches up.

- Ride the wave of automation and machine learning breakthroughs by focusing on tomorrow's innovators through these 24 AI penny stocks while they are still gaining traction.

- Strengthen your income stream by zeroing in on reliable yield opportunities using these 10 dividend stocks with yields > 3% so your capital works harder in any market backdrop.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报