CRISPR Therapeutics (CRSP): Reassessing Valuation After Positive Zugo‑cel Data and New Eli Lilly Collaboration

CRISPR Therapeutics (CRSP) just gave investors a fresh update on zugo cel, its off the shelf CAR T therapy, highlighting strong early responses, clean safety signals, and a new combo study with Eli Lilly.

See our latest analysis for CRISPR Therapeutics.

The upbeat zugo cel update comes after a choppy stretch where CRISPR Therapeutics’ 1 month share price return of 10.65 percent and year to date share price return of 36.88 percent contrast with a still deeply negative 5 year total shareholder return. This suggests that momentum is rebuilding as investors reassess long term risk and reward.

If this kind of clinical progress has your attention, it might be worth exploring other innovative biotech names using our healthcare stocks as a starting point for ideas.

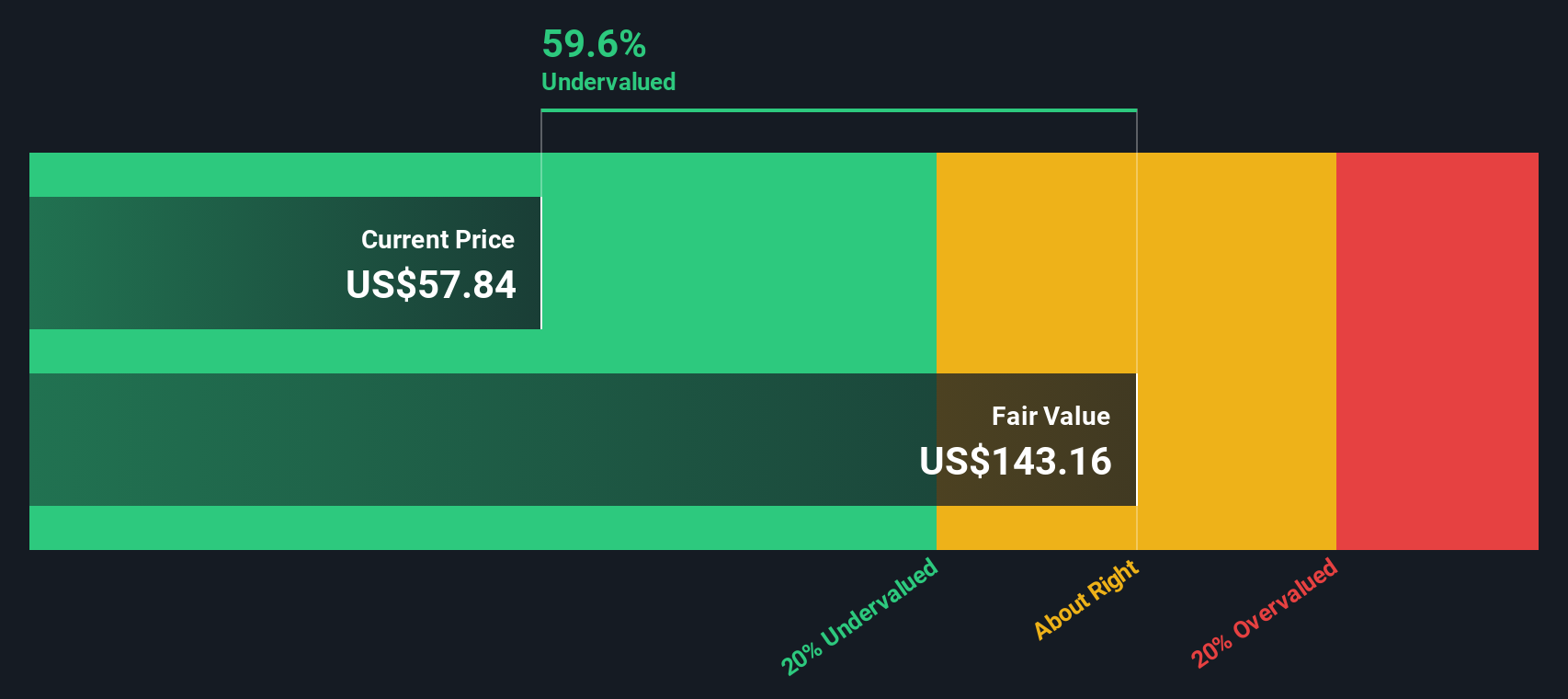

With shares still trading at a steep discount to Wall Street targets despite accelerating clinical momentum and solid double digit revenue growth, is CRISPR Therapeutics quietly undervalued, or is the market already pricing in the next leg of expansion?

Price to Book of 2.8x: Is it justified?

On a price to book basis, CRISPR Therapeutics looks slightly expensive versus the broader US biotech industry, even after a strong recent share price recovery.

The price to book ratio compares the market value of the company to the net assets on its balance sheet. It is a common yardstick for asset heavy or early stage biotech names where profits are still negative. With CRISPR Therapeutics currently unprofitable and carrying a negative return on equity, this metric helps investors gauge how much optimism is embedded into the stock relative to its underlying book value.

Today, CRISPR Therapeutics trades at 2.8 times book value, a touch richer than the US biotech industry average of 2.7 times. This suggests the market is pricing in somewhat stronger prospects than a typical peer. However, that same 2.8 times multiple looks far more conservative when stacked against a peer group average of 13.2 times book value, implying that investors are still assigning a sizable discount to the story despite rapid forecast revenue growth and a large gap to our own DCF fair value estimate of $126.78.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 2.8x (UNDERVALUED)

However, setbacks in pivotal zugo cel data or a slower than expected CASGEVY ramp, given ongoing losses, could quickly challenge the undervaluation case.

Find out about the key risks to this CRISPR Therapeutics narrative.

Another View Using Our DCF Model

Our DCF model presents a different perspective, suggesting fair value around $126.78 versus the current $56.71 share price. That implies CRISPR Therapeutics could be trading at over a 55 percent discount, but can such a large gap really persist if clinical momentum continues?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CRISPR Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CRISPR Therapeutics Narrative

If you see the numbers differently or want to dig into the data yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your CRISPR Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas you do not want to miss?

Before you move on, lock in your next set of high conviction opportunities using the Simply Wall Street Screener so fresh ideas never slip past you.

- Capture undervalued potential by targeting companies the market has overlooked with these 901 undervalued stocks based on cash flows based on future cash flows and solid fundamentals.

- Ride structural shifts in healthcare by focusing on innovators at the intersection of medicine and machine learning through these 29 healthcare AI stocks.

- Position ahead of digital finance trends by zeroing in on stocks linked to blockchain infrastructure and payment disruption via these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报