Varonis (VRNS) Valuation After Earnings Miss, ARR Guidance Cut, and Legal Probes

Varonis Systems (VRNS) is back in the spotlight after its third quarter 2025 earnings miss, a sharp drop in term license subscription revenue, and a cut to full year ARR guidance triggered a steep selloff.

See our latest analysis for Varonis Systems.

That reset has been brutal for recent holders, with the 90 day share price return at around negative 43 percent and 1 year total shareholder return down roughly 26 percent, even though the 3 year total shareholder return remains positive and suggests longer term believers are still ahead overall.

If this kind of volatility has you rethinking your tech exposure, it might be a good moment to explore other innovation focused names through high growth tech and AI stocks and see how they compare on growth and risk.

With shares now trading at a steep discount to analyst targets despite solid top line growth, ongoing losses, and legal overhangs, is Varonis a mispriced recovery story, or is the market correctly discounting its future growth?

Most Popular Narrative: 36% Undervalued

With Varonis Systems last closing at $33.44 against a narrative fair value near $51.84, the valuation case leans heavily on long term compounding assumptions.

Continued SaaS transition and high NRR notably for SaaS customers, combined with robust upsell momentum across cloud and multi cloud environments, enhance ARR visibility and predictability, driving durable earnings and margin expansion as the SaaS mix climbs and operational leverage improves post transition.

Want to see why steady double digit growth, a major margin swing, and a premium future multiple still line up as reasonable in this story? Explore the full narrative for more detail.

Result: Fair Value of $51.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if SaaS growth stalls amid tougher competition, or if on prem renewals and gross margins weaken more than expected.

Find out about the key risks to this Varonis Systems narrative.

Another Angle on Valuation

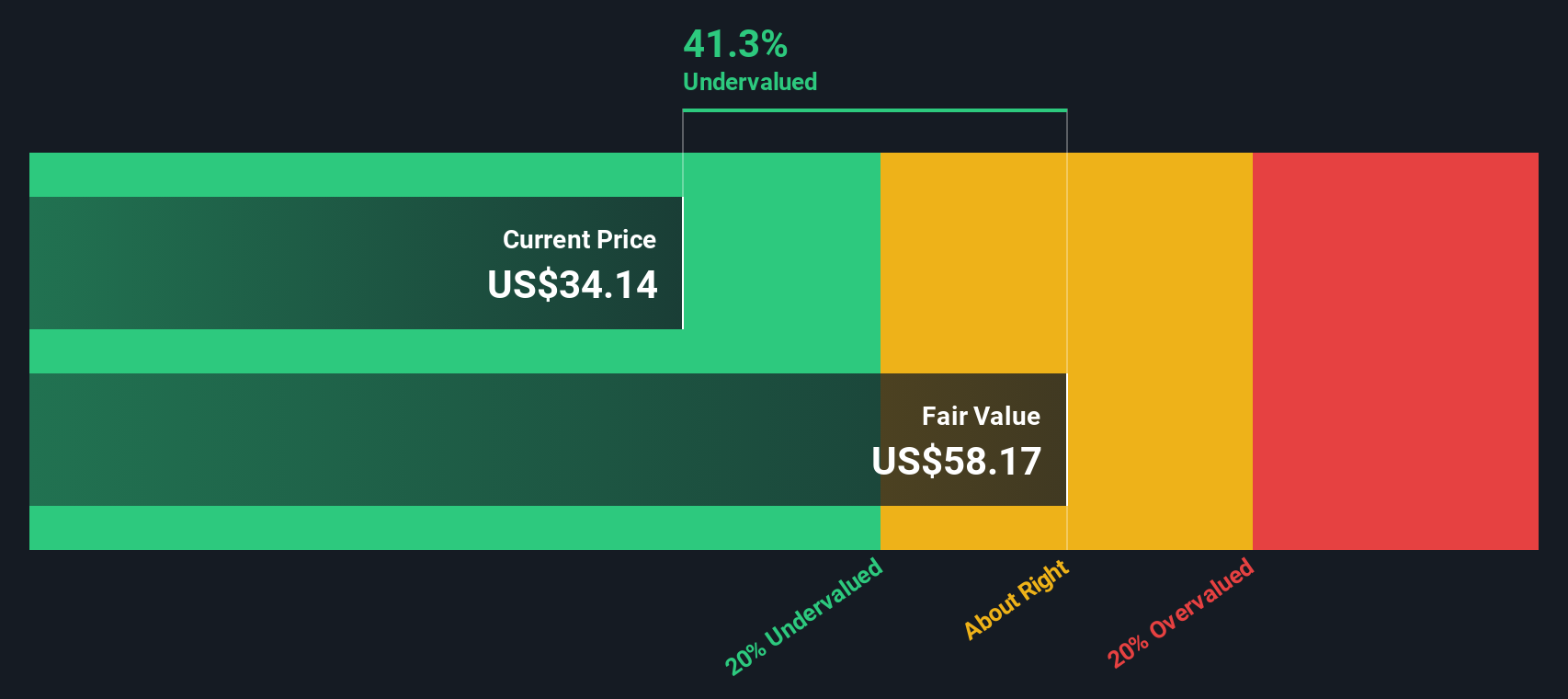

Our SWS DCF model paints a different picture, suggesting Varonis is trading around 42 percent below its estimated fair value of roughly $58 per share. If cash flows eventually catch up to the growth story, this selloff could be setting up a long term opportunity.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Varonis Systems Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Varonis Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Now turn this research into action, and use the Simply Wall St Screener to uncover fresh opportunities before the crowd rushes in.

- Capture potential multi baggers early by zeroing in on these 3622 penny stocks with strong financials that already show financial strength instead of relying on hype.

- Position your portfolio at the forefront of innovation by targeting these 24 AI penny stocks powering breakthroughs in automation, data analytics, and intelligent software.

- Lock in quality at attractive prices by focusing on these 901 undervalued stocks based on cash flows where cash flows suggest the market is still underestimating long term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报