Mineral Resources (ASX:MIN): Rethinking Valuation After Lithium Tailwinds and Onslow Iron Milestones

Mineral Resources (ASX:MIN) has jumped back onto investors radar after lithium prices spiked on Chinese supply disruptions, just as its Onslow Iron project hit nameplate capacity and delivered record quarterly shipments.

See our latest analysis for Mineral Resources.

Those lithium tailwinds and Onslow Iron milestones help explain why Mineral Resources has a 30 day share price return of 17.7 percent and a 1 year total shareholder return of 64.65 percent. Even though its 3 year total shareholder return is still negative, momentum is clearly rebuilding rather than fading.

If you are watching MIN’s renewed momentum and wondering what else could be setting up for the next leg higher, this is a good moment to explore fast growing stocks with high insider ownership.

With the share price already above analyst targets and long term returns back on track, investors now face a tougher call: is Mineral Resources still undervalued, or is the market already baking in its next phase of growth?

Most Popular Narrative: 20.2% Overvalued

With Mineral Resources closing at A$55.98 against a narrative fair value of A$46.58, expectations for future growth and margins are doing heavy lifting behind the scenes.

The net profit margin forecast has increased significantly to about 10.21 percent from 7.45 percent, driving a substantial portion of the higher fair value estimate. The future P/E multiple has fallen materially to about 20.7x from 27.9x, suggesting a lower valuation multiple being applied to future earnings.

Want to see how modest revenue growth, sharply higher margins, and a reset earnings multiple still point to upside value? The narrative outlines the profitability and valuation mix that underpins this view, and the timeframe over which the company might grow into today’s price.

Result: Fair Value of $46.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated debt from heavy capex and continued lithium and iron ore price volatility could quickly undermine the margin and valuation recovery that investors are banking on.

Find out about the key risks to this Mineral Resources narrative.

Another Angle on Valuation

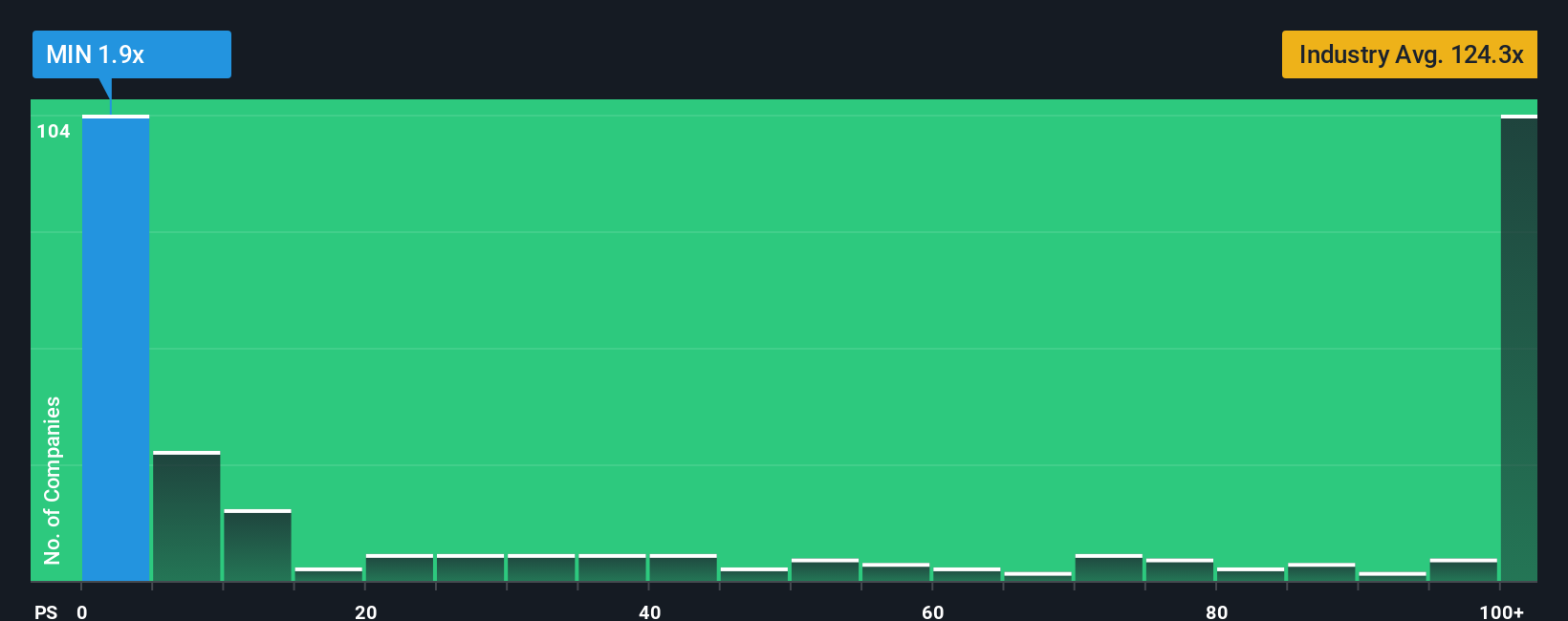

While the narrative fair value suggests Mineral Resources is 20.2 percent overvalued at A$55.98, its price to sales ratio of 2.5x looks cheap against a fair ratio of 12.8x and peers on 13.6x. If sentiment swings back, could this gap become the real driver?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mineral Resources Narrative

If you would rather dig into the numbers yourself and challenge this view, you can build a customised narrative in just a few minutes, Do it your way.

A great starting point for your Mineral Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Once you have sized up Mineral Resources, do not stop there. The smartest investors constantly refresh their watchlists with focused, high conviction opportunities from powerful screeners.

- Catch early movers in overlooked corners of the market by using these 3622 penny stocks with strong financials before the crowd notices their momentum building.

- Position yourself at the heart of technological change by scanning these 24 AI penny stocks that could reshape entire industries with smarter, faster solutions.

- Strengthen your long term core holdings with these 901 undervalued stocks based on cash flows that pair solid fundamentals with attractive prices the market has not fully recognised yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报