Northwest Natural Holding (NWN): Reassessing Valuation After $200m Debt Raise and General Counsel Succession Plan

Northwest Natural Holding (NWN) just paired a 200 million long term bond raise with a planned handoff in its top legal seat, a combination that quietly reshapes both its balance sheet and governance profile.

See our latest analysis for Northwest Natural Holding.

Those moves come after a solid run for the stock, with a year-to-date share price return of about 19 percent and a one-year total shareholder return close to 25 percent, suggesting momentum has been quietly building as investors reassess its income profile and governance stability.

If this kind of steady utility story appeals to you, it could be a good moment to also explore healthcare stocks for other resilient, cash generative names in different parts of the market.

That leaves a key question for investors today. With the stock up sharply yet still trading below analyst targets, is Northwest Natural Holding quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 10.7% Undervalued

With Northwest Natural Holding last closing at 47.09 dollars versus a narrative fair value of 52.75 dollars, the storyline leans toward upside driven by steady expansion.

Ongoing investments in infrastructure modernization and system upgrades, combined with supportive regulatory outcomes (recent rate increase and higher allowed ROE), are likely to improve net margins, operating efficiency, and future earnings reliability.

Curious how modest growth assumptions, rising margins, and a richer future earnings multiple all converge into that higher fair value line? Want to see the full blueprint?

Result: Fair Value of $52.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural decarbonization policies, along with potential regulatory pushback on cost recovery, could weigh on long term gas demand and compress future returns.

Find out about the key risks to this Northwest Natural Holding narrative.

Another Angle on Valuation

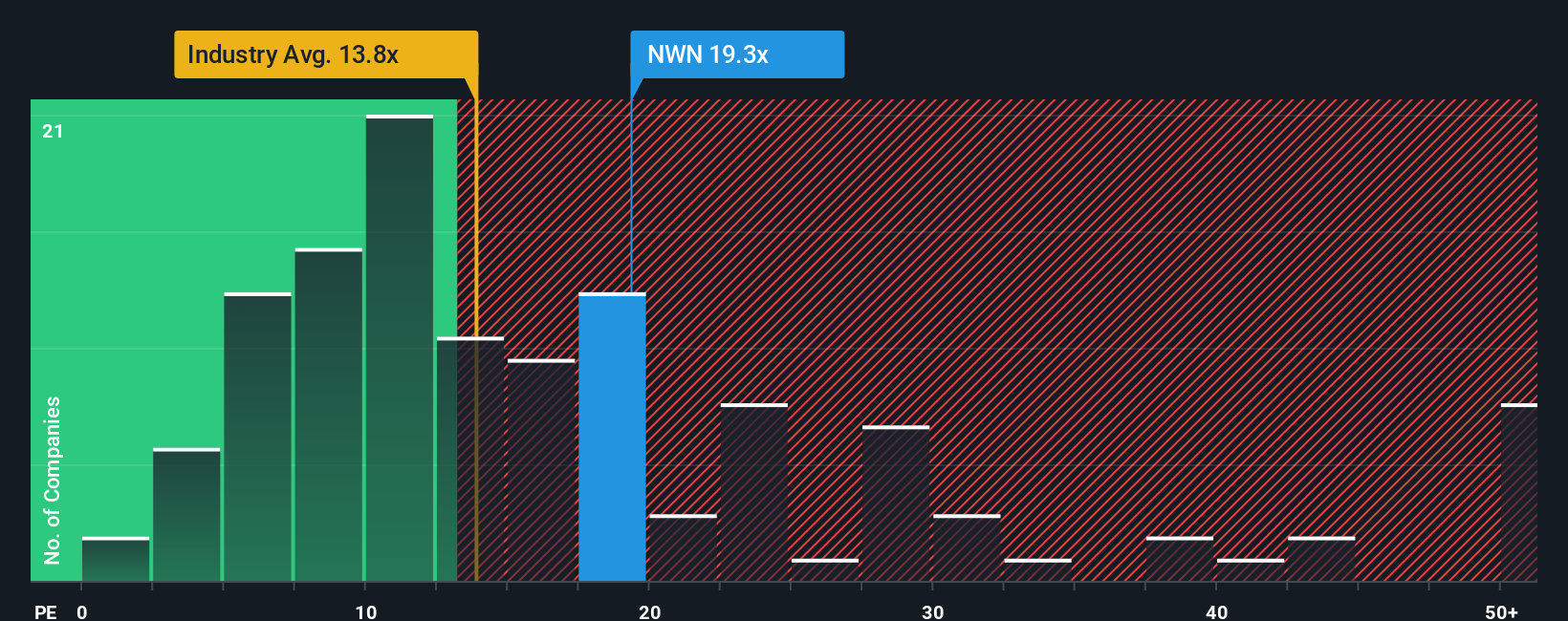

On a simple earnings lens, the picture looks tougher. Northwest Natural Holding trades on about 19.4 times earnings, richer than both US peers at 18 times and the global gas utilities average at 13.9 times, and only slightly below its fair ratio of 19.7 times. This leaves limited multiple upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Northwest Natural Holding Narrative

If you would rather examine the numbers yourself and build a personalized outlook in just a few minutes, the tools are available here: Do it your way.

A great starting point for your Northwest Natural Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you stop at one utility, give yourself an edge by hunting for fresh opportunities on the Simply Wall St Screener so potential winners do not pass you by.

- Secure steadier income potential by scanning these 10 dividend stocks with yields > 3% that balance yield with underlying business strength and consistent cash generation.

- Catch tomorrow’s innovators early by targeting these 24 AI penny stocks positioned to benefit from rapid advances in artificial intelligence and automation.

- Strengthen your margin of safety by focusing on these 901 undervalued stocks based on cash flows where market pessimism may already overstate the risks relative to long term cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报