NagaCorp Leads Our Top 3 Asian Penny Stock Picks

As Asia's markets navigate a complex economic landscape, marked by Japan's historic interest rate hike and China's mixed growth indicators, investors are increasingly looking for opportunities in less conventional areas. Penny stocks, though an outdated term, continue to represent a segment of smaller or less-established companies that may offer significant value due to their potential for growth. By focusing on those with solid financial foundations and promising trajectories, investors can uncover hidden gems that might provide both stability and upside potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.98 | THB894M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.78 | HK$2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.71 | HK$20.83B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.60 | HK$53.4B | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 967 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

NagaCorp (SEHK:3918)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NagaCorp Ltd., an investment holding company, manages and operates a hotel and casino complex in the Kingdom of Cambodia with a market cap of HK$20.83 billion.

Operations: The company's revenue is primarily derived from Casino Operations, contributing $591.45 million, with an additional $24.72 million generated from Hotel and Entertainment Operations.

Market Cap: HK$20.83B

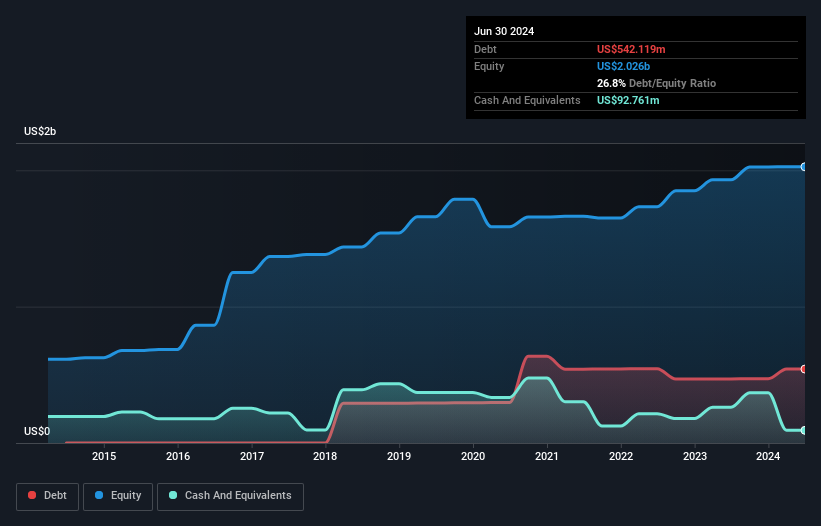

NagaCorp Ltd. demonstrates a strong financial position, with earnings growth of 176.5% over the past year, significantly outpacing the hospitality industry's average. The company maintains high-quality earnings and has reduced its debt-to-equity ratio from 18.7% to 3% over five years, indicating improved financial health. Its short-term assets exceed both short- and long-term liabilities, ensuring liquidity stability. While NagaCorp trades at a price-to-earnings ratio below the Hong Kong market average, offering relative value, its dividend track record remains unstable. Recent unaudited results show increased gross gaming revenue to US$532 million for nine months ending September 2025.

- Click to explore a detailed breakdown of our findings in NagaCorp's financial health report.

- Evaluate NagaCorp's prospects by accessing our earnings growth report.

Jiangsu Huifeng Bio Agriculture (SZSE:002496)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Huifeng Bio Agriculture Co., Ltd. operates in the agricultural sector, focusing on the production and sale of agrochemical products, with a market cap of CN¥2.67 billion.

Operations: Jiangsu Huifeng Bio Agriculture Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.67B

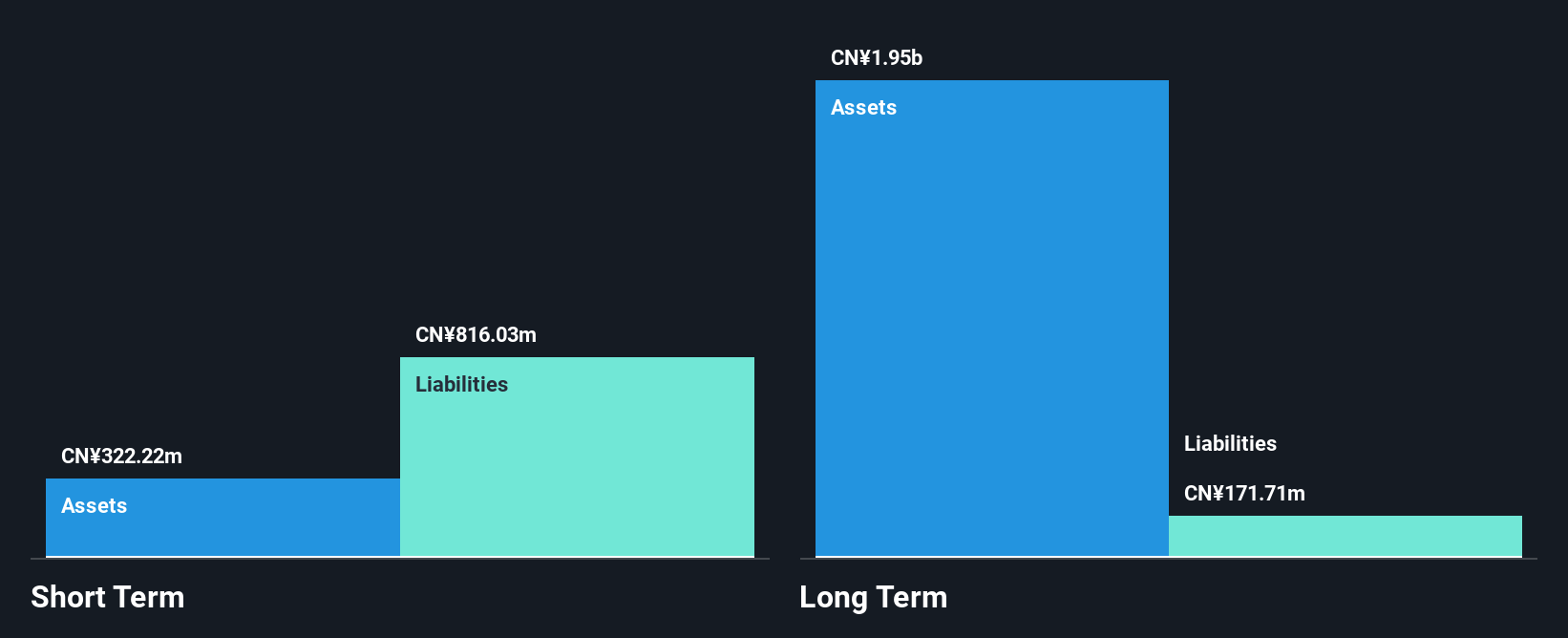

Jiangsu Huifeng Bio Agriculture Co., Ltd. is experiencing financial challenges, reporting a net loss of CN¥3.23 million for the first nine months of 2025, despite increased revenue to CN¥219.13 million from the previous year. The company faces liquidity issues with short-term assets of CN¥322.2 million falling short of its short-term liabilities totaling CN¥816 million, though it maintains a satisfactory net debt to equity ratio at 21%. Recent amendments proposed in its articles of association and board changes suggest potential strategic shifts as it navigates these financial hurdles amidst stable weekly volatility and an experienced board and management team.

- Click here to discover the nuances of Jiangsu Huifeng Bio Agriculture with our detailed analytical financial health report.

- Gain insights into Jiangsu Huifeng Bio Agriculture's historical outcomes by reviewing our past performance report.

Zhanjiang Guolian Aquatic Products (SZSE:300094)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhanjiang Guolian Aquatic Products Co., Ltd. operates in the aquaculture industry, focusing on the processing and sale of aquatic products, with a market cap of CN¥4.33 billion.

Operations: Zhanjiang Guolian Aquatic Products Co., Ltd. does not report specific revenue segments, but it is involved in the aquaculture sector, primarily dealing with the processing and distribution of aquatic products.

Market Cap: CN¥4.33B

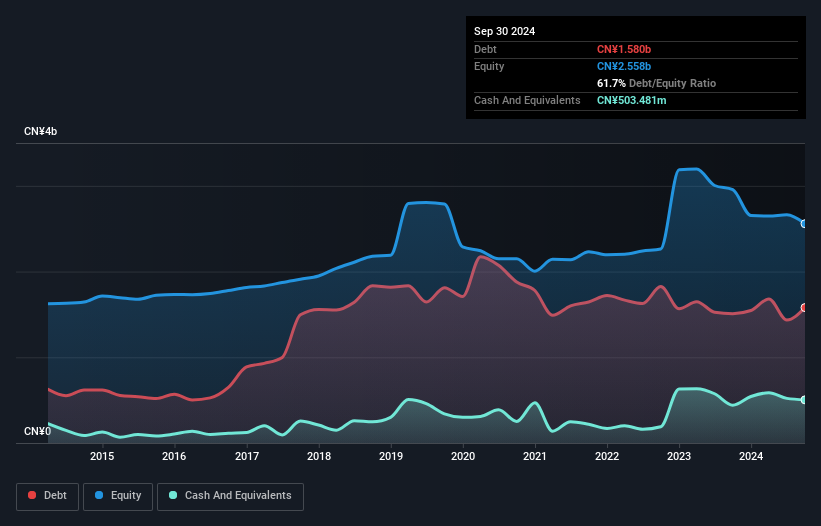

Zhanjiang Guolian Aquatic Products Co., Ltd. is navigating financial difficulties, with a net loss of CN¥799.82 million for the first nine months of 2025, despite generating sales of CN¥2.58 billion in the same period. The company struggles with profitability as losses have increased over five years, and it faces a high net debt to equity ratio at 94.5%. However, it has sufficient short-term assets (CN¥2.4 billion) to cover its liabilities and a cash runway exceeding three years if free cash flow remains stable, supported by an experienced board and management team amidst volatile share prices.

- Jump into the full analysis health report here for a deeper understanding of Zhanjiang Guolian Aquatic Products.

- Gain insights into Zhanjiang Guolian Aquatic Products' past trends and performance with our report on the company's historical track record.

Next Steps

- Dive into all 967 of the Asian Penny Stocks we have identified here.

- Contemplating Other Strategies? Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报