Silvercorp Metals (TSX:SVM) Valuation After Condor PEA Unveils Long-Life, High-Return Gold Project in Ecuador

Silvercorp Metals (TSX:SVM) has grabbed investor attention with a new Preliminary Economic Assessment for its Condor gold project in Ecuador, outlining a long mine life and eye catching project economics.

See our latest analysis for Silvercorp Metals.

That PEA lands after a big year for Silvercorp, with the shares now trading at $11.75 and a powerful year to date share price return of 158.24% alongside a 1 year total shareholder return of 170.75%. This suggests that recent index inclusion and awards are feeding into strong, growth focused momentum.

If this kind of rerating has you wondering what else could surprise on the upside, it might be worth exploring fast growing stocks with high insider ownership as your next hunting ground.

With earnings and cash flow racing ahead of past years and the share price still sitting modestly below analyst targets, is Silvercorp an underappreciated growth story, or are investors already paying up for tomorrow’s production?

Most Popular Narrative Narrative: 8.8% Undervalued

With the most followed narrative putting fair value above Silvercorp Metals last close of CA$11.75, the gap hinges on aggressive growth and margin assumptions.

The company's progress on new mine developments, particularly the construction ramp up at El Domo and advancement of Kuanping, positions it to significantly expand production volumes and diversify beyond China. This enhances future revenue and mitigates single jurisdiction risk.

Record operating cash flow ($48.3 million in Q1) and a substantial cash position ($377 million), together with disciplined capital allocation and access to additional financing (such as the $175 million Wheaton stream), support higher earnings stability, potential dividend capacity, and the ability to invest in further growth projects.

Curious how this growth story translates into a richer valuation, yet uses a surprisingly restrained earnings multiple and discount rate instead of blue sky assumptions?

Result: Fair Value of $12.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty in China and potential permitting setbacks in Ecuador could quickly cool enthusiasm around Silvercorp’s growth-led valuation narrative.

Find out about the key risks to this Silvercorp Metals narrative.

Another Lens On Value

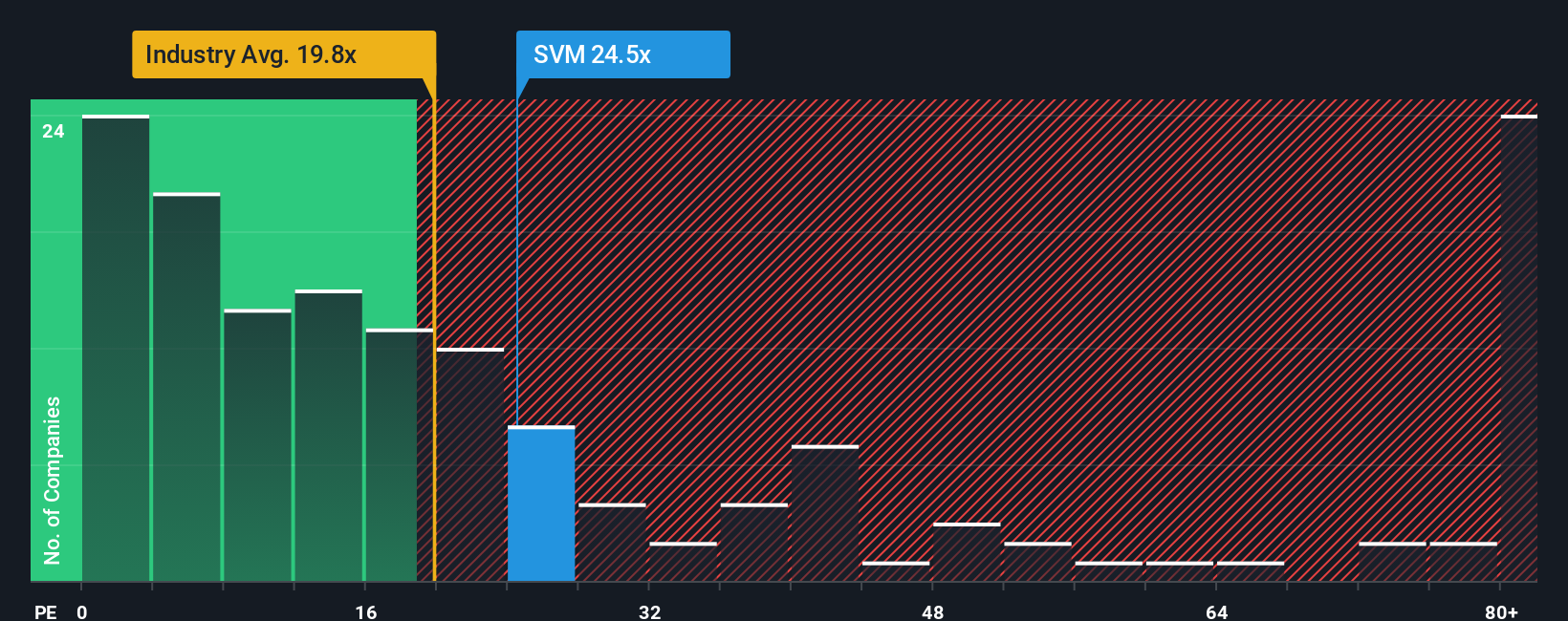

Step away from growth forecasts and Silvercorp suddenly looks expensive. Its price to earnings ratio of 75.3 times dwarfs the Canadian metals and mining average of 21.9 times. It also exceeds the 37 times fair ratio our models suggest the market could drift toward, raising the risk of a sharp de rating if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Silvercorp Metals Narrative

If you see the numbers differently or want to dig into the data yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Silvercorp Metals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall St Screener to uncover fresh stock ideas today, or risk watching others seize opportunities in themes you have not even reviewed yet.

- Explore asymmetric upside by targeting higher risk, high potential names through these 3622 penny stocks with strong financials that still meet disciplined financial quality checks.

- Focus on structural trends in automation and data by reviewing these 24 AI penny stocks positioned at the intersection of software, chips, and real world adoption.

- Identify potential mispricings by screening for companies trading below their estimated cash flow value using these 901 undervalued stocks based on cash flows before sentiment shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报