Snowflake (SNOW): Rethinking Valuation After a Strong Year-to-Date Rally and Recent Pullback

Snowflake (SNOW) has quietly outperformed the market this year, with shares up about 41% year to date even after a recent pullback. This has prompted fresh debate over how much growth is already priced in.

See our latest analysis for Snowflake.

The recent pullback, including a 1 day share price return of minus 1.41 percent and 1 month share price return of minus 8.29 percent, suggests momentum is cooling a bit. That still sits against a strong year to date share price return of about 40.9 percent and a solid 3 year total shareholder return of just over 60 percent, which points to investors still broadly backing the long term growth story.

If Snowflake’s run has you rethinking where growth could come from next, it is worth exploring other high growth tech and AI names through high growth tech and AI stocks as potential companions or alternatives in your portfolio.

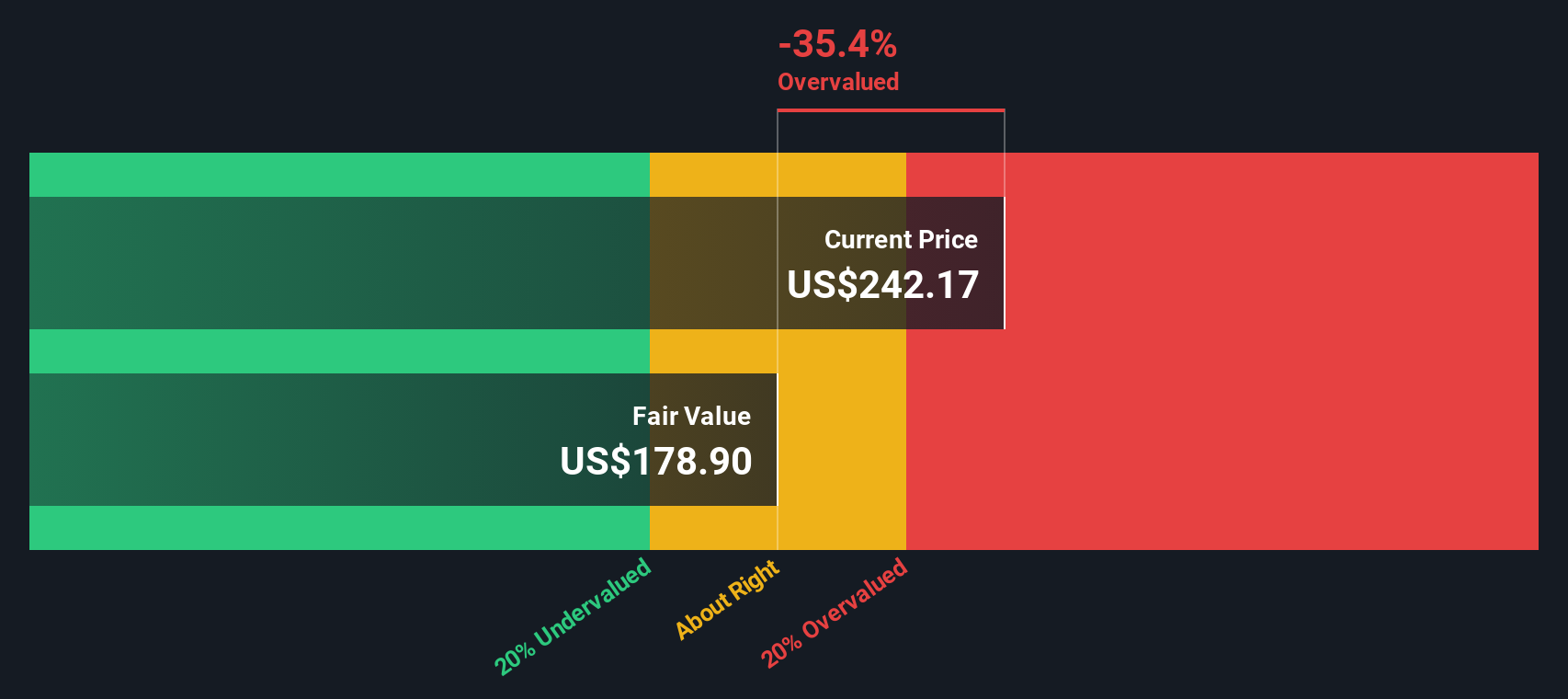

With revenue still growing near 20 percent annually, but profits deep in the red and the stock trading at a hefty premium, investors face a dilemma: Is Snowflake undervalued today, or is future growth already fully priced in?

Most Popular Narrative Narrative: 21.2% Undervalued

Compared with Snowflake’s last close of $221.93, the most popular narrative pegs fair value much higher, implying considerable upside if its long term thesis plays out.

The ongoing transition from legacy, on premise databases to cloud data platforms offers years of migration runway, with Snowflake benefiting disproportionately from large enterprises prioritizing modernization and migrating new workloads supporting sustained growth in customer count, net revenue retention, and expansion opportunities.

Curious how steady double digit growth, rising margins, and a rich future earnings multiple can still add up to upside from here? See how the narrative quantifies that path, the time frame it relies on, and the bold profitability swing baked into its fair value.

Result: Fair Value of $281.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on Snowflake overcoming slowing migration-driven demand and fierce competition from hyperscalers that could pressure growth and margins.

Find out about the key risks to this Snowflake narrative.

Another View: SWS DCF Flags Overvaluation

While the AI driven narrative sees Snowflake as roughly 21 percent undervalued, our DCF model paints a very different picture, suggesting fair value closer to $152 per share, well below the current $221.93 price and implying meaningful downside if cash flows do not ramp as hoped.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Snowflake for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Snowflake Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way

A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more smart investment angles?

Before you move on, consider scanning hand picked opportunities that could help balance Snowflake, potentially enhance your returns, and refine your portfolio strategy.

- Explore these 3622 penny stocks with strong financials to identify companies where stronger financials support compelling business stories.

- Review these 29 healthcare AI stocks to see how intelligent automation is influencing the delivery of care and the way medical decisions are made.

- Evaluate these 10 dividend stocks with yields > 3% for ideas on securities that offer income potential supported by sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报