Verizon (VZ) Valuation Check as New AI, Prepaid and First Responder Initiatives Expand Its Growth Story

Verizon Communications (VZ) has been quietly rewriting its growth story, from powering Kodiak AI’s autonomous trucking connectivity to expanding Total Wireless and bolstering first responder tech, giving investors fresh angles on an otherwise mature dividend stock.

See our latest analysis for Verizon Communications.

Those moves sit against a mixed backdrop for the stock, with a recent 1 day share price return of 1 percent to about $40 and a 1 year total shareholder return of just over 8 percent, which hints at steady, income led rather than explosive momentum.

If Verizon’s mix of connectivity and AI partnerships has you thinking about what else is shaping the next cycle, it is worth exploring high growth tech and AI stocks as potential ideas for your watchlist.

Yet with the stock still below analyst targets and trading at what looks like a sizable intrinsic discount, investors now face a familiar dilemma: is Verizon quietly undervalued, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 15.1% Undervalued

With Verizon Communications last closing at $40.32 against a narrative fair value near the high 40s, the story points to upside rooted in disciplined execution and gradual earnings expansion.

Ongoing cost optimization driven by successful voluntary separation programs, copper network decommissioning, AI powered process efficiencies, and operational streamlining continues to improve operating leverage and expand EBITDA and free cash flow, underpinning sustainable future earnings growth.

Want to see what is behind that earnings runway? This narrative quietly leans on modest growth, fatter margins, and a future valuation multiple that challenges today’s skepticism. Curious which assumptions really drive that gap between price and fair value? Read on to unpack the full playbook behind this underappreciated target.

Result: Fair Value of $47.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated 5G and fiber spending, along with a saturated and highly competitive wireless market, could still squeeze margins and stall the earnings recovery investors expect.

Find out about the key risks to this Verizon Communications narrative.

Another Lens On Value

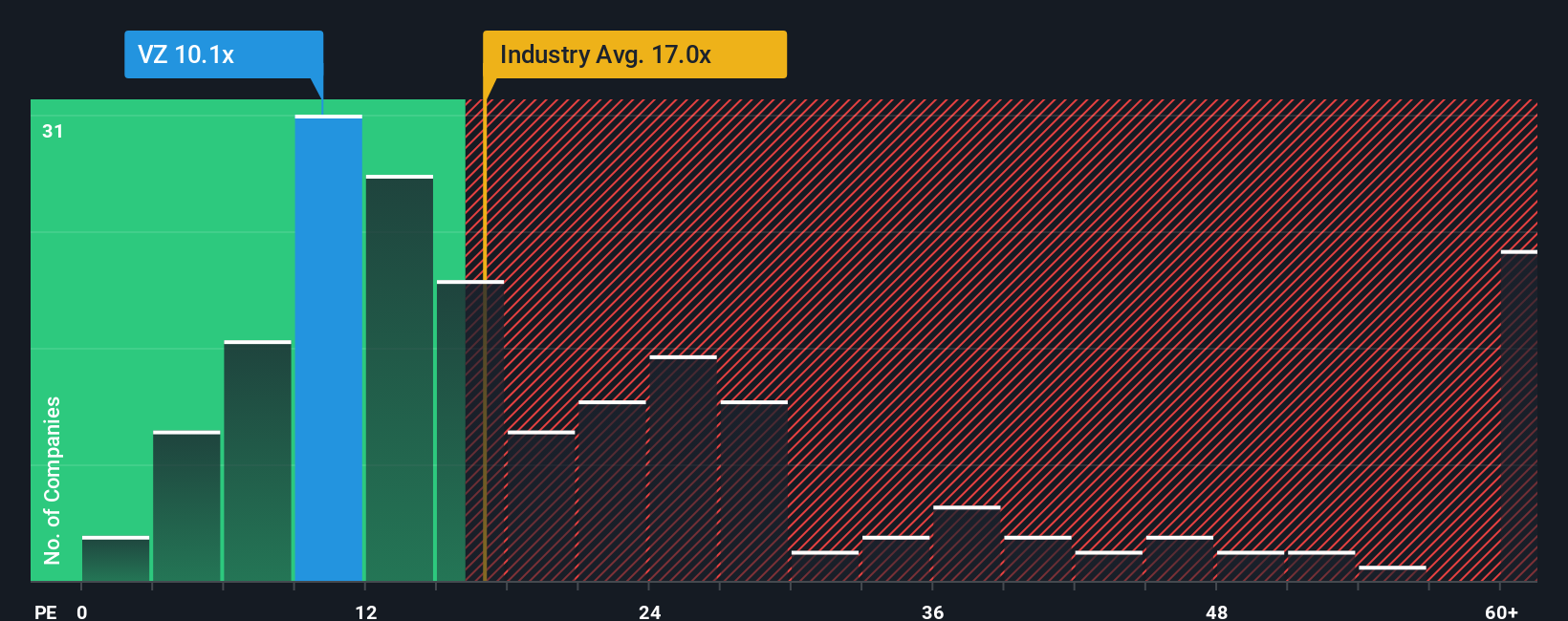

Looked at through its earnings multiple, Verizon sends a more cautious signal. It trades on about 8.6 times earnings, only slightly richer than peers at 8.2 times, but well below a fair ratio of 13.8 times, which suggests upside if sentiment and growth expectations improve.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Verizon Communications Narrative

If you see Verizon’s story differently or want to test your own assumptions using the same data, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Verizon Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop your research with one stock. Use Simply Wall Street’s powerful screener to uncover focused opportunities that match your strategy before the market catches on.

- Capture high-upside potential early by scanning these 3623 penny stocks with strong financials that already show solid financial underpinnings instead of speculative hype.

- Position your portfolio at the forefront of intelligent automation with these 29 healthcare AI stocks, where medicine, data, and algorithms meet real world demand.

- Strengthen your income stream by targeting these 10 dividend stocks with yields > 3% that combine meaningful yields with balance sheets built to sustain payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报