Is United Parks and Resorts Attractively Valued After Major Share Price Slump in 2025?

- If you are wondering whether United Parks & Resorts is a beaten down theme park stock or a quietly compelling value play right now, you are not alone, and the answer is more nuanced than the share price suggests.

- Despite a modest 0.8% gain over the last week and 5.6% over the past month, the stock is still down 38.1% year to date and 34.7% over the last year, which hints at a big gap between recent sentiment and the company’s longer term 14.2% five year return.

- Recent headlines have focused on the company’s strategic repositioning under the United Parks & Resorts banner and ongoing efforts to refresh its park portfolio and brand partnerships. These help explain some of the shifting expectations baked into the share price. Alongside this, investors have been weighing macro factors like discretionary spending trends and tourism demand, both of which feed directly into how the market prices the stock.

- On our checks, United Parks & Resorts scores a solid 5 out of 6 for valuation, suggesting it looks undervalued on most, but not all, metrics. Next, we will walk through those different approaches to see what they imply, before finishing with an even better way to think about what the stock might really be worth.

Find out why United Parks & Resorts's -34.7% return over the last year is lagging behind its peers.

Approach 1: United Parks & Resorts Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in $ terms.

For United Parks & Resorts, the latest twelve month free cash flow is about $162.9 million. Analysts expect this to rise steadily, with projections of around $239 million in 2026 and $260 million in 2027, and Simply Wall St extends those forecasts further so that free cash flow is estimated to reach roughly $369.4 million by 2035. These projections are fed into a 2 Stage Free Cash Flow to Equity model, which allows for a period of higher growth before assuming conditions normalise over the longer term.

On this basis, the model estimates an intrinsic value of $58.44 per share. Compared with the current share price, this implies the stock is trading at a 39.1% discount, suggesting that the market is pricing United Parks & Resorts well below what its cash generation profile might justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Parks & Resorts is undervalued by 39.1%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

Approach 2: United Parks & Resorts Price vs Earnings

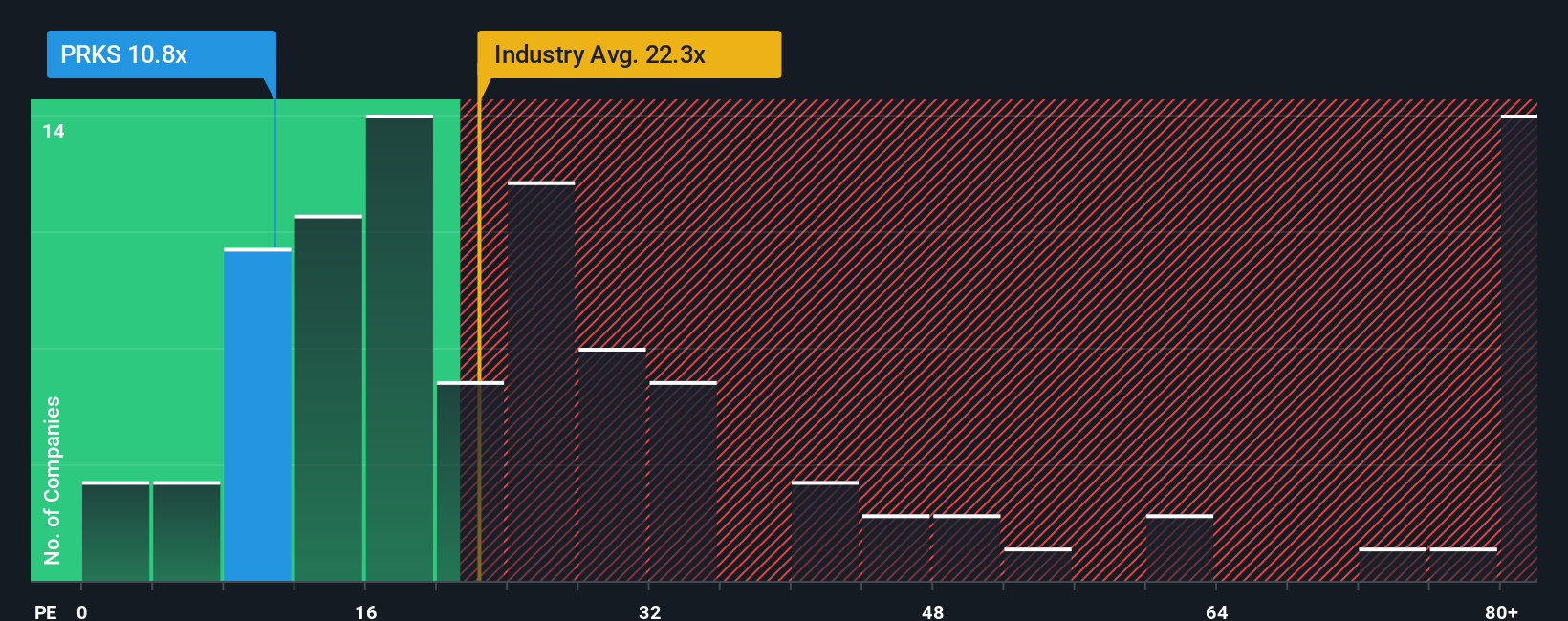

For profitable companies like United Parks & Resorts, the price to earnings (PE) ratio is a straightforward way to gauge what investors are paying for each dollar of current profits. In general, faster growing, lower risk businesses deserve a higher PE multiple, while slower growth or higher uncertainty usually justifies a lower one.

United Parks & Resorts currently trades on a PE of about 10.7x. That is well below both the wider Hospitality industry average of roughly 21.9x and the peer group average of around 23.8x. This suggests the market is applying a sizeable discount to its earnings. To move beyond simple comparisons, Simply Wall St also calculates a proprietary Fair Ratio of 16.6x, which reflects what a reasonable PE might be given the company’s earnings growth outlook, profit margins, risk profile, industry positioning and market capitalization.

This Fair Ratio is more informative than looking at peers alone because it tailors the valuation benchmark to United Parks & Resorts specific fundamentals rather than assuming all Hospitality stocks deserve the same multiple. Comparing the current 10.7x PE to the 16.6x Fair Ratio points to the shares trading materially below what these fundamentals might warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Parks & Resorts Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you turn your view of United Parks & Resorts into a clear story. You can then link that story to a set of revenue, earnings and margin forecasts, and translate those forecasts into a Fair Value you can compare with today’s share price to decide whether to buy, hold or sell. The Narrative automatically refreshes as new news or earnings arrive. For example, a bullish investor might build a Narrative where Orlando’s new park, digital upselling and real estate partnerships support a higher 2028 earnings path and a Fair Value closer to the optimistic 81 dollar target. A more cautious investor could emphasise weather risks, weaker pricing power and softer recurring revenue and land nearer the 46 dollar bear case. Both perspectives coexist transparently on the platform so you can see, test and refine the story that best fits your own assumptions.

Do you think there's more to the story for United Parks & Resorts? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报