Equifax (EFX): Rethinking Valuation After Q3 Revenue Beat and Expanding AI and Cloud Patent Portfolio

Equifax (EFX) just delivered a third quarter that beat its own revenue guidance while navigating a choppy mortgage and hiring backdrop, and the upside is increasingly tied to its AI and cloud playbook.

See our latest analysis for Equifax.

Even with today’s Q3 beat and a steady stream of AI and cloud patent wins, the stock’s 1 month share price return of 5.22 percent comes against a softer year to date share price return and a modestly positive 3 year total shareholder return. This suggests momentum is only starting to rebuild as investors reassess Equifax’s long term growth story.

If Equifax’s AI push has your attention, this is a good moment to explore other high growth tech and AI names by scanning high growth tech and AI stocks.

With shares still down double digits year to date and trading roughly 20 percent below analyst targets, investors face a key question: Is Equifax quietly undervalued, or is it already pricing in its AI driven growth runway?

Most Popular Narrative: 17.3% Undervalued

With Equifax last closing at $220.56 against a narrative fair value of $266.75, the story leans toward upside built on durable data assets.

Global cloud migration and investments in proprietary technology platforms are now largely complete, enabling margin expansion through operating leverage, efficiency gains, and scalable innovation, which is expected to increase EBITDA and net margins over time.

Want to see how this margin engine powers that valuation gap? The narrative leans on accelerating earnings, expanding margins, and a premium future multiple. Curious which assumptions really do the heavy lifting here? Dive in to see the precise growth path behind that fair value call.

Result: Fair Value of $266.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent litigation costs and intensifying competition from alternative scoring models could compress margins and slow the company’s expected earnings trajectory.

Find out about the key risks to this Equifax narrative.

Another Angle on Valuation

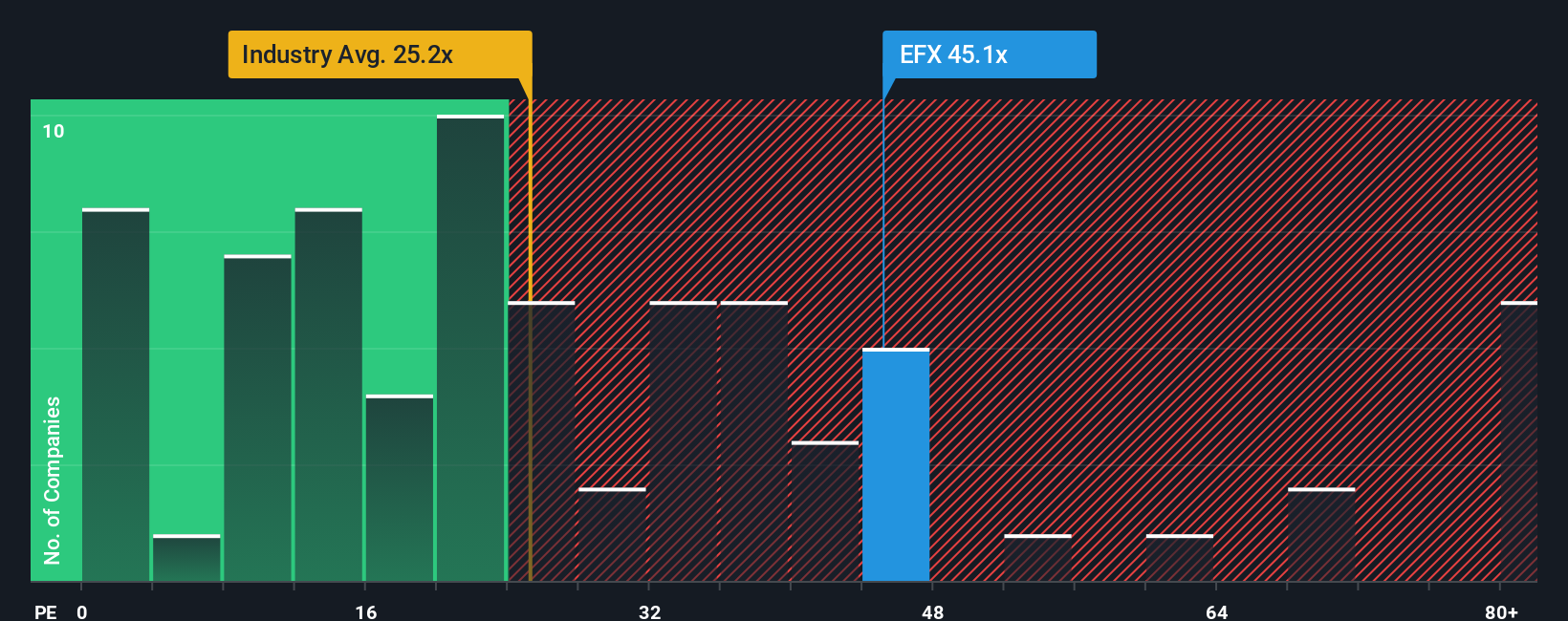

Valuation based on earnings tells a very different story. At about 41 times earnings, Equifax trades well above the US Professional Services average of 24.3 times and a fair ratio of 33.7 times, suggesting investors are paying up for growth that may already be in the price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equifax Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fully custom view in minutes: Do it your way.

A great starting point for your Equifax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next opportunity by scanning targeted stock lists that surface ideas many investors may overlook using the Simply Wall Street Screener.

- Explore potential multi baggers early by reviewing these 3626 penny stocks with strong financials with solid fundamentals before they reach broader attention.

- Focus on the AI theme by looking at these 24 AI penny stocks that combine technology trends with observable business traction.

- Strengthen your portfolio foundation by pinpointing these 903 undervalued stocks based on cash flows that may be trading below their long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报