Do Inventory Strains and Legal Scrutiny Reveal Deeper Demand Visibility Issues for Lennox (LII)?

- In October 2025, law firm Levi & Korsinsky began investigating Lennox International for potential federal securities law violations after the company reported mixed third-quarter results, revenue declines, inventory challenges, and revised full-year guidance.

- This combination of operational setbacks and legal scrutiny raises fresh questions about Lennox’s risk controls, demand visibility, and the resilience of its longer-term business plan.

- Against this backdrop of an investigation tied to inventory and revenue pressure, we’ll examine how these developments reshape Lennox’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lennox International Investment Narrative Recap

To own Lennox International, you need to believe the company can turn its inventory and demand visibility issues into a temporary setback rather than a structural problem, while still benefiting from replacement-driven HVAC demand and efficiency regulations. The recent guidance cut and sharp share price reaction make execution on inventory reduction the key short term catalyst, and elevate the risk that excess stock, weaker volumes, or discounting could weigh more heavily on margins and cash flow.

Against this backdrop, Lennox’s continued commitment to a quarterly dividend of US$1.30 per share, most recently affirmed in December 2025, stands out. The payout signals confidence in underlying cash generation, but it also tightens the margin for error if inventory markdowns or prolonged revenue softness start to bite. How Lennox balances shareholder returns with the need to de risk its balance sheet is now central to the story, particularly as...

Read the full narrative on Lennox International (it's free!)

Lennox International's narrative projects $6.2 billion revenue and $1.1 billion earnings by 2028.

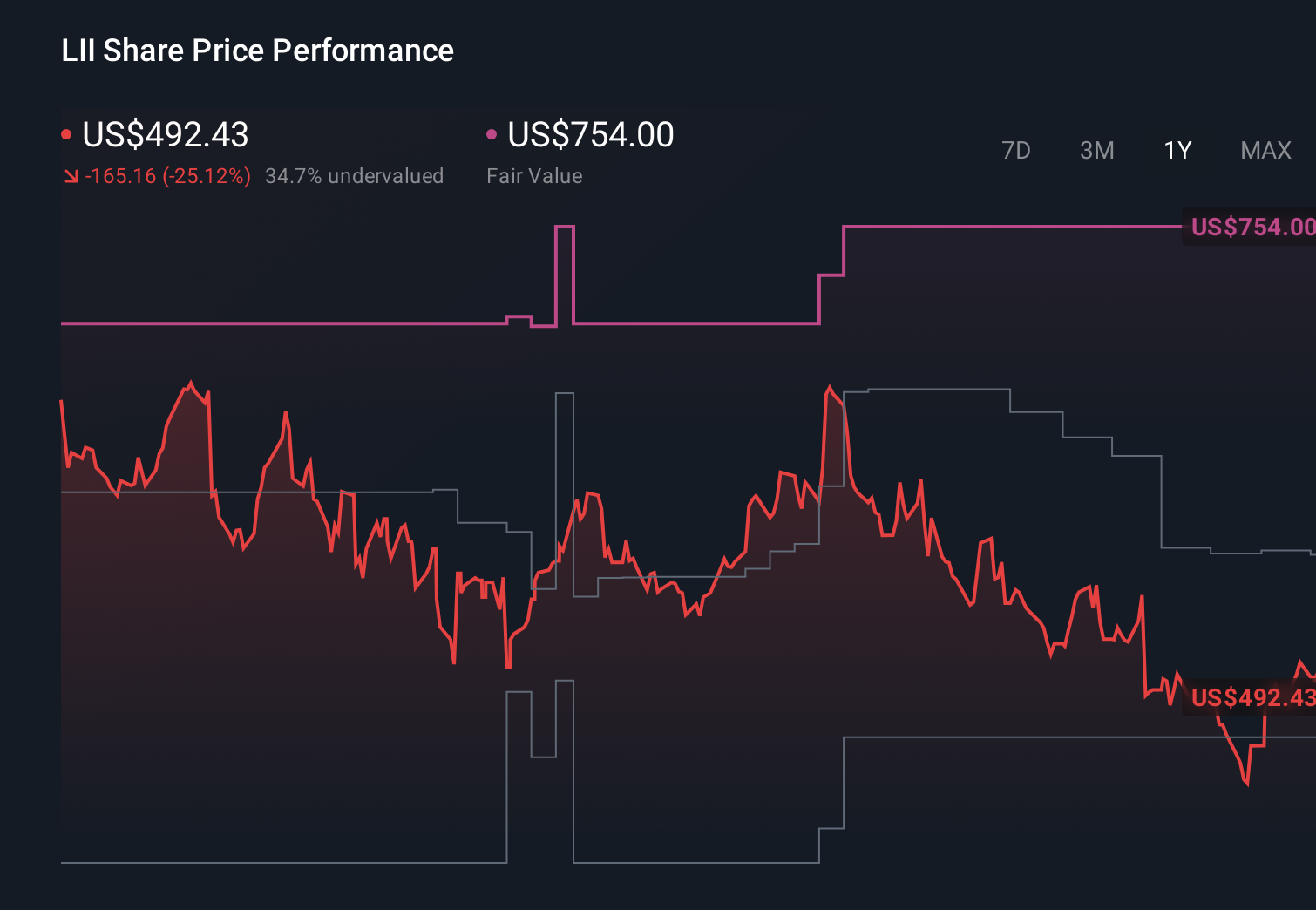

Uncover how Lennox International's forecasts yield a $571.43 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$404 to US$571 per share, underscoring how far apart individual views can be. You are weighing those opinions against a business now facing heightened inventory and revenue risks that could influence both its recovery path and the strength of its HVAC replacement opportunity over time.

Explore 2 other fair value estimates on Lennox International - why the stock might be worth 19% less than the current price!

Build Your Own Lennox International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennox International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lennox International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennox International's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报