General Electric (GE) valuation after new Pegasus engine deal and U.S. Navy contract wins

General Electric (GE) is back in focus after a pair of aerospace wins: a major LEAP-1B engine deal with Pegasus Airlines and a fresh U.S. Navy R&D contract on its F414 fighter jet engine program.

See our latest analysis for General Electric.

Those deals land against a backdrop of powerful momentum, with the share price up strongly over the past year and a multi year total shareholder return above 500 percent, signaling renewed confidence in GE Aerospace’s growth runway.

If GE’s surge has you rethinking the whole sector, this could be a smart moment to explore other aerospace and defense stocks that are also riding structural defense and commercial aviation tailwinds.

With GE now trading near record highs and analysts still seeing upside, the real question is whether today’s valuation fully reflects its aerospace supercycle, or if there is still a genuine buying opportunity left on the table.

Most Popular Narrative: 6.8% Undervalued

With General Electric closing at 316.75 dollars against a most popular narrative fair value near 339.69 dollars, the storyline assumes the aerospace upswing still has room to run.

Major supply chain stabilization and productivity gains from the FLIGHT DECK operating model and 2 billion dollars plus investment in capacity are unlocking pent up services demand and enabling double digit output growth, translating into sustained higher free cash flow conversion and improved operating leverage.

Curious how steady, mid single digit revenue growth can still justify a premium earnings multiple and rising margins for a legacy industrial name? The most popular narrative leans on ambitious earnings expansion, a richer profit mix from services, and a valuation multiple more often seen in faster growing sectors. Want to see exactly which growth, margin, and discount rate assumptions are doing the heavy lifting in that fair value calculation? Read on to uncover the full playbook behind this price target.

Result: Fair Value of $339.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain tightness or a prolonged air travel slowdown could pressure margins and earnings, which could force a rethink of today’s upbeat valuation assumptions.

Find out about the key risks to this General Electric narrative.

Another Take On Valuation

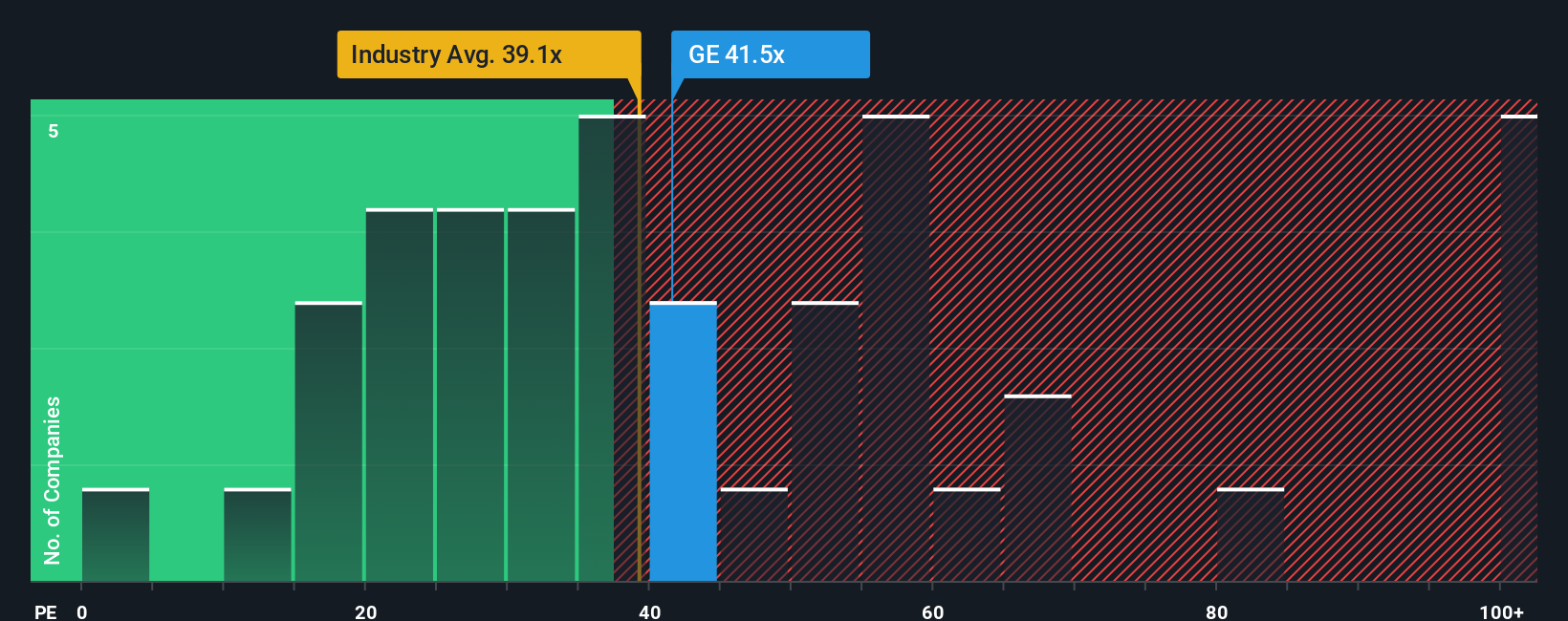

Our view based on price to earnings paints a very different picture. At about 41.5 times earnings, GE trades well above the sector at 38 times and a fair ratio of 36.4 times, suggesting the shares may already be pricing in a lot of good news. Is the margin of safety too thin?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own General Electric Narrative

If you want to stress test these assumptions or lean on your own research instead, you can build a personalized view in minutes: Do it your way.

A great starting point for your General Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready For Your Next Investment Move?

Before you close this tab, lock in an edge by scanning fresh, data driven ideas on Simply Wall St so you are not chasing yesterday’s winners.

- Capture potential bargains early by targeting companies flagged as attractively priced through these 903 undervalued stocks based on cash flows, where cash flows and fundamentals do the talking.

- Explore the next wave of innovation by narrowing in on high potential names among these 24 AI penny stocks, positioned at the intersection of software, data, and automation.

- Strengthen your income stream by hunting for reliable payers across these 10 dividend stocks with yields > 3%, focusing on yields that may help support returns during periods of market volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报