Does Nutex Health’s (NUTX) Missouri Micro-Hospital Push Clarify Its Long-Term Expansion Economics?

- Nutex Health has opened its 26th hospital and first Missouri location, Archview ER & Hospital in St. Louis, a 16,000-square-foot facility with 15 emergency beds, 3 inpatient suites, and full-service lab and advanced imaging available 24/7/365.

- This move extends Nutex Health’s micro-hospital footprint into a new state, underlining its focus on smaller, technology-equipped facilities aimed at convenient community care.

- We’ll now look at how this Missouri micro-hospital opening fits into Nutex Health’s growth narrative and future expansion assumptions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Nutex Health Investment Narrative Recap

To own Nutex Health, you need to believe its micro hospital and freestanding ER model can keep attracting growing patient volumes while managing heavy dependence on out of network arbitration and new-site openings. The Missouri hospital opening supports the near term growth catalyst of expanding into high demand markets, but it does not materially change the key risk that revenue and cash flow remain closely tied to the No Surprises Act’s Independent Dispute Resolution process.

The reopening of Red River ER & Hospital in Texas in November 2025 sits alongside the St. Louis launch as part of Nutex’s push to scale its footprint and lift patient visits. Together, these facilities illustrate how new and revived locations are central to the company’s expansion pipeline, which could support earnings if volumes ramp as expected, but also heightens exposure to any slowdown in micro hospital performance or payer related arbitration outcomes.

Yet behind this expansion story, investors should be aware of how vulnerable Nutex remains to any shift in the No Surprises Act and IDR...

Read the full narrative on Nutex Health (it's free!)

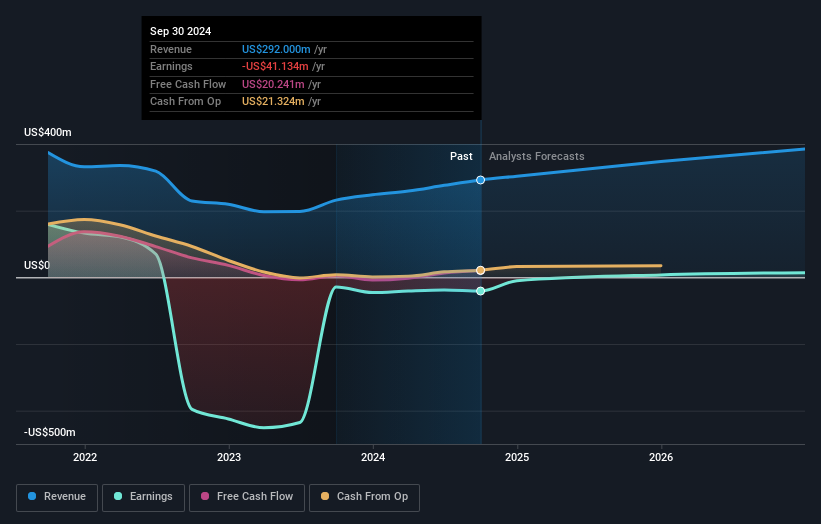

Nutex Health's narrative projects $1.2 billion revenue and $98.9 million earnings by 2028. This requires 22.7% yearly revenue growth and a $31.7 million earnings increase from $67.2 million today.

Uncover how Nutex Health's forecasts yield a $241.67 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community currently estimate Nutex’s fair value between US$104 and US$5,524, showing extremely wide valuation opinions. Against that backdrop, Nutex’s reliance on the No Surprises Act’s arbitration process for over 60% of revenue gives you a clear risk lens to compare these views and assess how sustainable the current business mix might be.

Explore 8 other fair value estimates on Nutex Health - why the stock might be a potential multi-bagger!

Build Your Own Nutex Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nutex Health research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nutex Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nutex Health's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报