Weighing Keurig Dr Pepper After Portfolio Shifts And Sliding Share Price In 2025

- If you have been wondering whether Keurig Dr Pepper is quietly turning into a value opportunity or just a value trap, you are not alone. This is exactly what we are going to unpack.

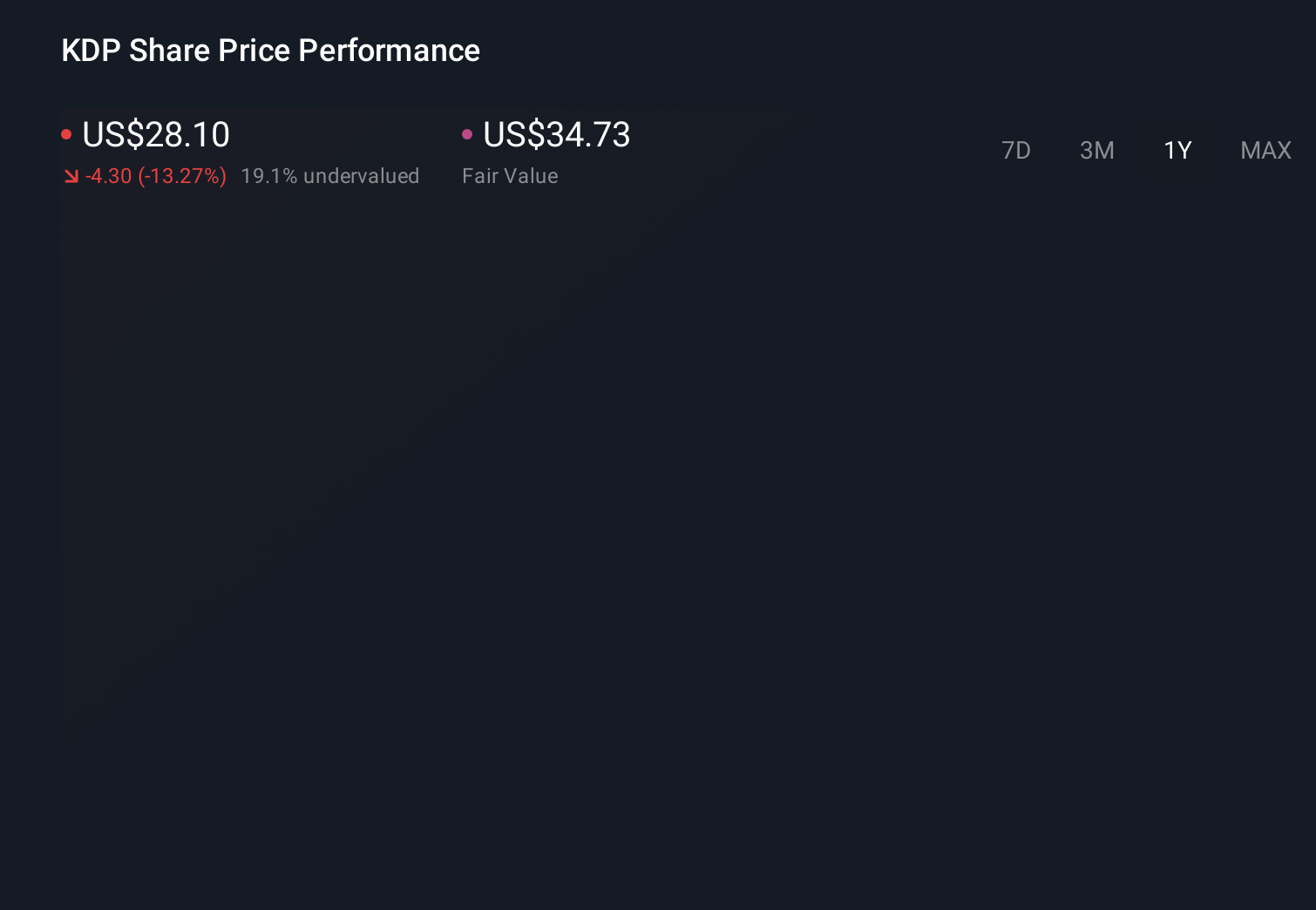

- The stock has drifted lower over the longer term, with returns of about -11.1% over the last year and -11.8% year to date, even though it has managed a modest 2.3% gain over the last month.

- Recently, the company has stayed in the headlines for portfolio reshuffles, new beverage partnerships, and ongoing integration of its coffee and soft drink platforms, all aimed at sharpening its competitive edge against giants like Coca Cola and PepsiCo. These strategic moves help explain why the market keeps reassessing the stock, even when the share price looks subdued.

- On our framework, Keurig Dr Pepper scores a solid 5/6 valuation checks, which suggests undervaluation and sets us up to compare what different valuation methods say, before finishing with an intuitive way to frame what the stock might be worth.

Find out why Keurig Dr Pepper's -11.1% return over the last year is lagging behind its peers.

Approach 1: Keurig Dr Pepper Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to their value in the present.

For Keurig Dr Pepper, the latest twelve month Free Cash Flow is about $1.6 billion. Analysts provide detailed forecasts for the next few years, and from around 2027 onward Simply Wall St extrapolates those estimates, assuming gradually slowing growth. On this basis, annual Free Cash Flow is expected to rise to just over $4.0 billion in ten years. This implies steady but not explosive expansion of the cash the business can return to shareholders.

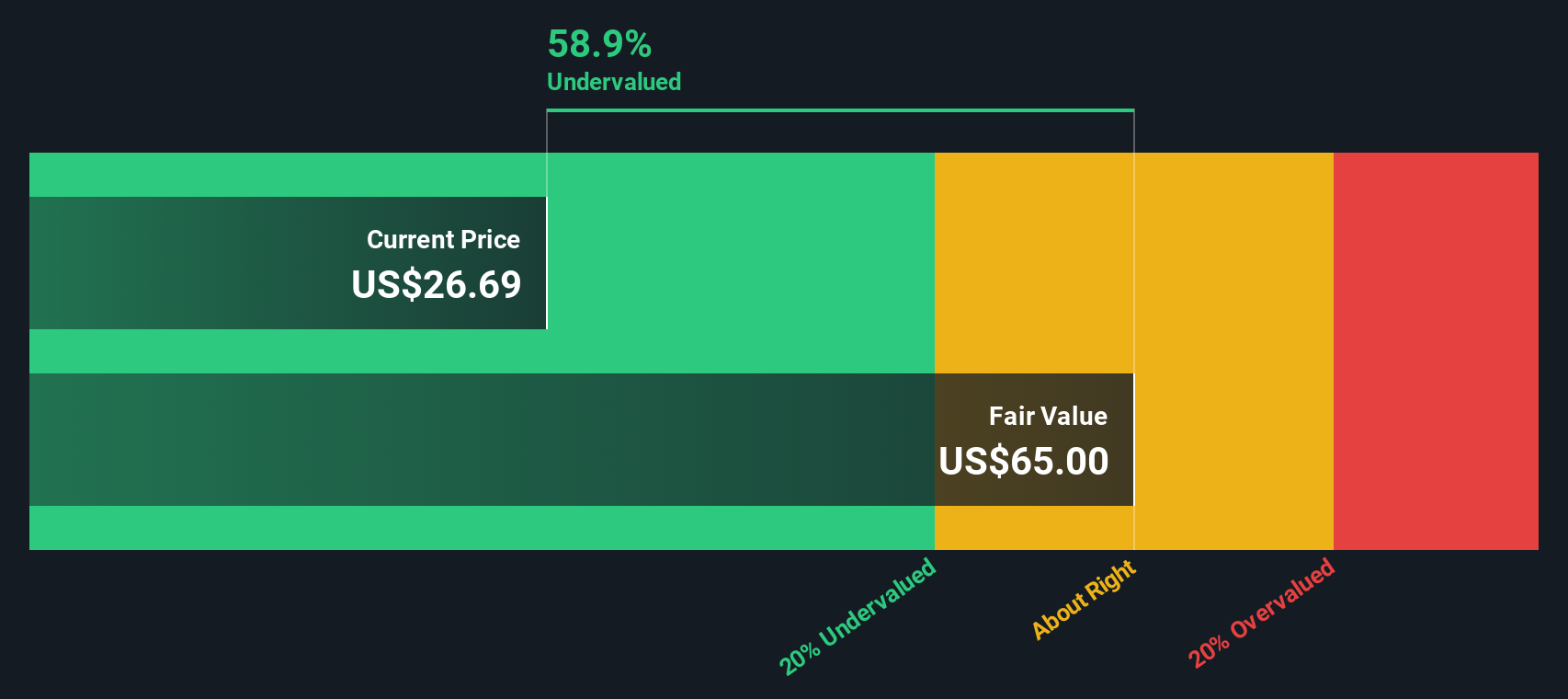

When all those projected cash flows are discounted back to today using a 2 Stage Free Cash Flow to Equity model, the intrinsic value for Keurig Dr Pepper comes out at roughly $59.17 per share. Compared with the current market price, this implies the stock is about 52.7% undervalued. This indicates that investors are paying significantly less than what the underlying cash flows appear to justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Keurig Dr Pepper is undervalued by 52.7%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Keurig Dr Pepper Price vs Earnings

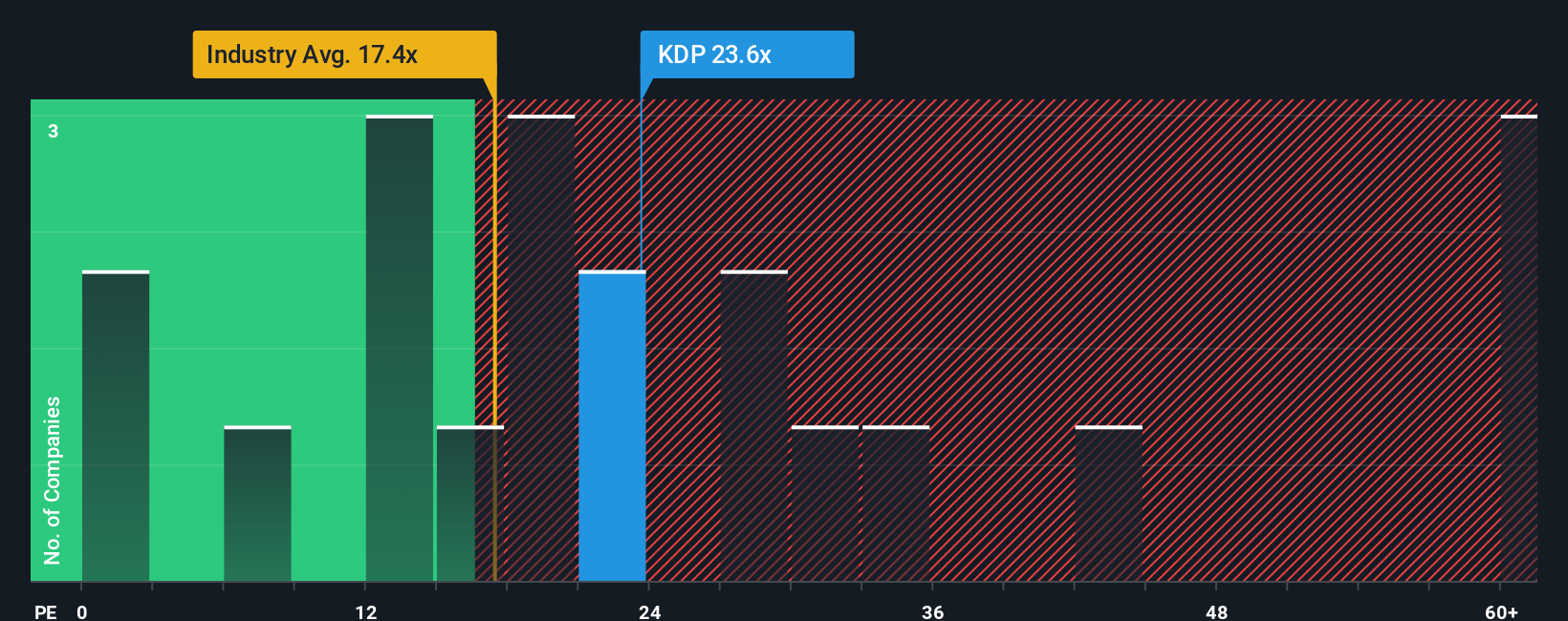

For profitable companies like Keurig Dr Pepper, the Price to Earnings ratio is a practical way to judge whether the stock price makes sense relative to the profits it generates each year. In broad terms, faster growth and lower perceived risk can justify a higher normal or fair PE, while slower growth or higher uncertainty usually call for a lower one.

Keurig Dr Pepper currently trades at about 24.0x earnings, which is above the Beverage industry average of roughly 17.5x but below the peer group average of around 27.3x. Simply Wall St also calculates a Fair Ratio of about 27.8x, which is the PE level that would be reasonable given the company’s earnings growth profile, margins, industry positioning, market cap and risk characteristics. This Fair Ratio is more tailored than a simple comparison with peers or the sector, because it adjusts for the specific strengths and weaknesses of Keurig Dr Pepper rather than assuming all beverage companies deserve the same multiple. With the shares trading meaningfully below this Fair Ratio, the PE perspective suggests the stock may be undervalued rather than expensive.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Keurig Dr Pepper Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your own story about a company, tied directly to your assumptions about its future revenue, earnings, margins and fair value.

On Simply Wall St, Narratives live in the Community page and make it easy for you to connect the dots from a company’s story, to a financial forecast, and then to a clear estimate of fair value that you can compare to today’s share price.

Because Narratives are updated dynamically as new information, such as earnings results, M and A news or analyst revisions comes in, they become a live tool that helps you consider whether Keurig Dr Pepper looks like a buy, a hold or a sell as the facts change.

For example, one Narrative on Keurig Dr Pepper might lean bullish and align with a higher fair value around $42.00 based on successful JDE Peet integration, tariff relief and sustained earnings growth. Another might be more cautious and anchor closer to $30.00 if you think coffee headwinds, deal risk and slower consumer demand will weigh on the business. Comparing these perspectives against the current price can help you decide which story you find more convincing and how that might influence your investment approach.

Do you think there's more to the story for Keurig Dr Pepper? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报