BlackBerry (TSX:BB) Valuation Check After Recent Share Price Weakness

BlackBerry (TSX:BB) has slipped about 7% over the past week and roughly 16% in the past 3 months, and that drift lower has value focused investors rechecking the story.

See our latest analysis for BlackBerry.

At around CA$5.46, BlackBerry’s recent slide adds to a choppy year in which short term share price returns have softened, even as the three year total shareholder return remains solidly positive. This suggests momentum has cooled while the longer term story is still intact.

If BlackBerry’s mixed momentum has you reassessing your tech exposure, it could be a good moment to explore other high growth tech and AI stocks that might offer cleaner growth trends.

So with shares drifting, earnings improving, and the stock trading near analysts’ targets but at a modest intrinsic discount, is BlackBerry quietly undervalued today, or is the market already baking in most of its future growth?

Price to earnings of 111.7x: Is it justified?

BlackBerry trades at CA$5.46, but its triple digit price to earnings ratio indicates the market is paying a steep premium for current profits.

The price to earnings multiple compares the share price to per share earnings, giving a quick sense of how much investors are willing to pay for each dollar of profit in a software focused business like BlackBerry.

In this case, a 111.7x price to earnings ratio suggests expectations for strong earnings growth ahead, yet it also signals that the market may be overpricing near term profitability relative to what the company currently delivers.

That tension becomes clearer when you compare BlackBerry with its peers. The Canadian Software industry trades around 49.3x earnings, and the estimated fair ratio for the company itself is closer to 36.1x. This implies the present valuation sits well above both the sector norm and the level our models suggest the market could eventually gravitate toward.

Explore the SWS fair ratio for BlackBerry

Result: Price-to-earnings of 111.7x (OVERVALUED)

However, risks remain, including a premium valuation that is vulnerable to earnings disappointments and ongoing competition across cybersecurity and automotive software that could slow growth.

Find out about the key risks to this BlackBerry narrative.

Another View on Value

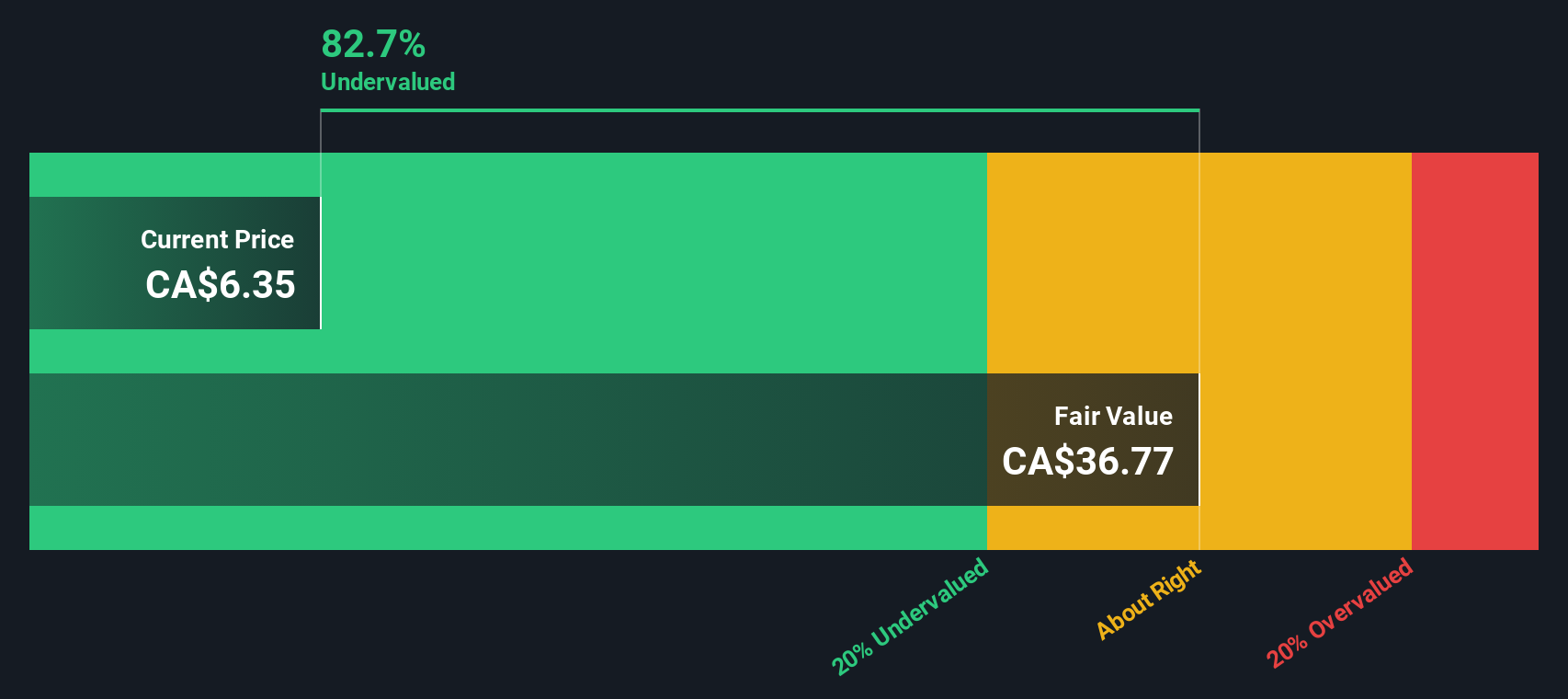

Our DCF model paints a different picture, suggesting BlackBerry is trading about 11.2% below its fair value, at roughly CA$5.46 versus an estimated CA$6.15. If earnings grow as forecast, is this a premium story that has quietly slipped into value territory?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BlackBerry for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BlackBerry Narrative

If this perspective does not quite match your own, or you prefer digging into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your BlackBerry research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next round of opportunities by using the Simply Wall St Screener to uncover focused ideas tailored to your strategy.

- Generate powerful upside potential by targeting these 903 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Capture cutting edge innovation by zeroing in on these 24 AI penny stocks shaping the future with real world AI applications.

- Strengthen your income stream by focusing on these 10 dividend stocks with yields > 3% that can support long term returns through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报