Evaluating Fifth Third (FITB) After a 14% Monthly Rally: Is the Bank Still Undervalued?

Fifth Third Bancorp (FITB) has quietly put together a strong run, with the stock up about 14% over the past month and 16% in the past year, outpacing many regional bank peers.

See our latest analysis for Fifth Third Bancorp.

That 13.91% 1 month share price return, alongside a 16.15% 1 year total shareholder return, suggests momentum is building as investors warm to Fifth Third’s growth profile and risk outlook at around $48.22 per share.

If strong regional bank performance has your attention, this could be a good moment to explore solid balance sheet and fundamentals stocks screener (None results) as potential next candidates for your watchlist.

With earnings growing faster than revenue and the shares still trading at a notable discount to some value estimates, investors face a key question: Is Fifth Third genuinely undervalued today, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 6.3% Undervalued

With Fifth Third shares at $48.22 versus a narrative fair value of about $51.50, the spread points to modest upside if the growth story delivers.

Several research updates highlight projected peer leading profitability metrics, including return on assets above 1.5 percent and return on tangible common equity above 20 percent once synergies are realized, supporting higher valuation multiples.

Curious how a regional bank earns premium style multiples? The narrative leans on ambitious revenue expansion, resilient margins, and a punchy profit trajectory. Want the full playbook behind that valuation call?

Result: Fair Value of $51.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be knocked off course if the Comerica integration stumbles or commercial loan demand stays weaker for longer than analysts expect.

Find out about the key risks to this Fifth Third Bancorp narrative.

Another View: Market Ratios Tell A Different Story

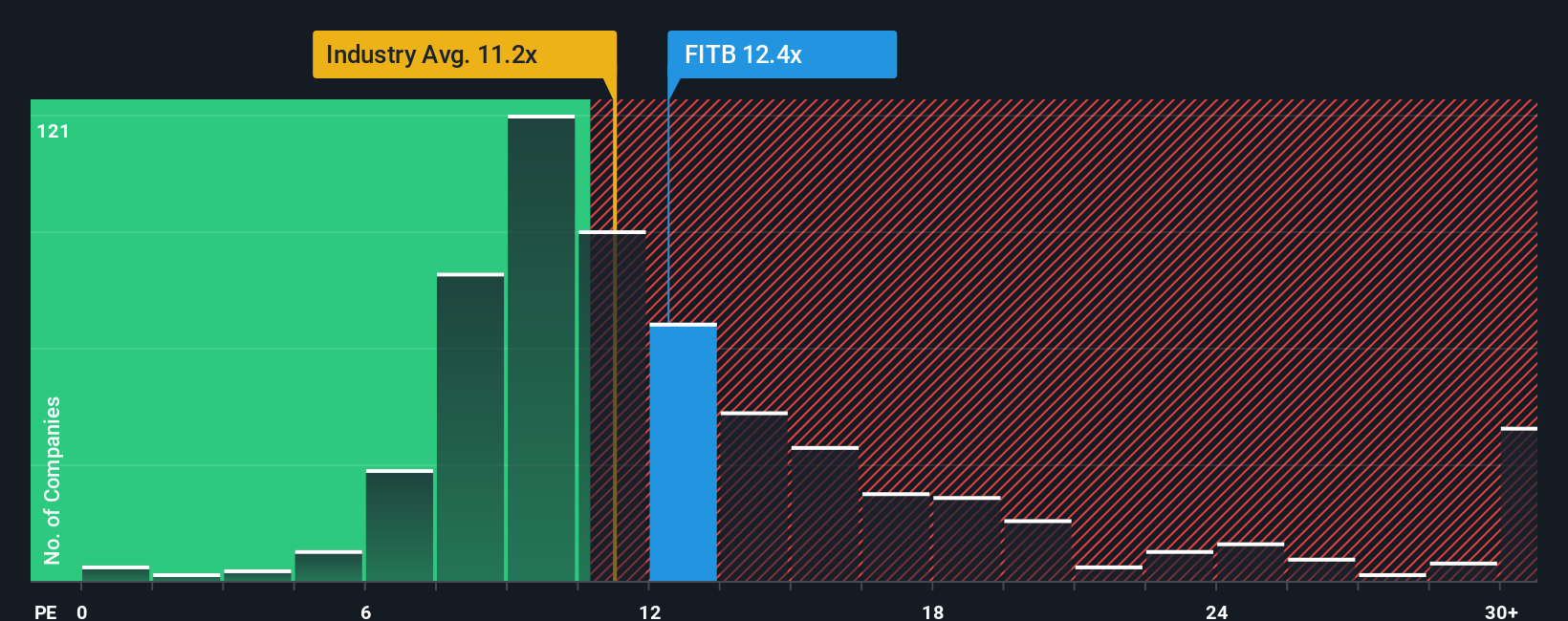

Step away from narratives and our SWS fair ratio, and the market looks less generous. FITB trades on a 14.1x price to earnings multiple, above the US banks average of 11.9x, yet below its 19.5x fair ratio. This leaves investors to decide if this is cushion or complacency.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fifth Third Bancorp Narrative

If you see things differently or want to dig into the numbers yourself, you can shape a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Fifth Third Bancorp.

Looking for more investment ideas?

Do not stop at one opportunity. Put Simply Wall Street to work and uncover focused stock ideas tailored to your strategy before the market moves first.

- Capture potential multi-baggers early by scanning these 3626 penny stocks with strong financials where improving fundamentals can quickly re rate tiny businesses.

- Position your portfolio at the heart of the automation boom by targeting these 29 healthcare AI stocks shaping the next generation of medical breakthroughs.

- Turn volatility into a tool, not a threat, by filtering these 80 cryptocurrency and blockchain stocks that are actually building durable blockchain businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报