Seadrill (SDRL) Is Up 7.9% After New Gulf and Angola Contracts Extend Rig Visibility – Has The Bull Case Changed?

- In December 2025, Seadrill Limited announced new contract awards for the West Neptune and Sevan Louisiana in the U.S. Gulf and a five-well option exercise extending the Sonangol Quenguela’s operations in Angola to February 2027, adding about US$48 million to backlog from the West Neptune alone.

- The maiden deployment of Trendsetter well-intervention equipment on the Sevan Louisiana and the multi-well extension in Angola highlight both technological progress and longer-term rig visibility for Seadrill.

- We’ll now examine how these fresh contract awards, especially the extended Sonangol Quenguela program, may influence Seadrill’s broader investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Seadrill Investment Narrative Recap

To own Seadrill, you need to believe that tight high spec offshore rig supply will eventually translate into stronger day rates and cash flows, despite current margin pressure and legal overhangs. The latest Gulf of Mexico and Angola awards modestly ease near term utilization and backlog worries, but they do not remove the key risks around softer day rates through 2026 or the potential for further legal and regulatory setbacks.

The ten month extension of the Sonangol Quenguela in Angola is the most relevant piece of this update, because it directly addresses the risk of political and administrative delays leaving rigs idle in that region. Locking in work through February 2027 improves visibility on one of Seadrill’s critical deepwater assets and slightly strengthens the case that the company can bridge the softer part of the cycle while waiting for the expected pickup in offshore FIDs and higher spec day rates.

Yet investors also need to consider how unresolved legal exposures and delayed approvals could still affect cash flows and balance sheet flexibility...

Read the full narrative on Seadrill (it's free!)

Seadrill's narrative projects $1.6 billion revenue and $231.6 million earnings by 2028. This requires 7.2% yearly revenue growth and about a $154.6 million earnings increase from $77.0 million today.

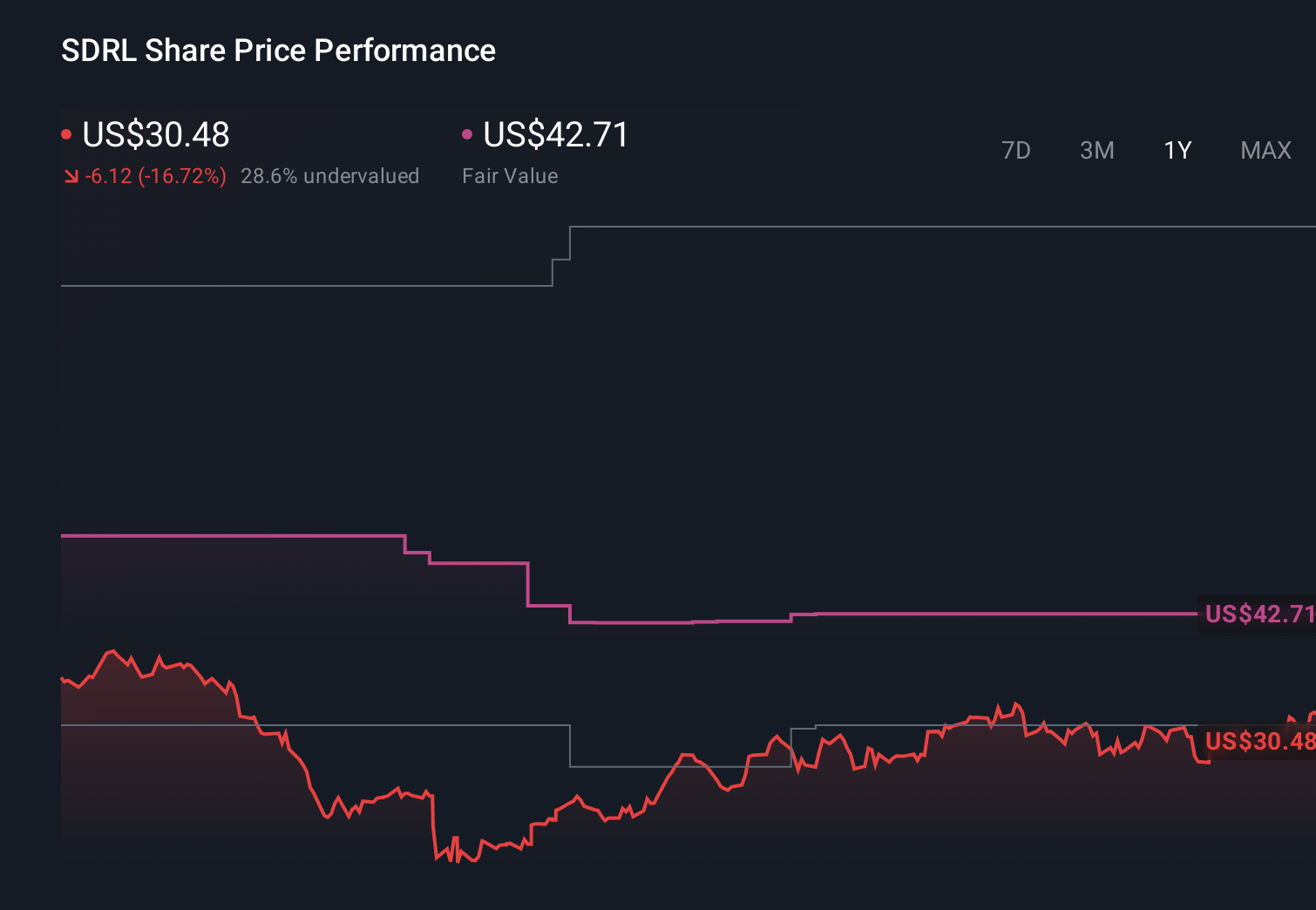

Uncover how Seadrill's forecasts yield a $43.50 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently estimate Seadrill’s fair value between US$41.86 and US$478.65, underlining how far opinions can diverge. Set against this wide spread, the tension between improving deepwater contract visibility and ongoing legal and regulatory risks gives you a lot to weigh up when thinking about the company’s future performance.

Explore 5 other fair value estimates on Seadrill - why the stock might be a potential multi-bagger!

Build Your Own Seadrill Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seadrill research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Seadrill research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seadrill's overall financial health at a glance.

No Opportunity In Seadrill?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报