FTI Consulting (FCN): Reassessing Valuation After a Quiet 3‑Month Share Price Rebound

FTI Consulting (FCN) has quietly outperformed the market over the past 3 months, gaining about 10% even as its year to date return is still negative. That combination makes the current setup interesting.

See our latest analysis for FTI Consulting.

The recent 1 month share price return of about 8 percent and 3 month share price return near 10 percent, against a weaker year to date share price return and slightly negative 1 year total shareholder return, suggests momentum is rebuilding as investors warm back up to FTI Consulting’s growth and risk profile.

If FCN’s rebound has you thinking about what else might be quietly gaining traction, now is a good moment to explore fast growing stocks with high insider ownership.

With earnings still growing at a healthy clip but the share price lagging over the past year, the real question now is whether FTI Consulting is quietly undervalued or if the market already sees the next leg of growth coming.

Most Popular Narrative: 5.9% Overvalued

With FTI Consulting last closing at $175.85 against a narrative fair value of $166.00, the story tilts toward a modestly rich valuation that still assumes solid execution ahead.

The analysts have a consensus price target of $185.0 for FTI Consulting based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.3 billion, earnings will come to $358.3 million, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 7.2%.

Curious how steady revenue expansion, margin uplift, and a lower future earnings multiple still point to upside from here? The narrative unpacks a tight, numbers driven path that might surprise you.

Result: Fair Value of $166 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster than expected adoption of AI tools or a slowdown in restructuring and litigation demand could quickly undermine the current growth narrative.

Find out about the key risks to this FTI Consulting narrative.

Another Angle on Valuation

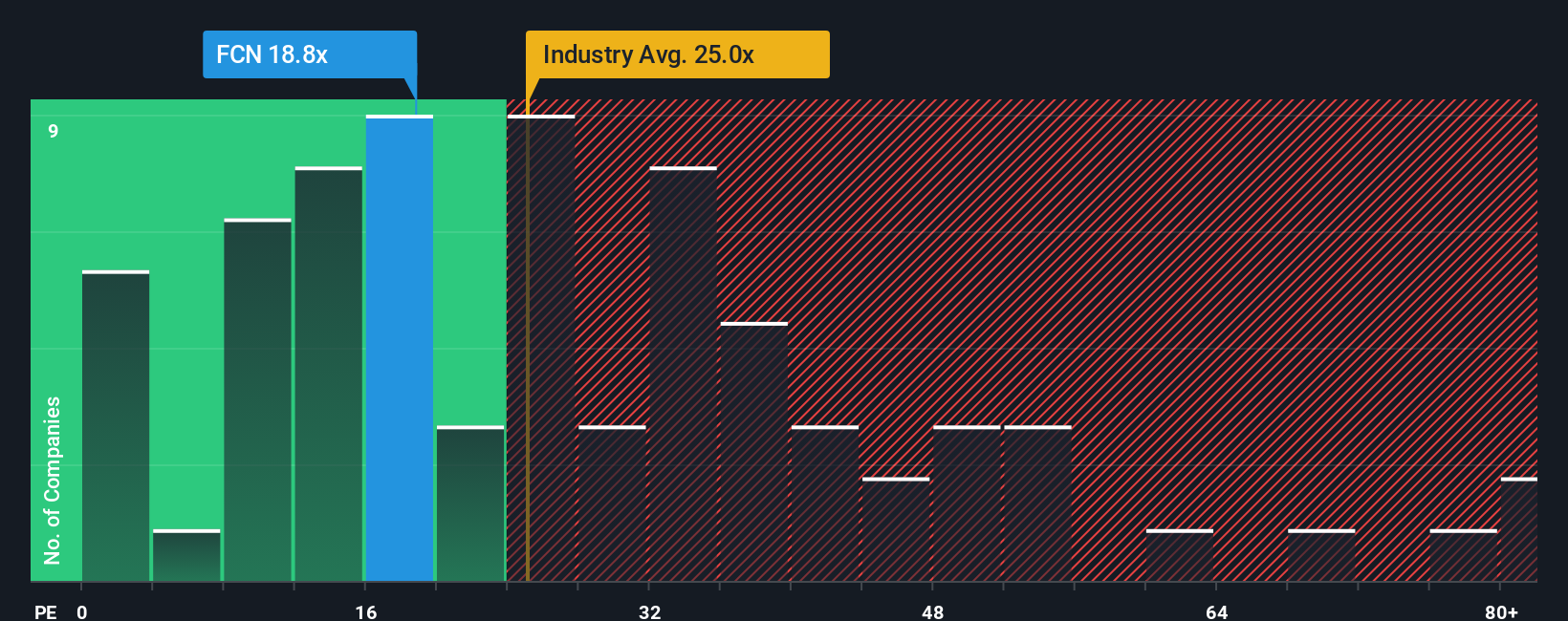

On earnings, FCN looks cheap rather than rich. It trades on about 20 times earnings versus 21.7 times for peers, while our fair ratio points nearer 24 times. That gap hints at upside if sentiment normalizes, but also raises the question of whether earnings can keep justifying a catch up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FTI Consulting Narrative

If this perspective does not quite fit your view or you would rather dig into the numbers yourself, you can build a fresh narrative in under three minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

Ready for your next investing edge?

Do not stop at one opportunity. Use the Simply Wall Street Screener to find more stocks that match your strategy before the market catches on.

- Capture potential mispricings early by scanning these 901 undervalued stocks based on cash flows that could offer stronger upside than widely followed names like FTI Consulting.

- Ride powerful secular trends by targeting these 24 AI penny stocks positioned at the heart of automation, data intelligence, and next generation software.

- Lock in dependable cash flow potential by focusing on these 10 dividend stocks with yields > 3% that may strengthen portfolio income and smooth out market volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报