Inspire Medical Systems (INSP): Reassessing Valuation After Inspire V Lawsuits and Guidance Cut

Inspire Medical Systems (INSP) is back in the spotlight after a wave of securities class actions accused the company of downplaying serious launch problems with its Inspire V sleep apnea device.

See our latest analysis for Inspire Medical Systems.

The lawsuits froze sentiment just as the business was showing double digit revenue and profit growth. The stock reflects that shift in risk perception, with a 30 day share price return of minus 18.45 percent, a year to date share price return of minus 49.44 percent, and a five year total shareholder return of minus 49.51 percent. This suggests that long term holders have endured a deep drawdown even after a 90 day share price rebound of 23.71 percent, so momentum still looks fragile rather than firmly rebuilt.

If this legal overhang has you thinking more broadly about healthcare opportunities, you might want to explore other names using our curated healthcare stocks.

With shares down nearly 50 percent this year but still growing revenue and profits, investors face a simple question: Is Inspire now trading at a meaningful discount, or is the market correctly pricing in the risks to future growth?

Most Popular Narrative: 31.7% Undervalued

With Inspire Medical Systems last closing at $95.65 versus a narrative fair value of about $140, the story hinges on whether elevated reimbursement can genuinely transform long term earnings power.

The analysts have a consensus price target of $144.533 for Inspire Medical Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $230.0, and the most bearish reporting a price target of just $97.0.

Curious how double digit growth, richer reimbursement, and a premium future earnings multiple can still add up to upside from here? The most followed narrative spells out a precise path for revenue, margins, and valuation that might surprise you.

Result: Fair Value of $140.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering concerns around Inspire V rollout execution and potential GLP 1 driven shifts in sleep apnea treatment could still derail that optimistic trajectory.

Find out about the key risks to this Inspire Medical Systems narrative.

Another Lens on Valuation

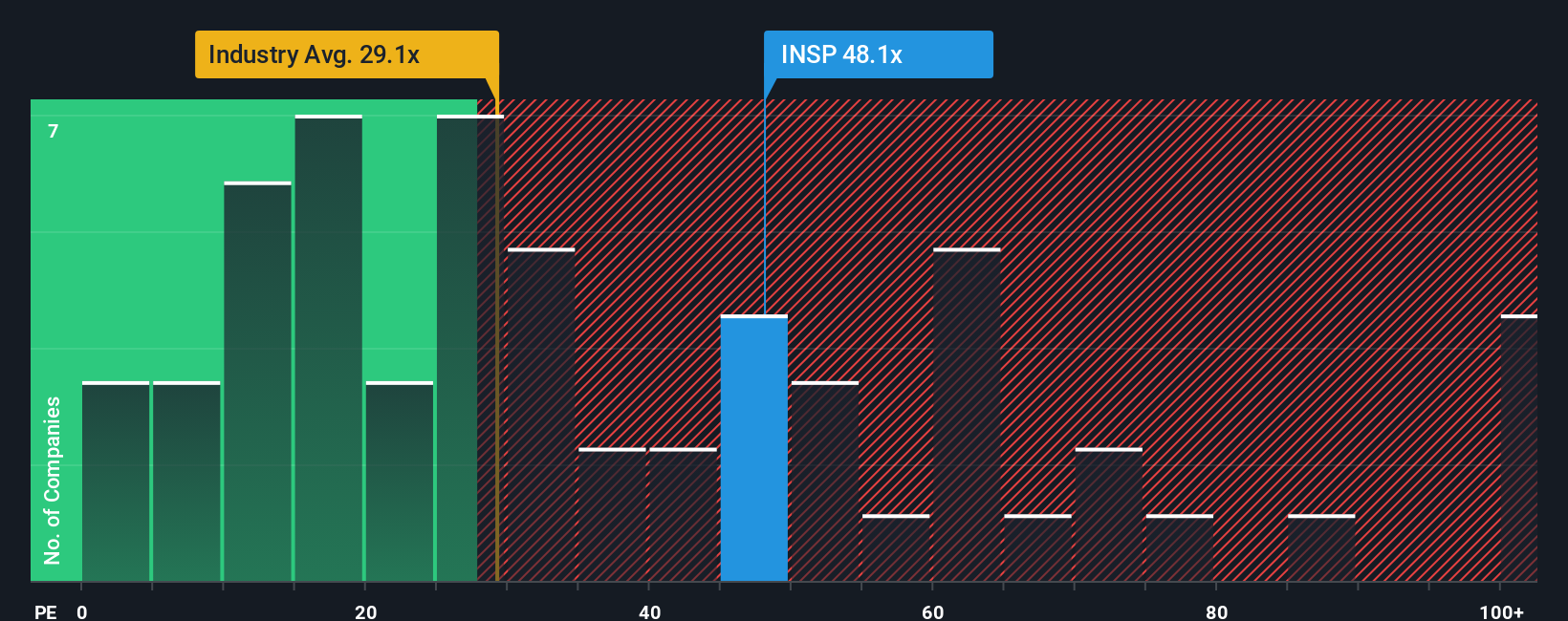

Step away from the narrative fair value, and the price to earnings picture looks stark. INSP trades on 62.4 times earnings, more than double the US Medical Equipment industry at 29.6 times and well above its 31.3 times fair ratio. This raises the risk of a painful de rating if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Inspire Medical Systems Narrative

If you see the situation differently or prefer to dig into the numbers yourself, you can build a personalized view in just minutes with Do it your way.

A great starting point for your Inspire Medical Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more actionable investment ideas?

Before you move on, lock in your next set of opportunities with targeted screens across value, income, and innovation, so your watchlist never falls behind the market.

- Capture potential bargains by zeroing in on these 901 undervalued stocks based on cash flows where strong cash flows may not yet be fully reflected in share prices.

- Boost your income strategy by focusing on these 10 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

- Position for the next wave of innovation by targeting these 24 AI penny stocks poised to benefit from accelerating demand for intelligent automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报