Is Jabil (JBL) Still Undervalued After Its Recent Strong Share Price Performance?

Jabil (JBL) has been quietly rewarding patient shareholders, with the stock up about 19% over the past month and nearly 12% in the past 3 months, well ahead of broader benchmarks.

See our latest analysis for Jabil.

Zooming out, that recent strength builds on a powerful backdrop, with a roughly 64 percent year to date share price return and a five year total shareholder return above 460 percent suggesting momentum is still very much intact.

If Jabil has you rethinking what consistent execution can do for returns, it could be worth discovering high growth tech and AI stocks next for more ideas riding similar digital tailwinds.

With shares hovering near record highs yet still trading at a discount to analyst targets and some intrinsic value models, the real debate is whether Jabil remains a buyable compounder or if markets are already pricing in years of growth.

Most Popular Narrative Narrative: 10% Undervalued

With Jabil last closing at 234.49 dollars versus a narrative fair value of 259.25 dollars, the valuation debate hinges on how durable its growth drivers really are.

Strong demand in AI related markets, with expected revenue growth of 40 percent year on year, indicates significant potential to drive future revenue and improve operating margins through an expanded share of high growth technology sectors.

Want to see what kind of revenue trajectory and margin expansion have to line up for that upside case to work? The narrative spells it out, step by step.

Result: Fair Value of $259.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer demand in renewable and EV markets, alongside lingering inventory and tariff uncertainties, could easily cap upside if those pressures persist.

Find out about the key risks to this Jabil narrative.

Another Angle on Valuation

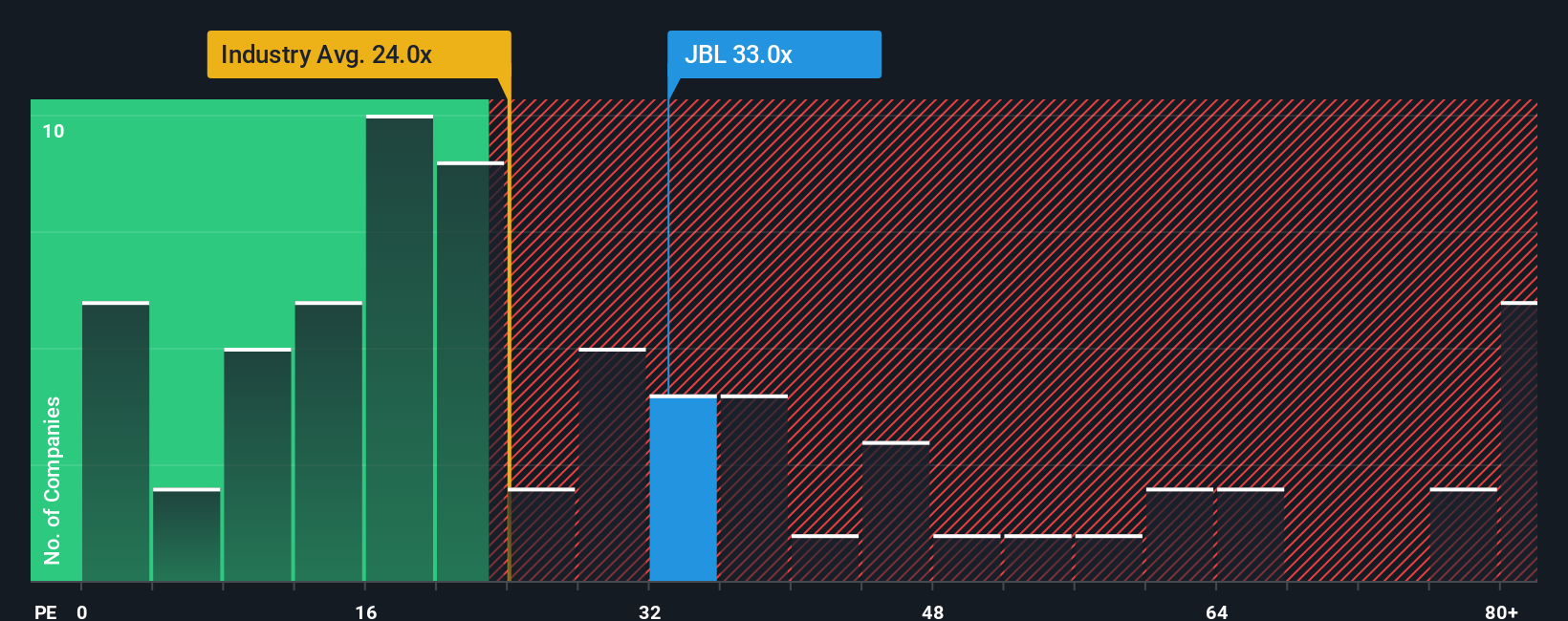

Our fair value estimate suggests Jabil trades about 33 percent below where it could be. However, its 35.6 times earnings multiple sits above the US Electronic industry at 24.9 times and even above its own 31.2 times fair ratio. Is the premium a reward for quality or a warning on downside risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jabil Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom view of Jabil in just minutes: Do it your way.

A great starting point for your Jabil research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with Jabil. Lock in your edge by running the Simply Wall Street Screener now and spot tomorrow's winners before the crowd notices.

- Seize potential mispricings by scanning these 901 undervalued stocks based on cash flows that the market may be overlooking today but rewarding richly tomorrow.

- Ride structural growth by targeting these 24 AI penny stocks positioned at the heart of accelerating demand for intelligent automation and data driven products.

- Strengthen your income stream with these 10 dividend stocks with yields > 3% that combine attractive yields with the fundamentals to sustain payouts across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报