What Carvana (CVNA)'s S&P 500 Debut and Sports Push Means For Shareholders

- Carvana Co. (NYSE:CVNA) recently joined the S&P 500 and S&P Global 1200, while exiting a Russell small-cap growth index, after reporting record third-quarter 2025 unit and revenue growth.

- Alongside its index promotion, Carvana is amplifying brand reach through new sports partnerships, including NASCAR paint schemes and title sponsorship of a major pickleball tournament in early 2026.

- We’ll now examine how Carvana’s elevation into the S&P 500 reshapes its investment narrative and longer-term growth assumptions.

Find companies with promising cash flow potential yet trading below their fair value.

Carvana Investment Narrative Recap

To own Carvana, you generally need to believe its online model can keep scaling profitably while heavy logistics and reconditioning investments do not erode margins. The most important near term catalyst is continued execution on unit growth and profitability; the biggest current risk is that high expectations and valuation leave little room for operational or market setbacks. The S&P 500 inclusion does not materially change these fundamentals, though it may influence trading in the short term.

The most relevant recent announcement here is Carvana’s S&P 500 and S&P Global 1200 inclusion, which can increase visibility and institutional ownership just as the company is reporting record Q3 2025 unit and revenue growth. That pairing tightens the focus on whether Carvana can sustain its growth targets without running into bottlenecks in reconditioning capacity and logistics, a key test for the bullish case around its long term margin potential.

However, investors should also be aware that if reconditioning and logistics capacity fail to keep pace with Carvana’s unit growth ambitions, then...

Read the full narrative on Carvana (it's free!)

Carvana's narrative projects $33.2 billion revenue and $2.2 billion earnings by 2028.

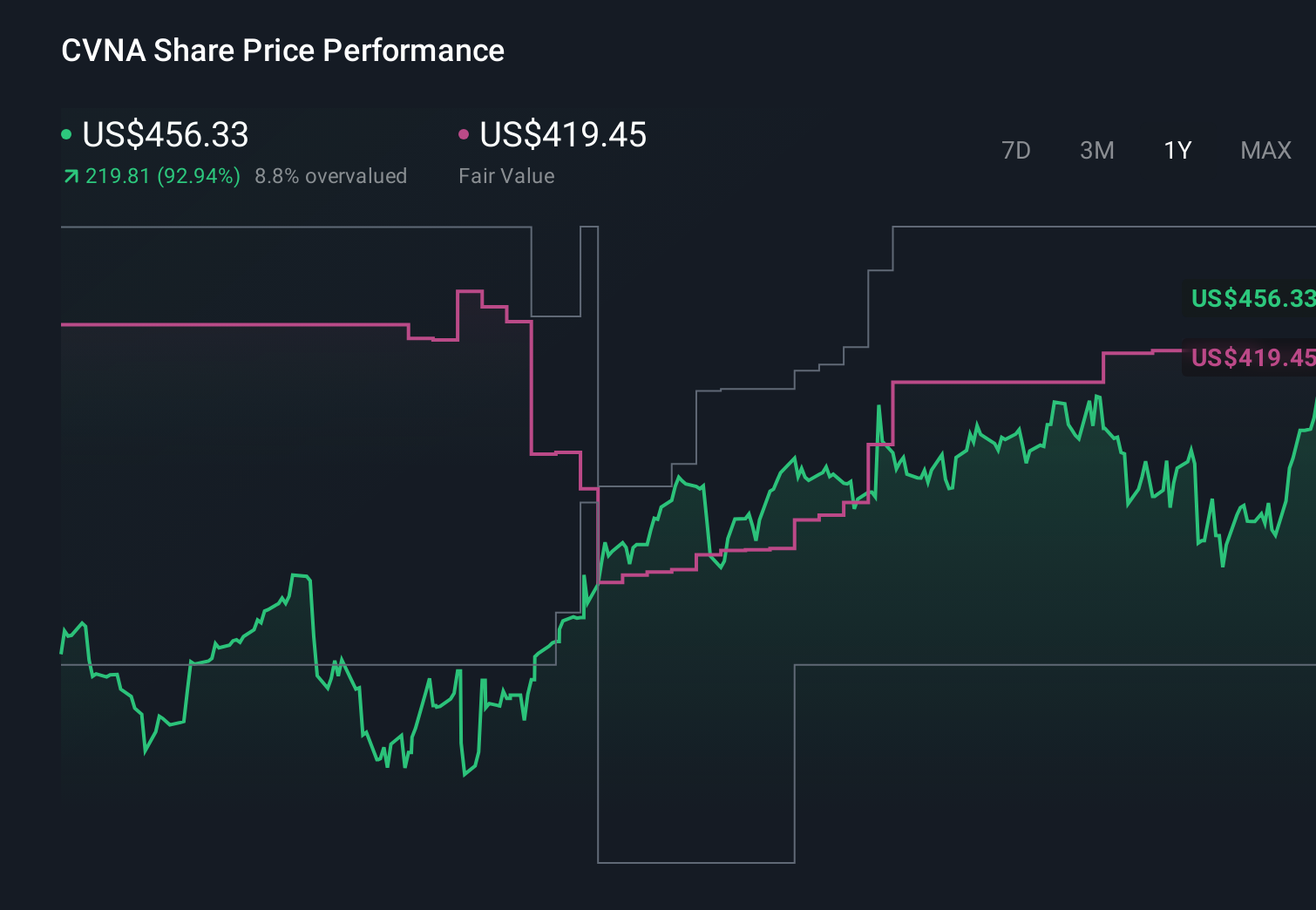

Uncover how Carvana's forecasts yield a $419.45 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Eighteen fair value estimates from the Simply Wall St Community span roughly US$60 to over US$532 per share, showing wide dispersion in investor expectations. When you set that against the ambitious unit growth targets and execution risk highlighted above, it underlines how important it is to weigh several contrasting viewpoints before forming your own view on Carvana’s prospects.

Explore 18 other fair value estimates on Carvana - why the stock might be worth as much as 21% more than the current price!

Build Your Own Carvana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carvana research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Carvana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carvana's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报