Unity Software (U): Valuation Check After Insider Selling and AI‑Driven Growth Push

Unity Software (U) has come under the spotlight after recent insider stock sales, raising questions about management confidence just as the company leans on strong margins, solid liquidity, and AI driven 3D tools for future growth.

See our latest analysis for Unity Software.

Despite the insider sales, Unity’s recent price action has been resilient. An 85 percent year-to-date share price return and a near doubling of 1-year total shareholder return suggest momentum is still building as investors reassess its long-term AI and 3D growth story.

If Unity’s recent run has you rethinking the software and AI space, it could be a good time to scout other high-growth tech names using high growth tech and AI stocks.

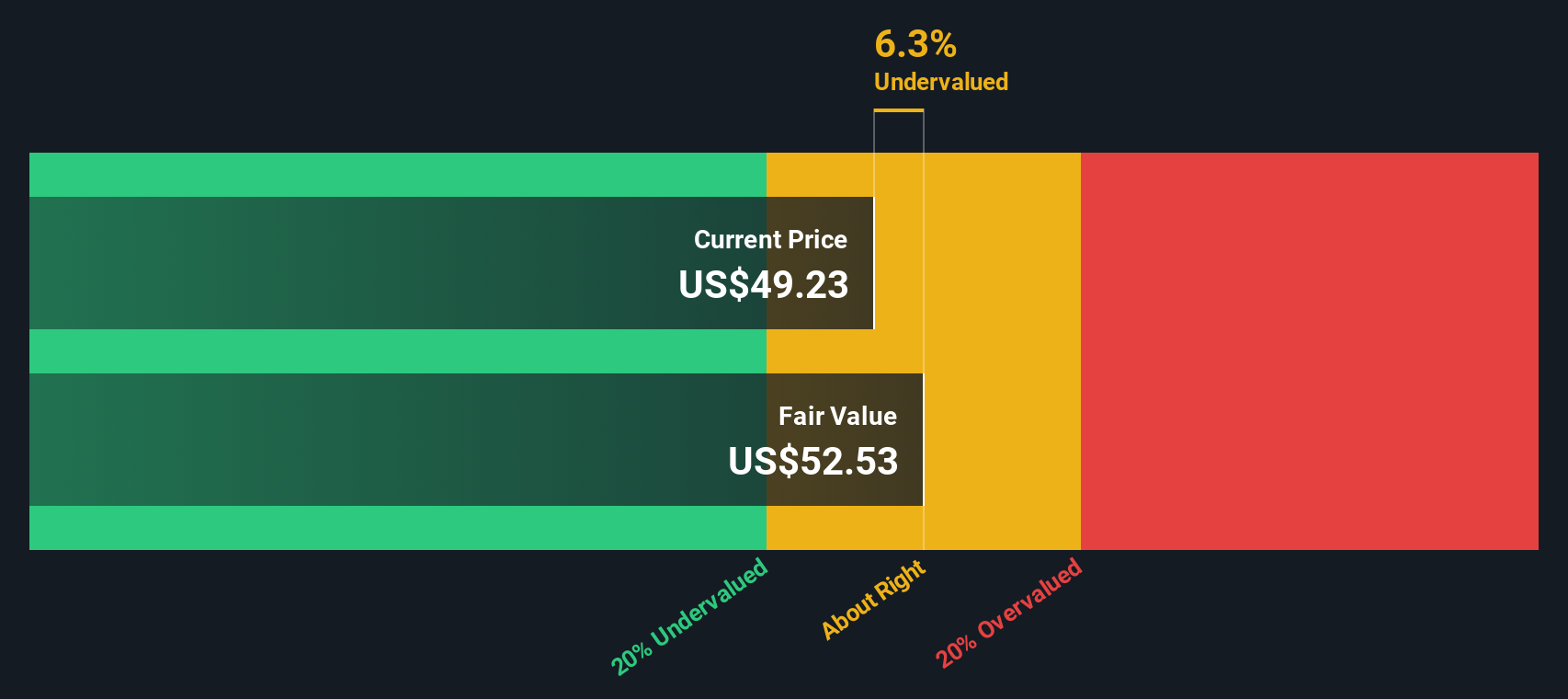

With shares up sharply this year and trading only slightly below Wall Street targets, yet still showing a double digit intrinsic discount, the key question is clear: Is Unity undervalued today, or is the market already pricing in its future growth?

Most Popular Narrative: 18.1% Overvalued

According to andreas_eliades, the narrative fair value of Unity Software sits below the last close, framing the recent rally as ahead of fundamentals.

With analysts predicting no real growth until 2028 Unity holds a significant upside if it executes its strategy successfully.

Curious how flat near term growth turns into a premium valuation story. The narrative leans on future margins and a rich profit multiple. Want the full playbook.

Result: Fair Value of $38.48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition in gaming ads and any stumble executing its restructuring could compress margins and undercut the long dated growth and valuation case.

Find out about the key risks to this Unity Software narrative.

Another View, DCF Signals Upside

While the popular narrative leans on a rich profit multiple and calls Unity 18.1 percent overvalued at $38.48, our DCF model paints a different picture. It pegs fair value closer to $52.53, implying the current $45.44 price still holds upside. Which story wins out: sentiment or cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Unity Software Narrative

If this perspective does not fully match your own, or you would rather dig into the numbers yourself, you can build a customized view in just a few minutes, Do it your way.

A great starting point for your Unity Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at Unity. Sharpen your edge by scanning fresh stock ideas through Simply Wall Street’s powerful screener before the next wave of opportunities moves without you.

- Capture potential multi baggers early by focusing on these 3629 penny stocks with strong financials that already back their promise with solid financial strength.

- Position yourself at the heart of digital disruption by targeting these 24 AI penny stocks pushing real world breakthroughs in automation and intelligent software.

- Lock in stronger income streams by filtering for these 10 dividend stocks with yields > 3% that can support attractive payouts without stretching their balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报