Helios Technologies (HLIO): Assessing Whether Recent Share Price Momentum Still Leaves the Stock Undervalued

Helios Technologies (HLIO) has quietly delivered a solid run lately, with shares up around 5% over the past month and more than 20% over the past year, outpacing many industrial peers.

See our latest analysis for Helios Technologies.

At around $55.42 per share, Helios’s steady 30 day share price return of roughly 4.7 percent and 1 year total shareholder return of about 21.8 percent suggest momentum is gradually building as investors warm to its earnings trajectory.

If Helios has you thinking about what else is gaining traction in industrial adjacent names, it could be worth exploring fast growing stocks with high insider ownership as your next hunting ground.

With shares still trading at a discount to both analysts’ targets and some intrinsic value estimates despite strong profit growth, the key question is whether Helios is a mispriced compounder or if the market is already baking in future gains.

Most Popular Narrative: 15% Undervalued

With the narrative fair value sitting well above the last close of $55.42, the storyline leans on Helios turning operational progress into durable earnings power.

The shift in the industry towards electrification of mobile and industrial equipment is driving OEM demand for sophisticated electro-hydraulic and electronic control solutions, areas where Helios is actively innovating (e.g., Enovation Controls, Cygnus Reach), supporting both top line growth and margin expansion over the medium to long term.

Want to see what kind of revenue glide path and profit margin reset are being penciled in here, and why the projected earnings multiple looks more like a growth stock than a traditional machinery name, even as discount rates stay grounded in today’s macro reality, not yesterday’s?

Result: Fair Value of $65.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could unravel if cyclically sensitive end markets soften again or if Helios struggles to keep pace with faster moving digital competitors.

Find out about the key risks to this Helios Technologies narrative.

Another Angle on Valuation

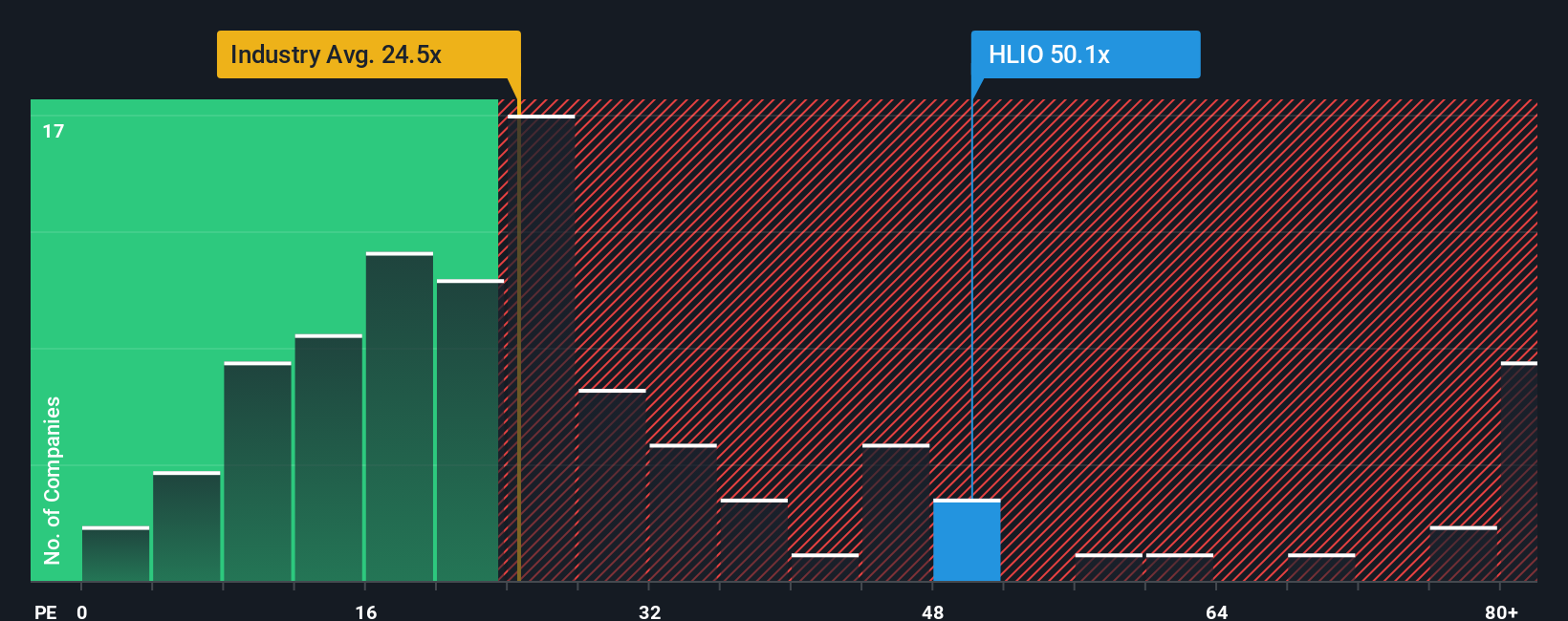

On simple earnings multiples, Helios looks stretched, trading on about 54.5 times earnings versus 25.5 times for the US Machinery industry and 36.6 times for peers, and even above a 47.2 times fair ratio. This suggests there may be less margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Helios Technologies Narrative

If you are not fully aligned with this view or would rather dig into the numbers yourself, you can build a personalized take in minutes: Do it your way.

A great starting point for your Helios Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with Helios. Use the Simply Wall Street Screener to uncover focused opportunities that match your style before the market fully catches on.

- Explore mispriced quality by targeting companies flagged as undervalued through future cash flows using these 902 undervalued stocks based on cash flows before expectations reset.

- Explore structural trends in medicine and diagnostics by focusing on innovators at the intersection of biotech and automation with these 29 healthcare AI stocks.

- Review potential income streams by scanning for reliable payouts and stronger yield support via these 10 dividend stocks with yields > 3% while prices still look reasonable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报