Assessing Castle Biosciences (CSTL) Valuation After New Uveal Melanoma Data and Renewed Analyst Optimism

Castle Biosciences (CSTL) is back in focus after new multicenter clinical data on its DecisionDx-UM test for uveal melanoma landed in Nature Communications, reinforcing the test’s role in treatment guidelines and long term patient management.

See our latest analysis for Castle Biosciences.

The latest data drop comes as momentum has been rebuilding, with a roughly mid single digit 1 month share price return feeding into a powerful 90 day share price return of about 76 percent. Meanwhile, the 1 year total shareholder return in the mid 40s hints that investors are again warming to Castle’s growth story after a tougher long term ride.

If Castle’s story has you rethinking your healthcare exposure, it might be worth exploring other opportunities across healthcare stocks to see what else fits your strategy.

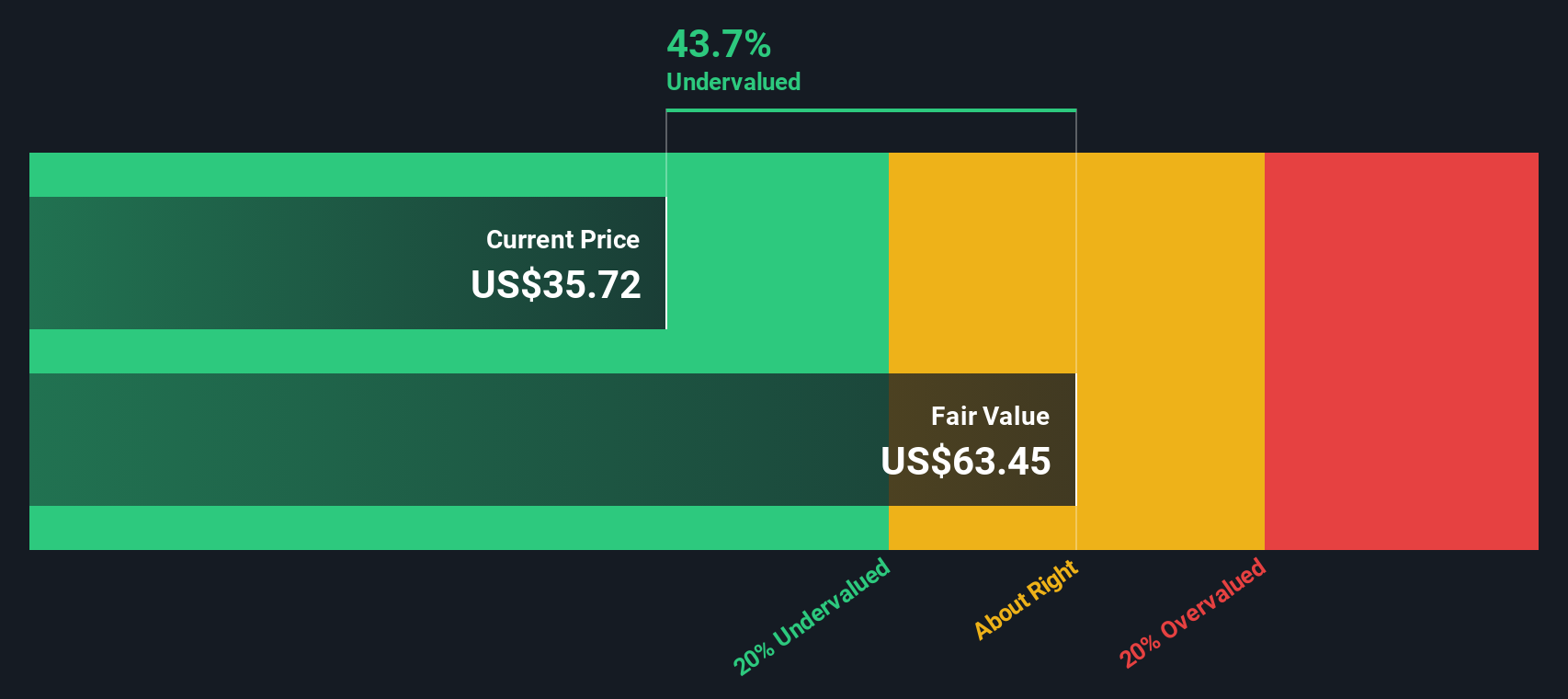

With the shares now hovering just below analysts’ targets, yet still trading at a sizeable discount to some intrinsic value estimates, is Castle Biosciences an underappreciated growth story or has the market already priced in its next leg higher?

Most Popular Narrative Narrative: 3.5% Overvalued

With Castle Biosciences last closing at 40.09 dollars against a narrative fair value of 38.75 dollars, expectations for future growth are doing the heavy lifting here.

The ongoing shift toward precision and individualized medicine across healthcare systems, combined with Castle's robust real-world evidence (e.g. NCI SEER study showing 32% reduction in melanoma mortality), sets the stage for broader clinical adoption and increased commercial and payer demand, likely boosting test volumes and supporting higher revenues.

Curious how modest top line growth, improving margins, and a premium future earnings multiple can still support this price tag. Wonder which assumptions really move that valuation needle.

Result: Fair Value of $38.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering reimbursement uncertainty and intensifying competitive pressure could quickly undermine bullish growth assumptions and compress the premium multiple that investors are paying.

Find out about the key risks to this Castle Biosciences narrative.

Another View: Cash Flows Tell a Different Story

While the narrative fair value suggests Castle is slightly overvalued, our DCF model paints a sharper contrast, indicating the shares trade at a 46 percent discount to an estimated 74.67 dollars per share. Are expectations too cautious, or is the model too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Castle Biosciences for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Castle Biosciences Narrative

If you want to dig into the numbers yourself or challenge these assumptions, you can spin up a fresh narrative in just minutes: Do it your way.

A great starting point for your Castle Biosciences research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next watchlist candidates with hand picked, data driven ideas you will not want to realize you missed later.

- Explore potential mispricings by targeting proven cash generators using these 902 undervalued stocks based on cash flows to help pinpoint businesses the market may be overlooking.

- Consider the next wave of innovation by scanning these 24 AI penny stocks for companies commercializing real world artificial intelligence solutions, not just hype.

- Review your income stream by assessing these 10 dividend stocks with yields > 3%, which is built to highlight consistent payers with yields that may contribute to long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报