Taboola.com And 2 Other Promising Penny Stocks

As the U.S. stock market celebrates new highs with the Dow Jones and S&P 500 setting records, investors are keenly observing various opportunities across different sectors. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.72 | $582.91M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.83 | $661.84M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8702 | $148.8M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.40 | $572.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.33B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.40 | $571.19M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.46 | $360.73M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.905 | $6.57M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.83 | $86.77M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 341 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Taboola.com (TBLA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various countries, including Israel, the United States, and the United Kingdom, with a market cap of approximately $1.25 billion.

Operations: The company generates revenue primarily from its advertising segment, which amounts to $1.88 billion.

Market Cap: $1.25B

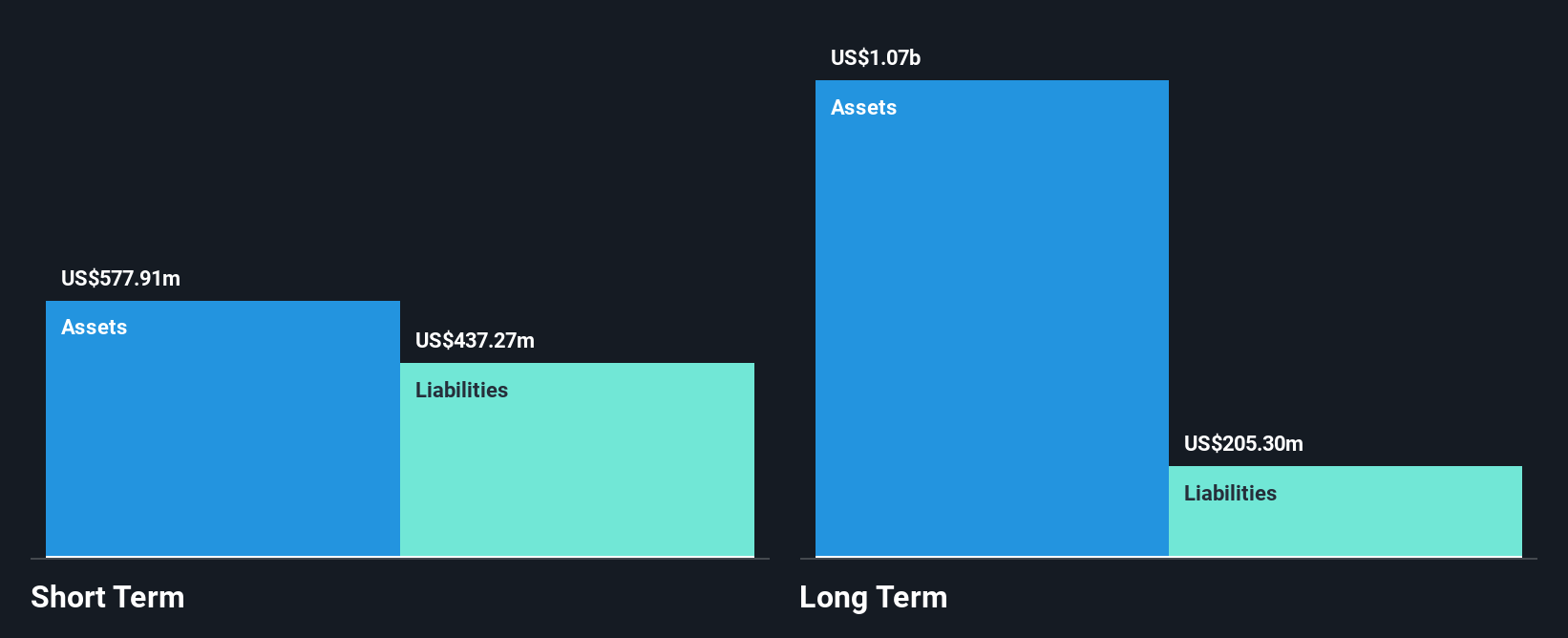

Taboola.com Ltd. has demonstrated robust financial health, with a market cap of US$1.25 billion and revenue primarily from its advertising segment reaching US$1.88 billion. The company has become profitable recently, reporting a net income of US$5.24 million for Q3 2025, compared to a loss the previous year, and raised its full-year revenue guidance to between US$1.914 billion and US$1.932 billion. Recent strategic partnerships with LG Ad Solutions and Paramount Advertising highlight Taboola's focus on enhancing digital advertising performance through AI-driven solutions like Performance Enhancer and Performance Multiplier, aiming to extend reach and optimize ad efficiency across platforms globally.

- Get an in-depth perspective on Taboola.com's performance by reading our balance sheet health report here.

- Evaluate Taboola.com's prospects by accessing our earnings growth report.

Nextdoor Holdings (NXDR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nextdoor Holdings, Inc. operates a neighborhood network that connects neighbors, businesses, and public agencies both in the United States and internationally, with a market cap of $854.80 million.

Operations: The company generates revenue of $253.40 million from its Internet Information Providers segment.

Market Cap: $854.8M

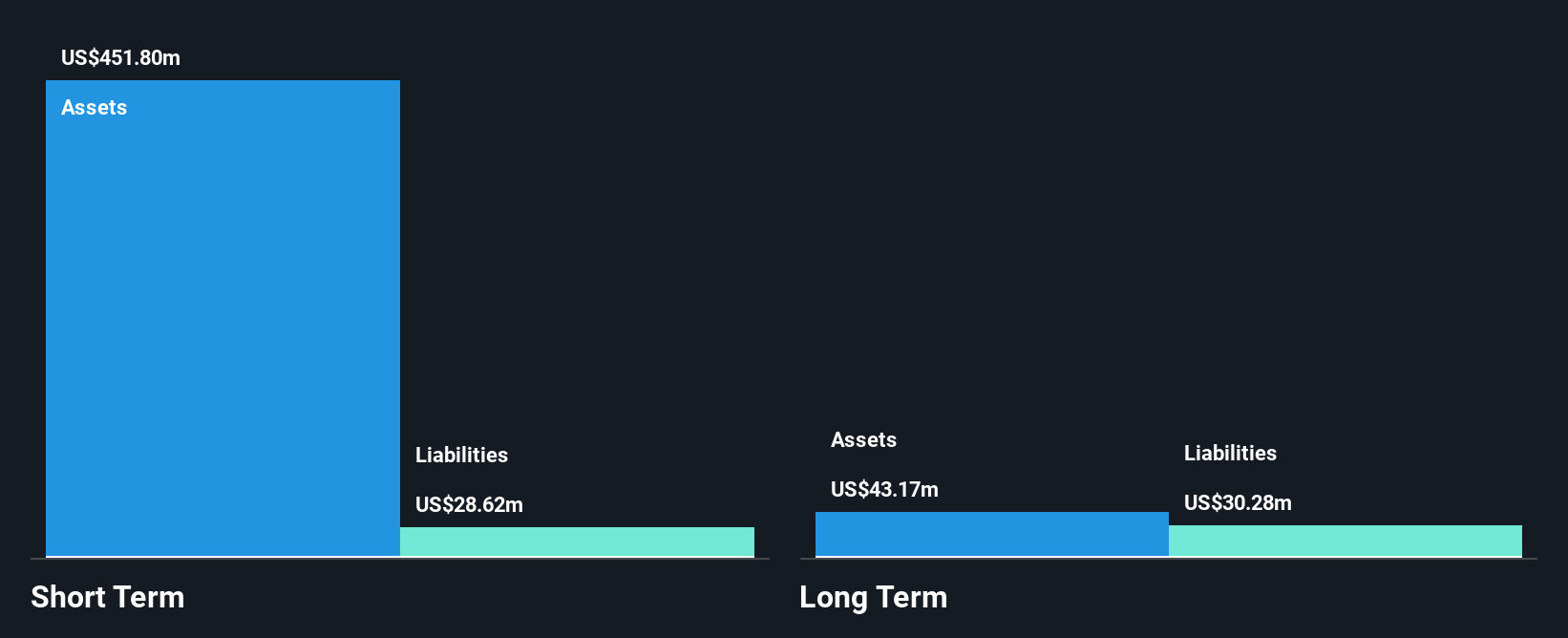

Nextdoor Holdings, Inc. remains unprofitable but shows promise with a market cap of US$854.80 million and revenue of US$253.40 million from its Internet Information Providers segment. The company has a strong cash position, covering liabilities comfortably with short-term assets of US$448.4 million against short-term liabilities of US$33.4 million, and no debt for the past five years. Recent innovations include AI-powered ad optimizations and expanded real-time alert integrations with partners like Waze and the U.S. Geological Survey, enhancing its platform's hyperlocal engagement capabilities while maintaining a stable cash runway for over three years despite ongoing losses.

- Click here to discover the nuances of Nextdoor Holdings with our detailed analytical financial health report.

- Gain insights into Nextdoor Holdings' outlook and expected performance with our report on the company's earnings estimates.

Under Armour (UAA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Under Armour, Inc. and its subsidiaries develop, market, and distribute performance apparel, footwear, and accessories for men, women, and youth with a market cap of approximately $1.92 billion.

Operations: The company's revenue is primarily derived from North America at $2.99 billion, followed by Europe, The Middle East and Africa (EMEA) at $1.14 billion, Asia-Pacific at $708.50 million, and Latin America at $212.47 million.

Market Cap: $1.92B

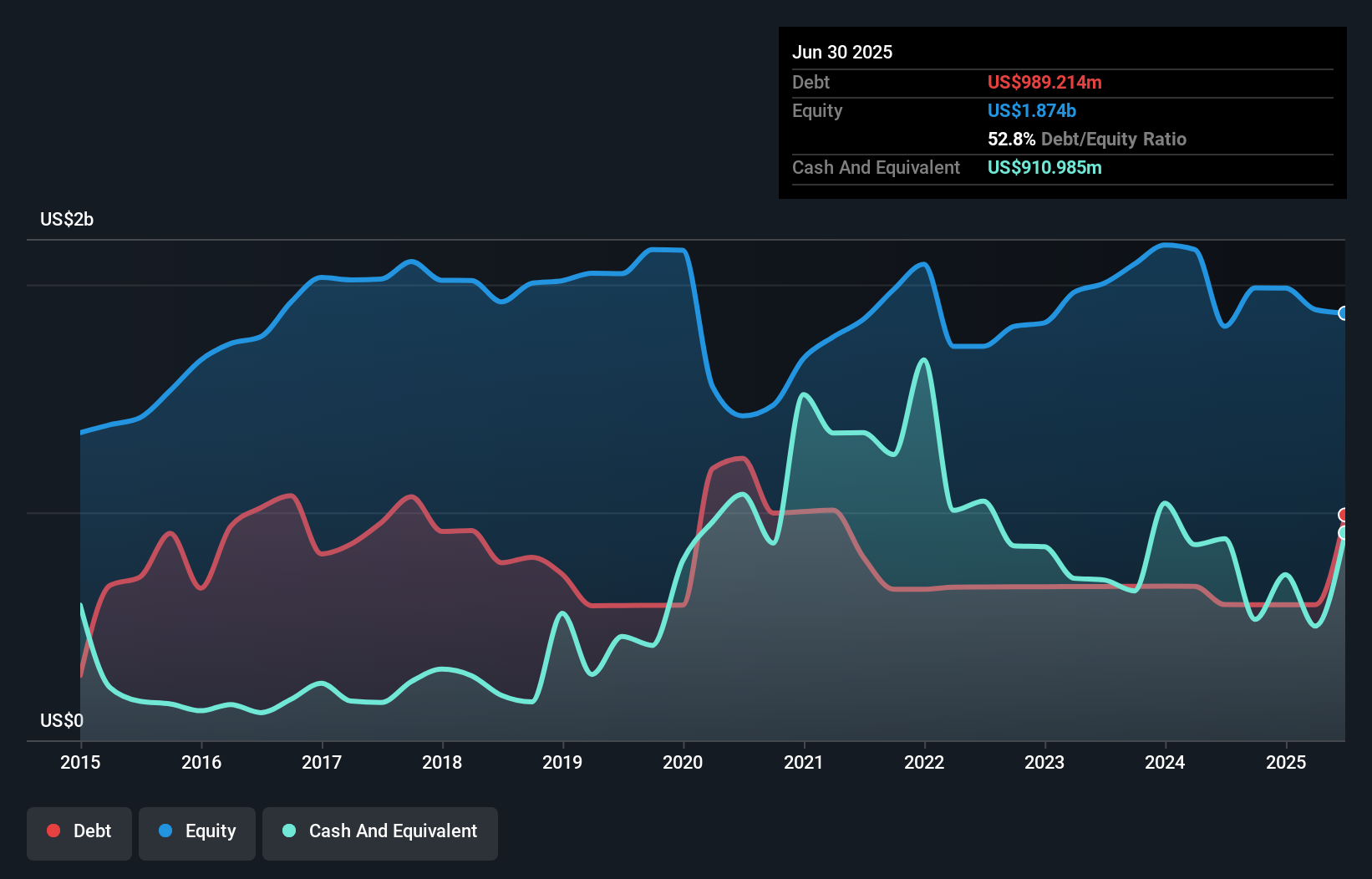

Under Armour, Inc., with a market cap of US$1.92 billion, faces challenges as it navigates financial instability marked by recent index reclassifications and lowered earnings guidance for fiscal 2026. Despite reducing its debt to equity ratio over five years, the company's debt remains inadequately covered by operating cash flow. Although unprofitable, Under Armour is trading at a good value relative to peers and has reduced losses over the past five years. The company recently announced leadership changes with Reza Taleghani set to join as CFO in February 2026, bringing extensive global financial experience that may aid future transformations.

- Navigate through the intricacies of Under Armour with our comprehensive balance sheet health report here.

- Understand Under Armour's earnings outlook by examining our growth report.

Key Takeaways

- Unlock more gems! Our US Penny Stocks screener has unearthed 338 more companies for you to explore.Click here to unveil our expertly curated list of 341 US Penny Stocks.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报