Mitsui Fudosan Accommodations Fund (TSE:3226) Valuation After Upgraded 2026 Earnings and Dividend Outlook

Mitsui Fudosan Accommodations Fund (TSE:3226) just nudged expectations higher, lifting both earnings and distributions for the March to August 2026 period after baking in recent property deals and financing moves.

See our latest analysis for Mitsui Fudosan Accommodations Fund.

Those upgraded forecasts land after a busy spell of acquisitions, selective disposals and new long term loans. The market seems to be warming to the story, with a roughly mid teens year to date share price return and a healthy double digit 1 year total shareholder return suggesting momentum is gradually building rather than fading.

If this reshaping of a J REIT portfolio has you thinking about where else capital is quietly compounding, it could be a good moment to explore fast growing stocks with high insider ownership.

With units already delivering strong total returns and now trading slightly above analyst targets, the key question is whether Mitsui Fudosan Accommodations Fund still offers upside or if the market is already pricing in this upgraded growth outlook.

Price to Earnings of 29.4x: Is it justified?

On a last close of ¥135,800, Mitsui Fudosan Accommodations Fund trades on a 29.4 times price to earnings multiple, sitting noticeably above peers and suggesting investors are already paying up for its cash flows.

The price to earnings ratio compares a REIT's market price to its annual earnings per unit and is a core shorthand for how richly the market values those earnings. For a mature Japanese residential and accommodation focused REIT with steady but modest profit growth, a higher multiple implies investors expect that stability and income profile to persist, even if headline expansion is only incremental.

Here, the market is assigning 29.4 times earnings versus a peer average of 24.5 times and an estimated fair price to earnings ratio of 24.7 times. That premium signals investors are willing to pay substantially more than both sector norms and our fair ratio estimate. This leaves less margin for error if earnings growth, which is forecast to remain in the low single digits, fails to accelerate meaningfully.

Compared with the wider Global Residential REITs industry average of 20.1 times, Mitsui Fudosan Accommodations Fund screens as even more expensive. This reinforces the view that its units carry a sizeable valuation premium relative to global accommodation and residential landlords.

Explore the SWS fair ratio for Mitsui Fudosan Accommodations Fund

Result: Price to Earnings of 29.4x (OVERVALUED)

However, risks remain, particularly if Japan's accommodation demand softens or financing costs climb faster than expected, which could pressure earnings and distribution growth assumptions.

Find out about the key risks to this Mitsui Fudosan Accommodations Fund narrative.

Another View on Value

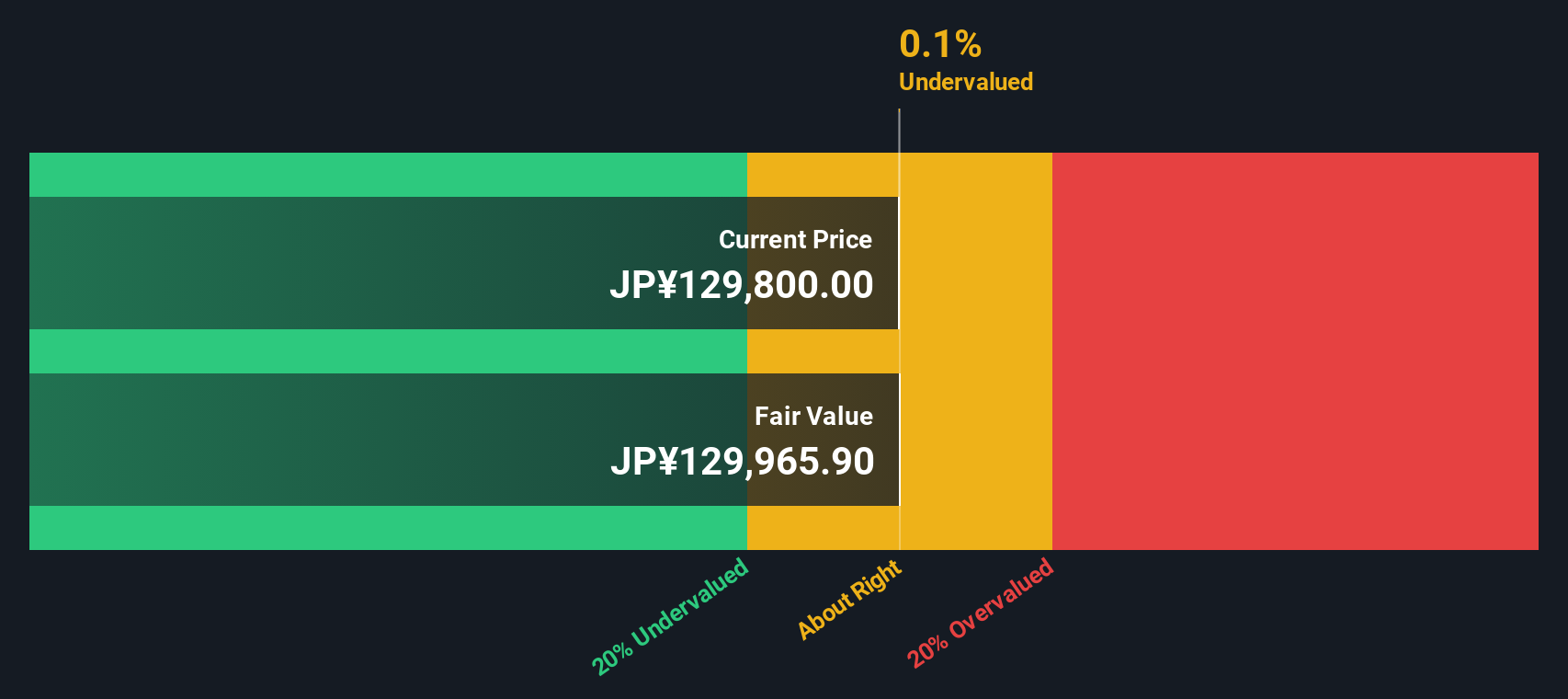

Our DCF model points to a fair value of around ¥134,959 per unit, slightly below the current ¥135,800 price, implying the units also screen as marginally overvalued on a cash flow basis. If both earnings multiples and cash flows flag limited upside, what exactly is the market paying up for?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsui Fudosan Accommodations Fund for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsui Fudosan Accommodations Fund Narrative

If you interpret the numbers differently or want to stress test your own assumptions directly against the data, you can build a complete narrative in just a few minutes, Do it your way.

A great starting point for your Mitsui Fudosan Accommodations Fund research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with one opportunity. Use the Simply Wall Street Screener to pinpoint fresh ideas that match your strategy before the crowd catches on.

- Capture early stage growth potential by reviewing these 3629 penny stocks with strong financials that already show solid financial underpinnings instead of just speculative stories.

- Position yourself ahead of technological shifts by scanning these 24 AI penny stocks harnessing artificial intelligence to reshape entire industries and earnings power.

- Lock in income focused opportunities by assessing these 10 dividend stocks with yields > 3% offering robust yields that can support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报